Gold price selling remains unabated amid receding safe-haven demand

- Gold price kicks off the new week on a weaker note, while a positive risk tone undermines safe-haven assets.

- Rising Fed rate cut bets prompt fresh USD selling, though it does little to support the non-yielding yellow metal.

- Traders now look forward to the release of US inflation figures this week to determine the near-term trajectory.

Gold price (XAU/USD) maintains its heavily offered tone through the first half of the European session on Monday and trades just above a multi-day low touched in the last hour. The US Dollar (USD) kicks off the new week on a weaker note and erodes a part of Friday's modest recovery gains from a two-week low amid bets that the Federal Reserve (Fed) will resume its rate-cutting cycle in September. This, in turn, is seen as a key factor lending some support to the non-yielding yellow metal.

Apart from this, trade-related uncertainties ahead of the looming US-China tariff truce deadline on Tuesday help limit the downside for the Gold price. Any meaningful recovery for the XAU/USD, however, seems elusive in the wake of the upbeat market mood, bolstered by the optimism over the US-Russia bilateral talks on Ukraine. Traders might also opt to wait for more cues about the Fed's rate-cut path. Hence, the focus will remain on US inflation figures due for release this week.

Daily Digest Market Movers: Gold price bears retain control amid US-Russia talks optimism

- Asian stock markets and US equity futures rose at the start of a new week amid hopes that a meeting between US and Russian leaders will increase the chances of ending the war in Ukraine. This, in turn, prompts heavy selling around the safe-haven Gold price at the start of a new week.

- However, the uncertainty over the US-China tariff truce, which is due to expire on August 12, lends some support to the precious metal. Adding to this, rising Federal Reserve rate cut bets and the emergence of fresh US Dollar selling help limit losses for the non-yielding yellow metal.

- Investors seem convinced that the US central bank will resume its rate-cutting cycle in September and deliver at least two 25-basis-point rate cuts by the end of this year. The expectations were lifted by the July Nonfarm Payrolls report, which pointed to a deteriorating US labor market.

- Meanwhile, St. Louis Fed President Alberto Musalem said last Friday that there is a risk that the US central bank may miss on both inflation and employment, with downside risk to jobs. Musalem further added that most of the impact of tariffs on inflation will likely fade.

- Separately, Fed Governor Michelle Bowman said on Saturday that the latest weak labor market data underscores her concerns about labor market fragility and strengthens her confidence in her forecast that three interest rate cuts will likely be appropriate this year.

- Investors this week will confront the release of the US inflation figures – the Consumer Price Index (CPI) on Tuesday and the Producer Price Index (PPI) on Thursday. This, along with speeches from influential FOMC members, will drive the USD and the XAU/USD pair.

