Gold price ties up with gains on geopolitical uncertainty remaining elevated

- Gold price trades higher on Tuesday as market turmoil on the Moody’s downgrade for the US credit rating remains sticky.

- President Trump alluded that the US might withdraw completely in further attempts to solve the Ukraine-Russia impasse.

- Gold trades in a tight range, holding above $3,225 in Tuesday’s trading.

Gold (XAU/USD) price trades around $3,240 on Tuesday at the time of writing, after reversing an earlier slide lower where several Federal Reserve (Fed) officials on Monday, commented on the US credit rating downgrade by rating agency Moody’s. Federal Reserve Bank of Atlanta President Raphael Bostic said the downgrade could have a ripple effect through the economy, and that another 3 to 6 months of waiting time is needed to see how uncertainty settles, Bloomberg reports.

In the geopolitics front, the image of the US got dented a bit further after United States (US) President Donald Trump commented on his two-hour phone call with Vladimir Putin on ending the impasse in Ukraine. President Trump said that negotiations would start immediately, though if they break down again, the US would back away from any further efforts and negotiations. Trump said there were "some big egos involved," and without progress, "I'm just going to back away," repeating a warning that he could abandon the process and concluded with "This is not my war," Reuters reports.

That statement suggests that the US President make a complete U-turn, as it was one of his campaign promises, to end the war in his first 100 days. Now that President Trump seems unable to resolve the situation, it looks like Trump will rather pull out and walk away from it.

Daily digest market movers: Moody's downgrade still hanging over

- Gold fell as the haven-demand boost from Moody’s Ratings downgrade of the US faded, and attention turned back to the easing of trade tensions between the two largest economies, Reuters reports.

- The Trump administration has granted the final federal permit for a Gold mine being developed by Perpetua Resources Corp., which also has a reserve of antimony, a critical mineral used in munitions. The US Army Corps of Engineers issued the Clean Water Act permit needed for the Stibnite project in Idaho, which was facilitated by Interior Secretary Doug Burgum, the chair of the National Energy Dominance Council, according to a statement from his department, Bloomberg reports.

- US Treasuries are treading steady on Tuesday after whipsawing on Monday with the downgrading of US debt by Moody’s Ratings. US equity-index futures are down 0.3% while Gold dips 0.5% due to weak demand for havens, Bloomberg reports.

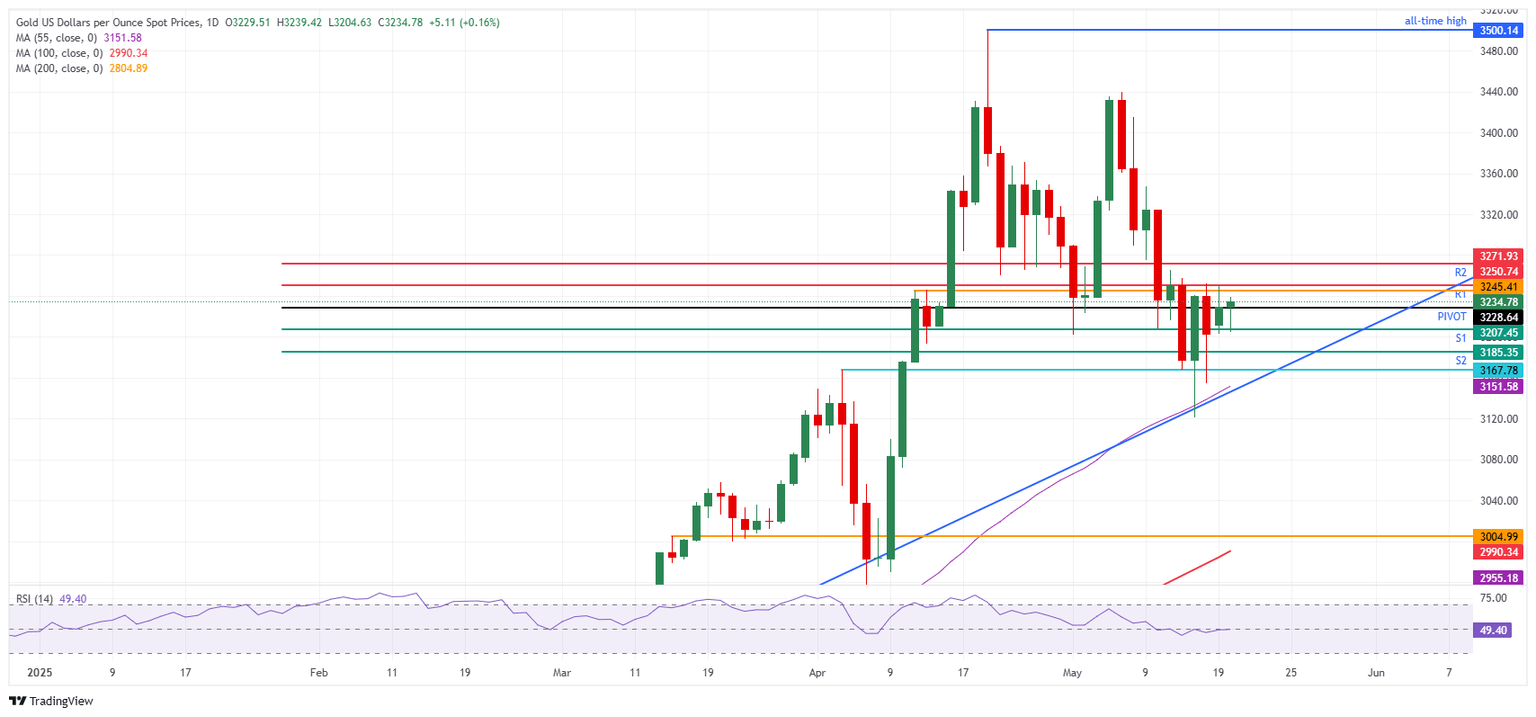

Gold Price Technical Analysis: Range Trading

The dented image of the US Dollar (USD) and the US as a whole should be something from which Gold as a safe haven should benefit. Though the headwinds coming from high yields make it difficult for the precious metal to bank on that. Instead, expect to see a sideways pattern for now, until the next catalyst presents itself.

On the upside, the pivotal technical level at $3,245 (April 1 high) is acting as resistance, already proved on Monday to be difficult to reclaim. Once through there, the R1 resistance at $3,250 and the R2 resistance at $3,271 are the following levels to watch, though a major catalyst would be needed to get it there.

On the other side, the daily S1 support stands at $3,207, ahead of the $3,200 big figure. In case that level does not hold, expect a move lower to the intraday S2 support at $3,185 and the April 3 high at $3,167, before the 55-day Simple Moving Average (SMA) at $3,151.

XAU/USD: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.