Gold price remains confined in a range as traders keenly await the crucial US NFP report

- Gold price struggles to capitalize on the overnight modest gains amid the Fed’s hawkish tilt.

- The USD stands firm near a fresh multi-month top and contributes to capping the commodity.

- Trade jitters act as a tailwind for the XAU/USD pair as traders now await the US NFP report.

Gold price (XAU/USD) extends its directionless price move through the first half of the European session on Friday as traders keenly await the release of the US monthly jobs report before positioning for a firm intraday trajectory. In the meantime, a combination of diverging factors fails to assist the commodity to capitalize on the previous day's modest recovery from a one-month low. US President Donald Trump signed an executive order imposing higher tariffs on key trading partners across the globe. Adding to this, the latest round of US-China trade talks ended with no deal in place. This fuels uncertainty in the markets and tempers investors' appetite for riskier assets, which, in turn, is seen acting as a tailwind for the safe-haven precious metal.

Meanwhile, the US Dollar (USD) prolongs its recent strong uptrend and advances to the highest level since late May in the wake of the Federal Reserve's (Fed) hawkish stance. In fact, comments from Fed Chair Jerome Powell on Wednesday forced investors to scale back their bets for a rate cut in September. This continues to act as a tailwind for the USD and caps the upside for the non-yielding Gold price. Hence, it will be prudent to wait for strong follow-through buying before confirming that the XAU/USD pair has formed a near-term bottom and positioning for any meaningful gains. Nevertheless, the commodity seems poised to register losses for the third consecutive week and remains at the mercy of the USD price dynamics heading into the weekend.

Daily Digest Market Movers: Gold price looks to US NFP report for some meaningful impetus

- Federal Reserve Chair Jerome Powell tempered hopes for an immediate rate cut and said on Wednesday that it is too soon to say whether the central bank will lower borrowing costs at the September meeting. Powell added that the current modestly restrictive monetary policy has not been holding back the economy and is in the right place to manage continued uncertainty around tariffs and inflation.

- The upbeat economic outlook was reaffirmed by the Advanced US GDP print, which showed that the economy expanded by a 3% annualized pace during the second quarter of the current year. Moreover, the US Bureau of Economic Analysis reported on Thursday that the Personal Consumption Expenditures (PCE) Price Index climbed to 2.6% in June from 2.4% in the previous month (revised up from 2.3%).

- Meanwhile, the core gauge, which excludes volatile food and energy prices, rose 2.8% during the reported month, matching May's reading and surpassing the consensus estimate of 2.7%. The data reaffirmed the view that price pressures would pick up in the second half of the year and delay the Fed's rate-cutting cycle until at least October, lifting the US Dollar to a multi-month top and capping the Gold price.

- US President Donald Trump on Thursday signed an executive order imposing new tariffs on a number of trading partners that go into effect on August 7. The Trump administration said that the universal tariff will remain at 10% for countries with which the US has a trade surplus, while nations with which the US has a trade deficit face a 15% floor. The fate of China’s trade relations with the US, however, remains uncertain.

- Despite a two-day meeting between Chinese and American negotiators this week, the world's two largest economic giants are yet to agree on a trade deal. US Treasury Secretary Scott Bessent said that any extension of the 90-day tariff truce, which is set to expire later this month, would be up to Trump. This, in turn, tempers investors' appetite for riskier assets and offers some support to the safe-haven commodity.

- Traders also seem reluctant to place aggressive directional bets around the XAU/USD pair and opt to wait for the release of the US monthly employment details. The popularly known Nonfarm Payrolls (NFP) report is expected to show that the US economy added 110K jobs in July, down from 147K in the previous month, and the Unemployment Rate is seen edging higher to 4.2% from 4.1% in June.

- Friday's US economic docket also features the release of the ISM Manufacturing PMI, which could further influence the USD and provide some meaningful impetus to the bullion. Nevertheless, the precious metal remains on track to register losses for the third straight week and could weaken further amid the underlying bullish sentiment surrounding the USD.

