Gold Price Forecast: XAU/USD advances steadily toward $1830 ahead of US NFP

- Gold price jumps off the week’s lows, around $1810s, despite Fed’s Powell hawkish remarks.

- US Initial Jobless Claims rose above estimates, signaling that the labor market is cooling.

- XAU/USD Price Analysis: Neutral upwards, but downside risks remain.

Gold price climbs sharply in the North American session after dropping more than 1.70% on Tuesday. Hawkish remarks by the US Federal Reserve (Fed) Chair Jerome Powell at his appearance at the US Congress bolstered the US Dollar (USD). However, the US employment and inflation figures on Friday and the next week could influence the Fed’s path on interest rates. At the time of writing, the XAU/USD is trading at $1831.87 after hitting a low of $1812.09.

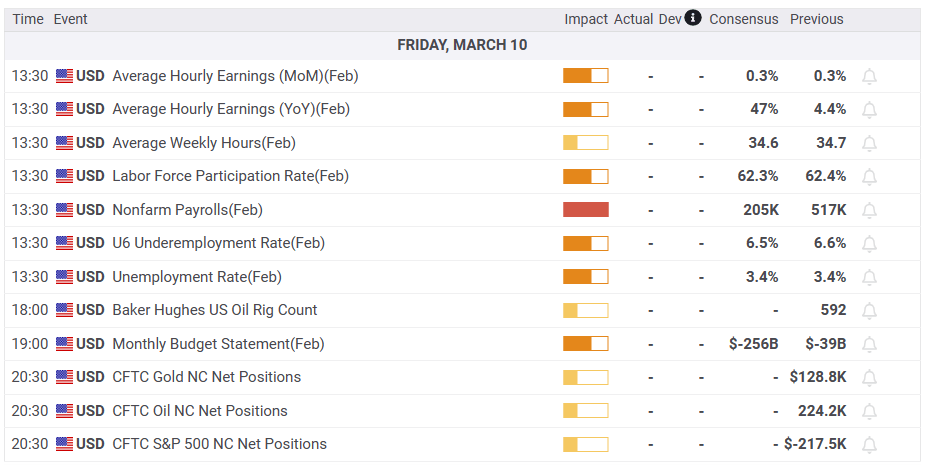

A fall in US jobless claims, a prelude of Friday’s NFP?

XAU/USD jumped sharply on the release of US economic data. The Bureau of Labor Statistics (BLS) revealed that Initial Jobless Claims for the week ending on March 4 rose by 211K above estimates of 195K. Even though Wednesday’s ADP report was solid, job openings exceeded forecasts; increasing unemployment claims could alleviate the labor market’s tightness. A solid US Nonfarm Payrolls report on Friday would pressure the Federal Reserve to deliver price stability. Hence, further tightening would be needed.

The US Dollar softened, and US Real Yields dropped from around 1.68%

In the meantime, the greenback is on the back foot, with traders booking profit ahead of tomorrow’s US jobs report. The US Dollar Index (DXY), which tracks the buck’s value against a basket of peers, retraces 0.46% at 105.172, a tailwind for the yellow metal prices.

US Treasury bond yields have come off the highs, with the 10-year rate at 3.944%, down five bps. The 10-yeas US TIPS, a proxy for Real Yields, are down from 1.686% to 1.614%, giving XAU/USD buyers a respite.

