Gold Price Forecast: XAU/USD remains vulnerable despite corrective pullback toward $1,740

- Gold is consolidating the huge increase in ATR since the NFP.

- The Fed is expected to move more hawkish and the US dollar takes control.

Update: Gold prices edge higher on Tuesday nursing the previous session’s wounds. Prices fell to their lowest level in the previous five months on better-than-expected US jobs data. The upward readings fueled the expectations that the US Fed may start the tightening of monetary policy sooner than anticipated. A shift in the stimulus and eventually rate hike dim the attractiveness of the precious metal. As the higher interest rates reduce the appeal for investment in gold. The US Dollar Index (DXY) rose to its three-week high level near 93.0. A higher USD valuation makes gold expensive for the other currencies holders. As per the latest, Fed officials comments investors assessed the possibility of Federal Reserve could start tapering between October and December.

At the time of writing, XAU/USD is trading around the $1,730 level in the consolidation of the opening drop this week to a low of $1,677.68 from $1,764.67.

A stronger USD and rising coronavirus cases weighed on sentiment last week.

Friday saw further selling in the commodities sector on the back of the US jobs data for which the precious metals sector led the complex lower.

Gold broke below USD1,800/oz after US jobs growth accelerated in July by the most in almost a year, while unemployment fell.

The greenback rallied along with the US 10-year Treasury yield shooting into the 1.3% area.

Concerns that the Federal Reserve is about to taper are likely to remain heightened in the short term, denting investor appetite for the precious metal for which we have witnessed an exodus at the start of the week.

The precious metals sector came under further pressure at the start of this week

''The strong jobs data helped catalyze significant liquidations, as the Fed's dual focus on inflation and jobs places additional attention on employment data, with global markets attempting to gauge the taper clock and to set a timer for the Fed's first hike,'' analysts at TD Securities explained.

''Gold prices broke below their bull-market defining trendline since 2019, fueling significant stop-outs and melting gold's price,'' the analysts said.

''We expect that trend following funds should still be adding to their net short position in the coming sessions.''

''With real yields also breaking above the relentless downtrend that had seen relative value players favour gold in recent weeks, we could continue to see some outflows from the yellow metal in the near-term.''

Meanwhile, long-end rates pushed higher on Monday, encouraged by strong job openings figures, and comments from Atlanta Fed President Bostic.

''If data comes out this strong for the next month or two then substantial progress would have been made on the Fed’s goals,'' Bostic said

Bostic also noted that robust market functioning meant a relatively rapid taper of asset purchases could be achieved.

Consequently, the dollar is bid and gold prices remain under pressure, down some 1.9% on the day.

Meanwhile, the global spread of the coronavirus is alarming investors as new cases and hospitalisations move into milestone territories.

In the US, coronavirus cases and hospitalizations are now at a six-month high, fueled by the spread of the Delta variant.

COVID-19 cases also are rising across Asia at an alarming rate.

If we have learned from the previous risk-off response, the US dollar stands to gain safe-haven flows, especially as investors look for yield with the prospects of higher rates denominated in the US dollar.

The headwinds for gold are two-fold as the US dollar smile theory continues to play out, a feature of today's markets that has been discussed in a number of prior articles in July calling for lower precious metals, such as follows:

- Gold Price Forecast: Bears waiting to target $1,700

- Silver prices are looking into the abyss below weekly support

Analysts at Brown Brothers Harriman described the theory as ''strong US data are feeding into increased dollar bullishness as the Fed continues to take tentative steps towards tapering...On the other hand, growing risk-off impulses are helping the dollar recently. This supports the view that the greenback is likely to benefit in either situation. Hence, the smile as the dollar turns up at both ends of the risk spectrum.''