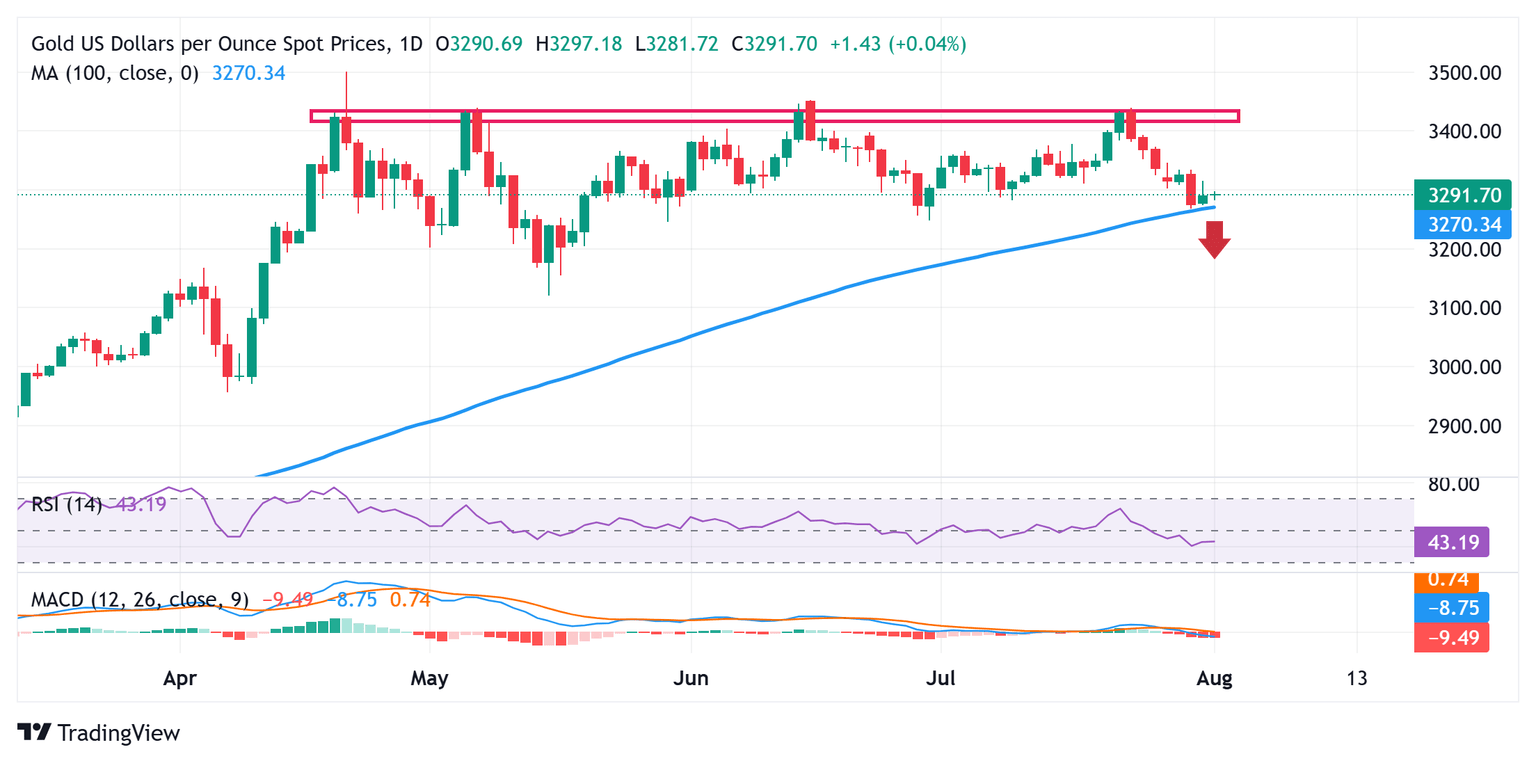

Gold price needs to break below the 100-day SMA support for bears to seize near-term control

The overnight swing high, around the $3,314-3,315 region, could act as an immediate hurdle for the Gold price. A sustained move above the latter could trigger a short-covering rally and lift the XAU/USD pair beyond the $3,325-3,326 horizontal barrier, towards the next relevant hurdle near the $3,360-3,365 region. Some follow-through buying should pave the way for a move towards reclaiming the $3,400 round figure.

On the flip side, the 100-day Simple Moving Average (SMA), around the $3,270 region, nearing a one-month low touched on Wednesday, might continue to protect the immediate downside. A convincing break below could drag the Gold price to the June swing low, around the $3,248-3,247 region. The downward trajectory could extend towards the $3,325 intermediate support before the commodity eventually drops to test the $3,200 round figure.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.