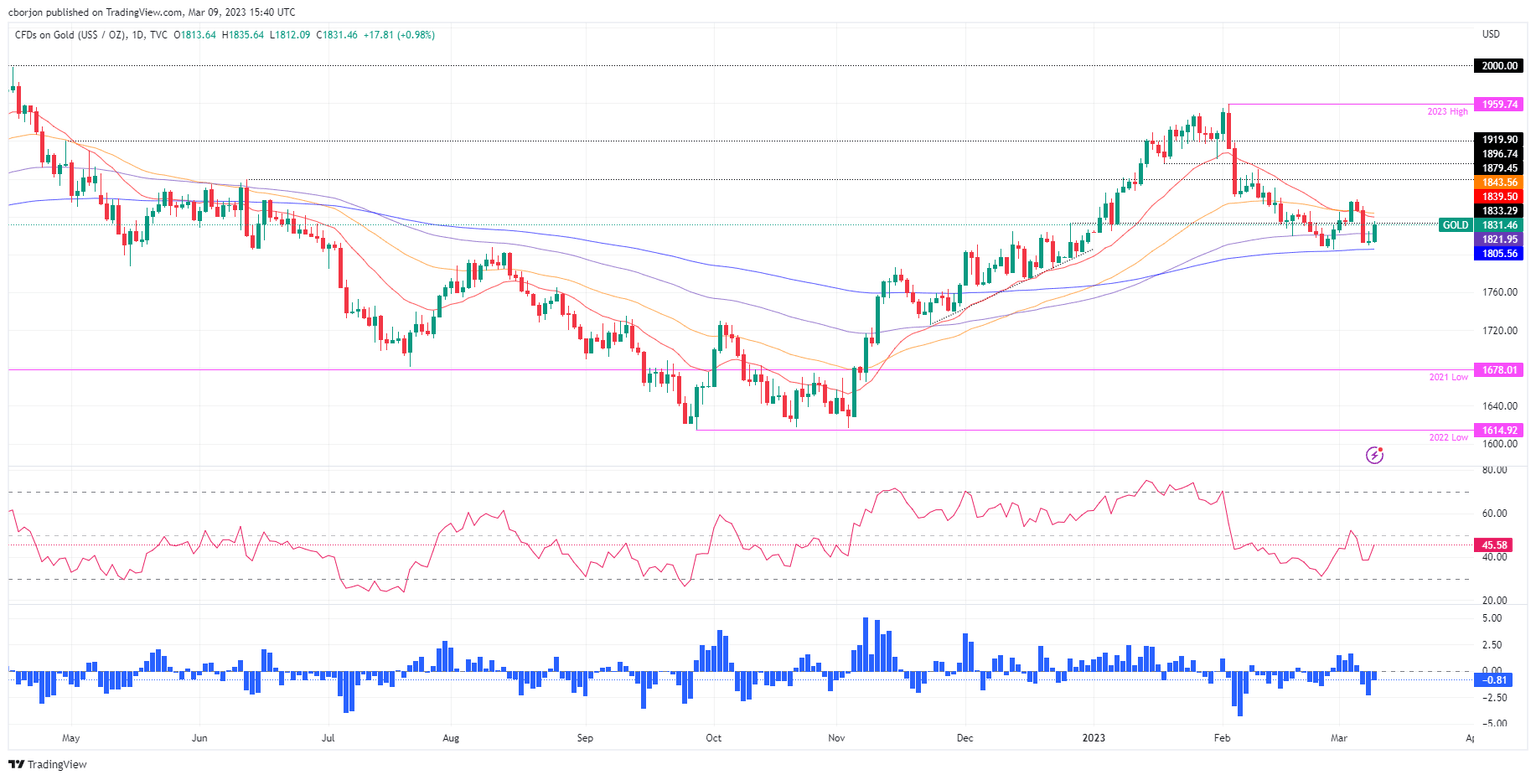

XAU/USD Technical analysis

XAU/USD jumped from around $1810, shy of testing the 200-day Exponential Moving Average (EMA) At $1805.56. On its way north, the XAU/USD reclaimed the 100-day EMA at $1821.94 and reduced the gap of the 20-day EMA, resting at $1839.43. For a bullish resumption, XAU/USD must reclaim the confluence of the 20 and 50-day EMAs at around $1844. Once cleared, it will expose the $1850 area. On the flip side, if XAU/USD tumbled back below the 100-day EMA, the path toward the 200-day EMA would be open.

What to watch?

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.