Gold price rebounds from one-month low amid weaker US Dollar

- Gold price drifts higher in Monday’s early European session.

- Optimism over US trade deals bolstered bets for earlier Fed rate cuts, supporting the Gold price.

- Traders brace for the Fedspeak later on Monday for a fresh impetus.

The Gold price (XAU/USD) recovers some lost ground during early European trading hours on Monday. Rising bets that the US Federal Reserve (Fed) will cut rates more times this year and possibly sooner than previously expected might undermine the Greenback and support the USD-denominated commodity price as a weaker USD makes Gold cheaper for foreign buyers.

Nonetheless, improved risk sentiment due to the US-China trade agreement, along with the ceasefire deal between Israel and Iran could diminish bullion's appeal as a traditional safe-haven asset. Traders brace for the Fedspeak later on Monday. The Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee are scheduled to speak.

Daily Digest Market Movers: Gold price gains momentum on increased optimism of a Fed rate cut

- “The slowdown in geopolitics has offered an opportunity for investors to start taking profit because of the forward-looking prospects of some kind of kinetic war with China and the developments in the Middle East,” said Daniel Pavilonis, senior market strategist at RJO Futures.

- Top US President Donald Trump advisers said on Friday that agreements with as many as a dozen of the US’s largest trading partners are expected to be completed by the July 9 deadline, per Bloomberg.

- US Personal Spending unexpectedly fell by 0.1% in May, the second decline this year, according to the US Bureau of Economic Analysis on Friday. Meanwhile, US Personal income dropped by 0.4% in May, the largest decrease since September 2021.

- The US Personal Consumption Expenditures (PCE) Price Index rose by 2.3% YoY in May, compared to 2.2% in April (revised from 2.1%), the US Bureau of Economic Analysis reported on Friday. This reading came in line with market expectations.

- The core PCE Price Index, which excludes volatile food and energy prices, climbed 2.7% in May, following the 2.6% increase (revised from 2.5%) seen in April. On a monthly basis, the PCE Price Index and the core PCE Price Index increased 0.1% and 0.2%, respectively.

Gold price retains a bullish tone in the longer term

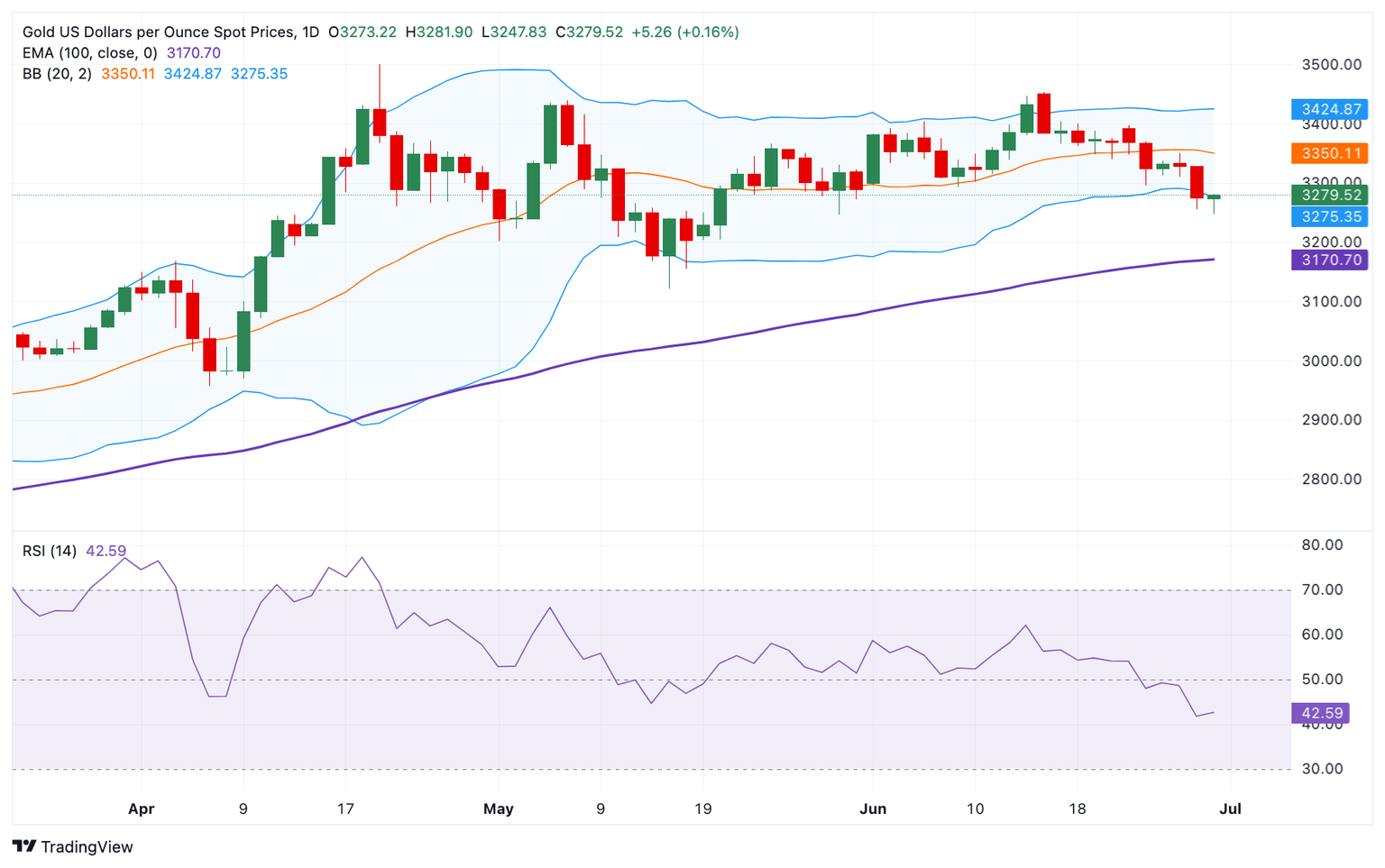

The Gold price trades in positive territory on the day. Technically, the precious metal keeps the bullish vibe on the daily chart, with the price holding above the key 100-day Exponential Moving Average (EMA). However, in the near term, the 14-day Relative Strength Index (RSI) is located below the midline near 41.50, suggesting further downside looks favorable.

The first upside barrier for yellow metal emerges near $3,350, the high of June 26. Sustained trading above this level could take XAU/USD back toward the $3,400 psychological level, en route to $3,425, the upper boundary of the Bollinger Band.

In the bearish event, the initial support level for yellow metal is seen at $3,170, the 100-day EMA. A break below the mentioned level might even drag the gold price toward $3,120, the low of May 15.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.