Gold technical analysis

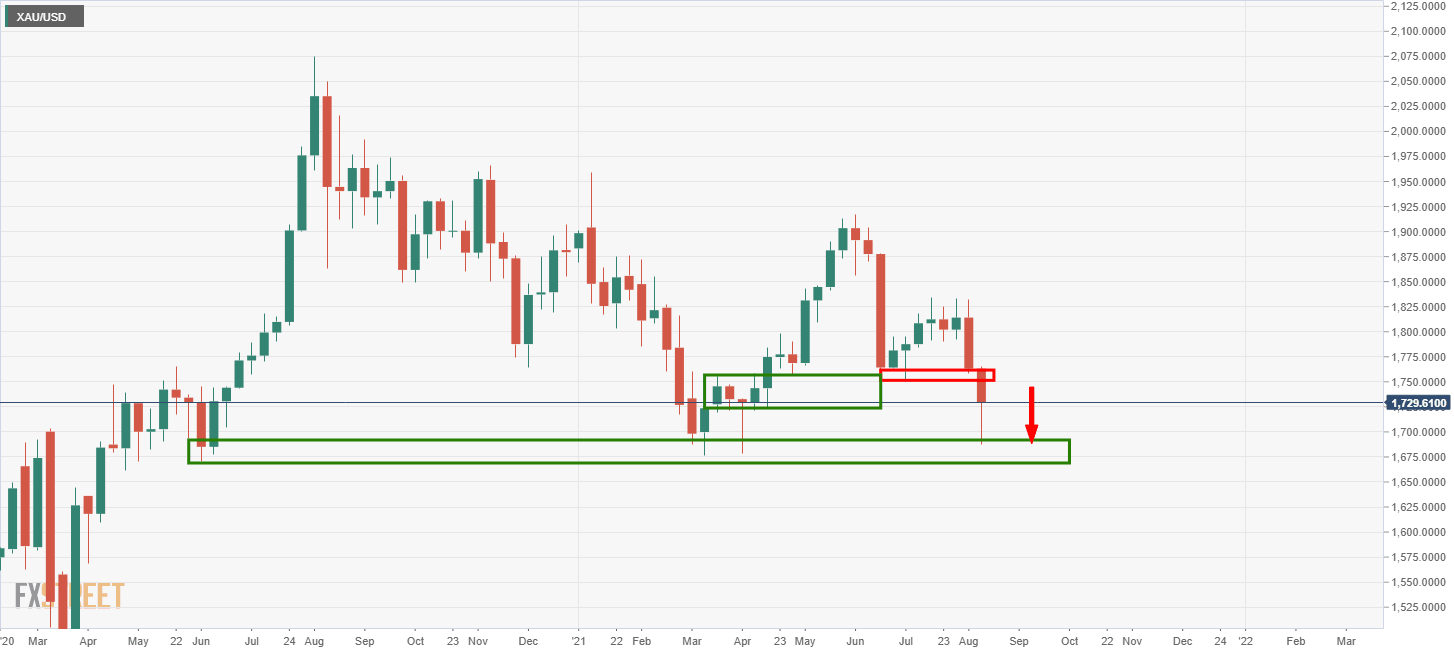

With ATR now around 14 from where it was before NFP at 8, the price has overshot technical supportive structure on a weekly basis.

The bears have cleared the way for a sustained move in on the higher third of the 1,600s:

However, it may take several weeks for the bears to build up enough of a support base in order to get there again from this juncture.

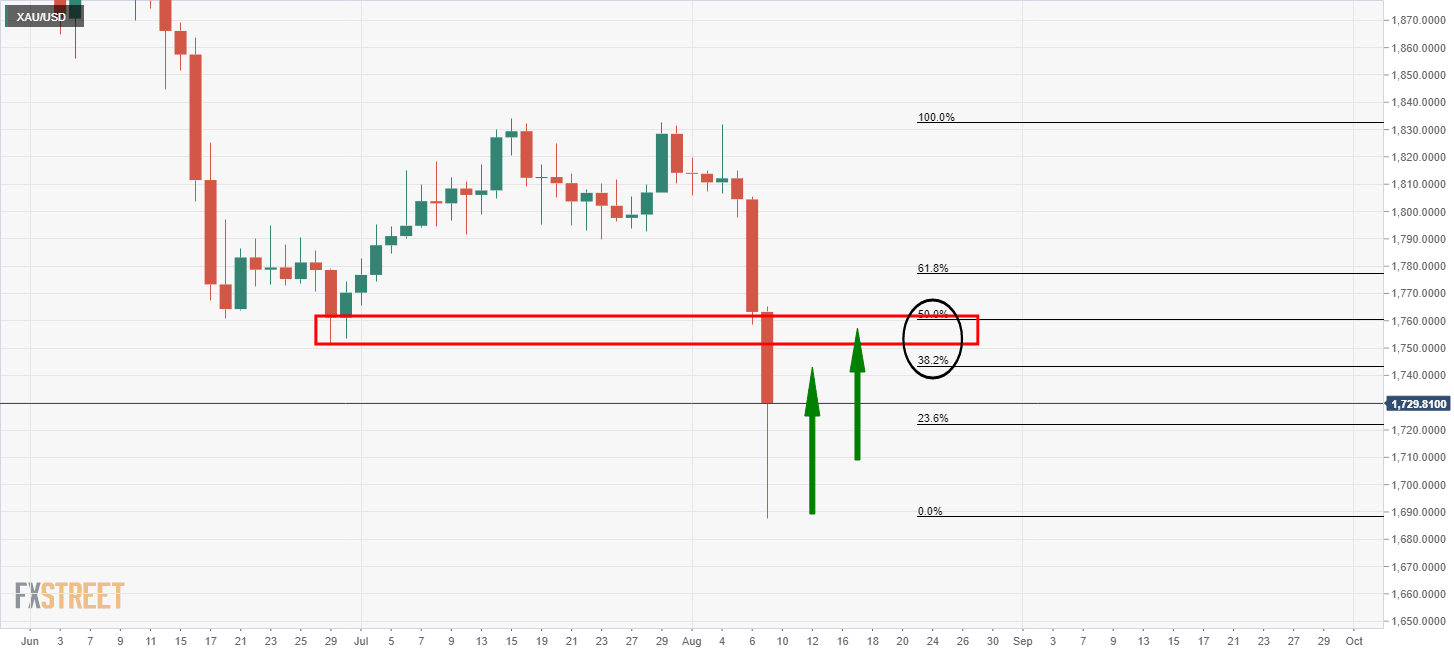

From a daily perspective, the price has corrected as hard as it fell and this gives rise to come meanwhile toing and froing in the low to the middle ground of the 1,700s with a focus on the 38.5% Fibonacci and 50% mean reversion areas as illustrated below:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.