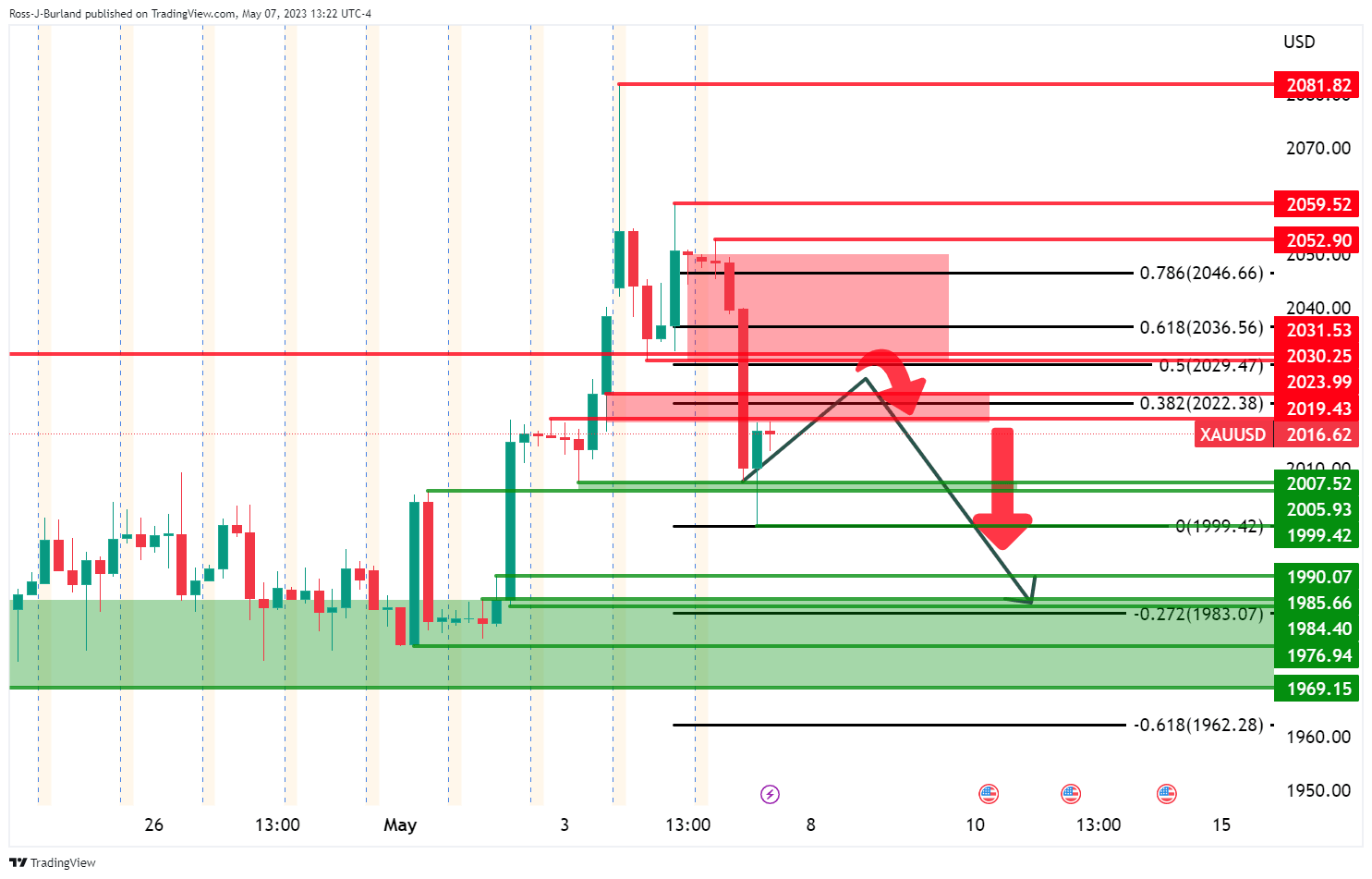

Gold Price Forecast: XAU/USD bears eye a run towards $2,000

- Gold price bears are taking back control.

- Bears eye a downside extension towards $2,000.

As per the pre opèn Gold price analysis, Gold, Chart of the Week: XAU/USD bears in the market, bias lower while below $2,030s, the market remains better offered as the following will illustrate:

Gold price, prior analysis

From a 4-hour perspective, it was stated that the support area look vulnerable considering the current formation of the schematic. It was argued that should the correction start to decelerate within the highlighted areas of potential resistance, bears could be encouraged to take on the support area between $1,970 and $1,990.The bias was bearish while below $2,050 and nearer term, the $2,030s.

Gold price updates

We have seen a run-into where resistance was expected to kick in. The price is currently moving away from here in textbook fashion:

The bears are in the market again and are in the process of engulfing the prior candle as illustrated. A bearish engulfment would be highly encouraging for the sellers.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.