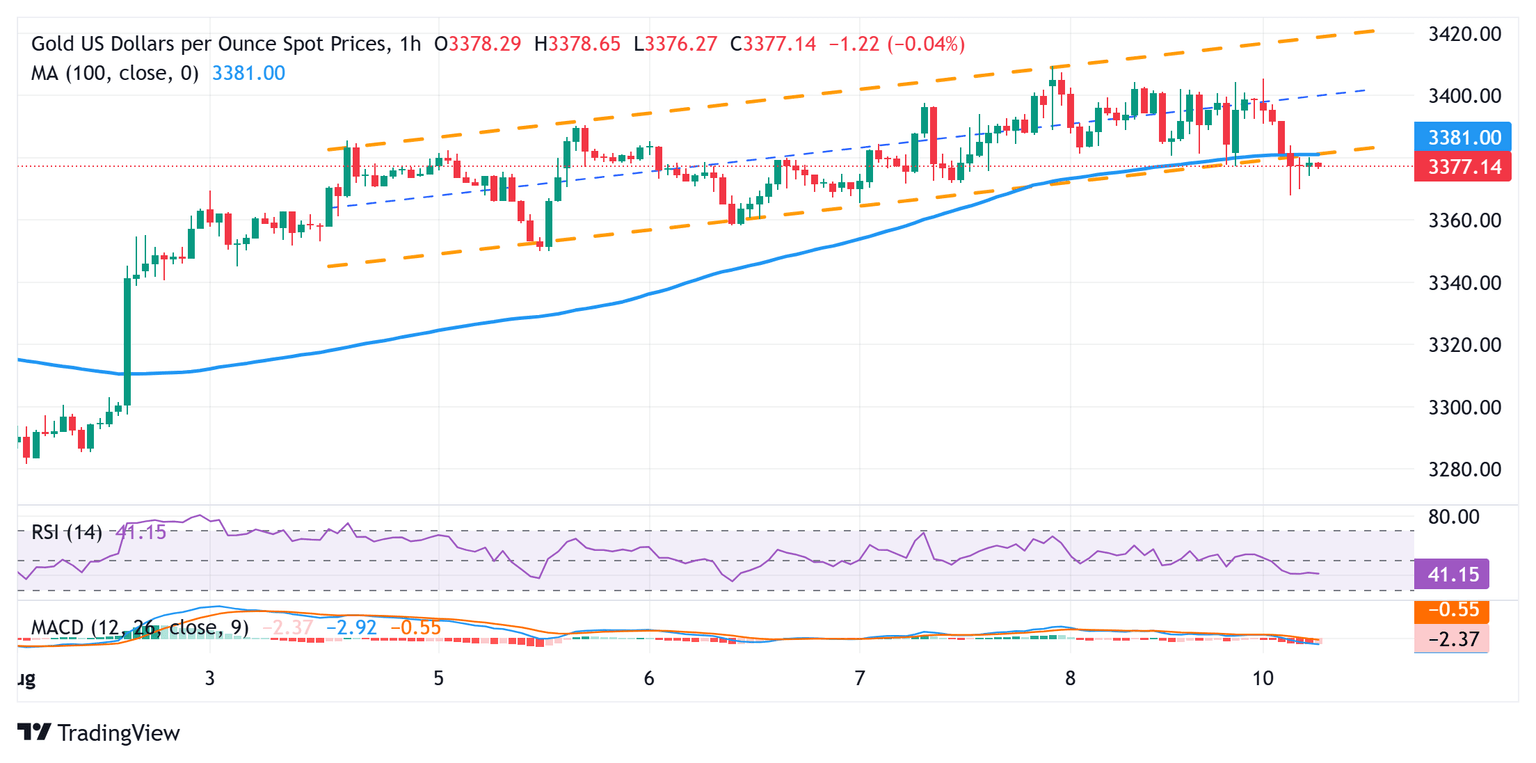

Gold price remains vulnerable while below $3,380 confluence support breakpoint

Monday's intraday downfall drags the Gold price below the $3,382 confluence – comprising the 100-hour Simple Moving Average (SMA) and the lower boundary of a short-term ascending channel. Furthermore, oscillators on the said chart have been gaining negative traction and back the case for a further depreciating move. That said, positive technical indicators on 4-hour/daily charts suggest that any subsequent slide is more likely to find decent support near the $3,353-3,350 area. A convincing break below, however, will be seen as a fresh trigger for bearish traders and makes the XAU/USD pair vulnerable to accelerate the slide towards the $3,315 intermediate support en route to the $3,300 round figure.

On the flip side, the $3,400 mark might continue to act as an immediate strong barrier and cap any attempted recovery. That said, some follow-through buying beyond last week's swing high, around the $3,409-3,410 area, would negate the negative outlook and lift the Gold price to the next relevant hurdle near the $3,422-3,423 area. The momentum could extend further towards the $3,434-3,435 strong horizontal barrier. A sustained strength beyond the latter should pave the way for a move towards challenging the all-time peak, around the $3,500 psychological mark touched in April.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.