Gold price flat lines below $3,400 as traders seem reluctant ahead of the critical FOMC meeting

- Gold price lacks firm intraday direction as traders keenly await the crucial FOMC decision.

- Fed rate cut bets keep the USD bulls on the defensive and lend support to the XAU/USD pair.

- Geopolitical risks also benefit the commodity ahead of the Fed meeting starting this Tuesday.

Gold price (XAU/USD) extends its intraday directionless price move and remains below the $3,400 mark through the first half of the European session on Tuesday. Traders now seem reluctant and opt to wait for more cues about the Federal Reserve's (Fed) rate cut path before placing fresh directional bets. Hence, the focus will remain glued to the outcome of a two-day FOMC meeting on Wednesday, which should provide a fresh impetus to the US Dollar (USD) and the non-yielding yellow metal.

Heading into the key central bank event risk, the growing acceptance that the Fed would lower borrowing costs further in 2025 keeps the USD close to a three-year low touched on Friday and acts as a tailwind for the Gold price. Apart from this, persistent trade-related uncertainties and rising geopolitical tensions in the Middle East assist the safe-haven precious metal to stall the previous day's retracement slide from a nearly two-month top. This, in turn, warrants some caution for the XAU/USD bears.

Daily Digest Market Movers: Gold price bulls await more cues about the Fed's rate cut path before placing fresh bets

- Israel struck Iran’s state-run television station on Monday, while Iran said that it is preparing for the largest and the most intense missile attack in history on Israeli soil. US President Donald Trump left the G7 Summit a day early because of the Middle East situation and has requested the National Security Council to convene in the Situation Room.

- Three tankers are reportedly on fire in the Gulf of Oman near the Strait of Hormuz, raising concerns of a possible repeat of the 2019 attacks attributed to Iran. This raises the risk of a further escalation of geopolitical tensions in the Middle East and assists the safe-haven Gold price to gain some positive traction during the Asian session on Tuesday.

- The US Dollar edges higher amid repositioning trades ahead of the crucial two-day FOMC policy meeting starting later today and acts as a headwind for the precious metal. The Federal Reserve is widely expected to maintain the status quo and keep its benchmark rate unchanged amid concern that Trump's tariffs could push up consumer prices.

- Meanwhile, the USD uptick lacks bullish conviction on the back of rising bets that the Fed will resume its rate-cutting cycle in September. Hence, the accompanying policy statement and Fed Chair Jerome Powell's comments during the post-meeting press conference will be scrutinized closely for cues about the future rate-cut path.

- This, in turn, will help in determining the next leg of a directional move for the USD and the non-yielding yellow metal. In the meantime, persistent trade-related uncertainties and geopolitical risks stemming from the worsening Iran-Israel conflict might continue to act as a tailwind for the safe-haven commodity.

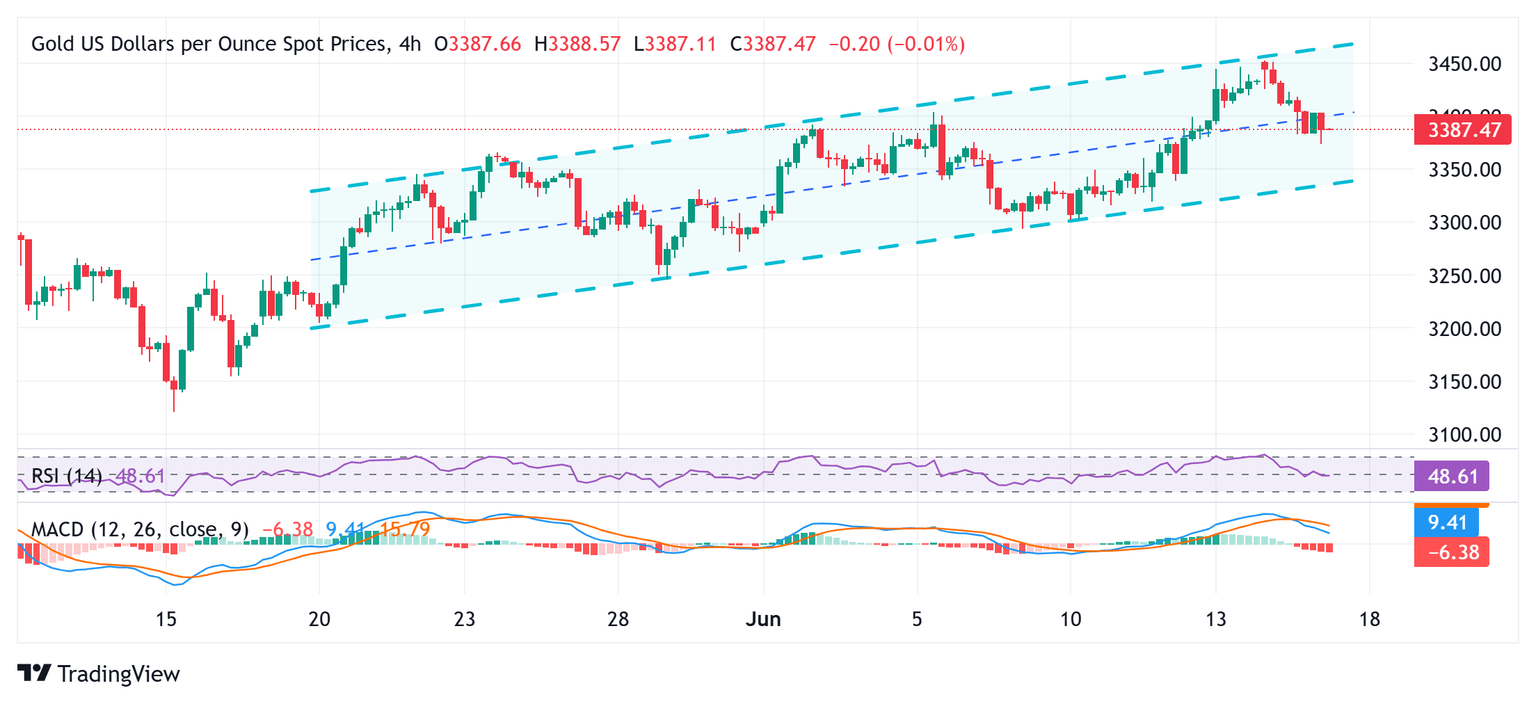

Gold price bullish potential seems intact; dip-buying near the $3,340-3,335 support should limit any corrective slide

From a technical perspective, the formation of an ascending channel points to a well-established short-term uptrend. Adding to this, positive oscillators on the daily chart back the case for the emergence of dip-buying, which should help limit the downside for the Gold price near the $3,340-3,335 area, or the lower boundary of the trend channel. A convincing break below the latter would negate any near-term positive outlook and shift the bias in favor of bearish traders.

On the flip side, the $3,400 round figure now seems to have emerged as an immediate hurdle, above which the Gold price could climb to the $3,434-3,435 region. Some follow-through buying, leading to a subsequent strength beyond the $3,451-3,452 area, or the multi-week top touched on Monday, should allow the Gold price to challenge the all-time peak, around the $3,500 psychological mark touched in April. The said handle coincides with the ascending channel barrier, which if cleared would pave the way for a further appreciating move.

Economic Indicator

FOMC Economic Projections

At four of its eight scheduled annual meetings, the Federal Reserve (Fed) releases a report detailing its projections for inflation, the unemployment rate and economic growth over the next two years and, more importantly, a breakdown of each Federal Open Market Committee (FOMC) member's individual interest rate forecasts.

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.