Gold price stalls intraday pullback from record high; bulls not ready to give up yet

- Gold price retreats after touching a fresh all-time peak in reaction to Trump’s reciprocal tariffs on Wednesday.

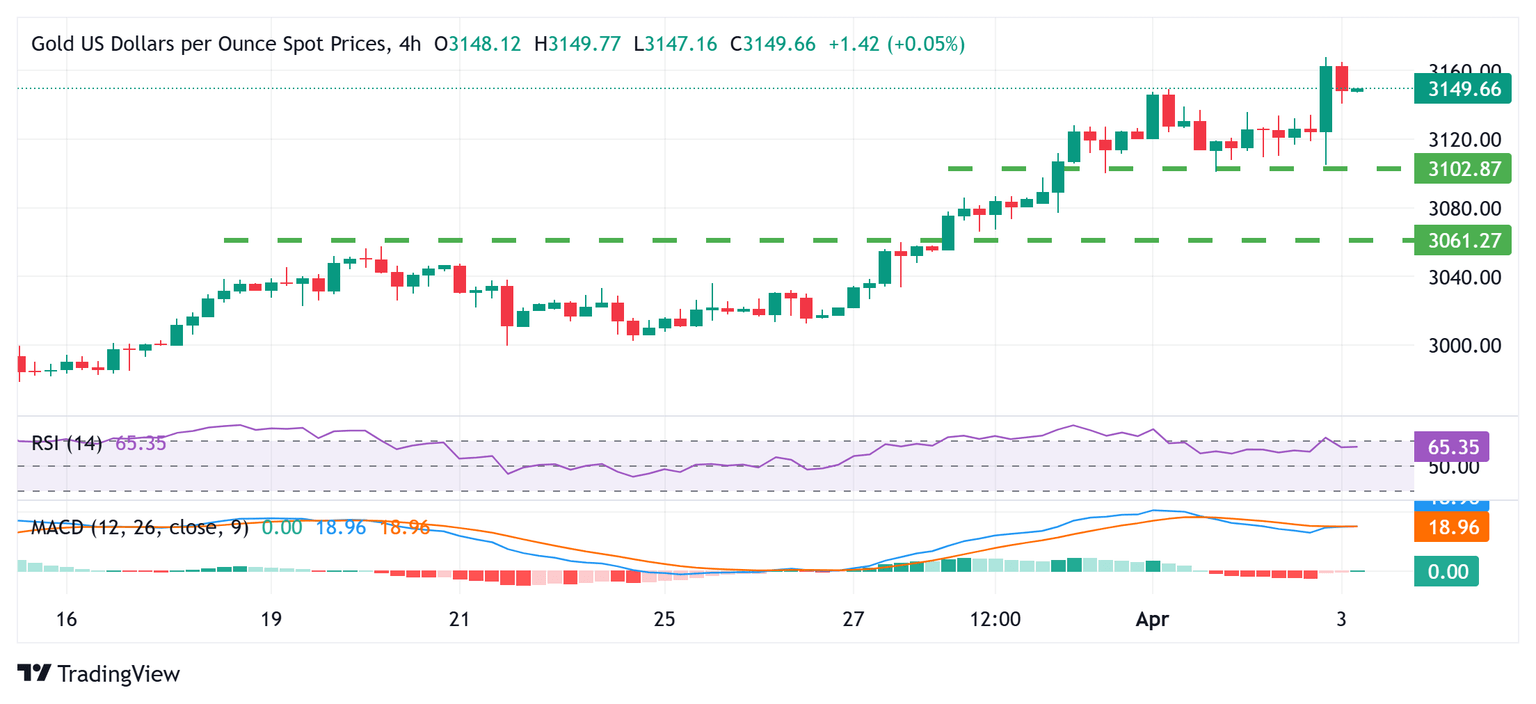

- The XAU/USD bulls pause for a breather and opt to take profits off the table amid bearish divergence on RSI.

- Fed rate cut bets and tumbling US bond yields drag the USD to a fresh YTD low, lending support to the commodity.

Gold price (XAU/USD) finds some support near the $3,116 area during the first half of the European session and for now, seems to have stalled its intraday pullback from a fresh all-time peak touched earlier this Thursday. Investors grew increasingly concerned that US President Donald Trump's sweeping reciprocal tariffs could upset global free trade and impact negatively on the world economy. This sends shockwaves through global financial markets, which is evident from the prevalent risk-off mood and lends some support to the safe-haven bullion.

Apart from the anti-risk flow, expectations that a tariff-driven slowdown in the US economy might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon trigger a steep decline in the US Treasury bond yields. This, in turn, drags the US Dollar (USD) to its lowest level since October 2024 and contributes to limiting the downside for the non-yielding Gold price. Hence, it will be prudent to wait for strong follow-through selling before confirming that the XAU/USD has topped out. Traders now look forward to Thursday's US macro data for short-term impetuses.

Daily Digest Market Movers: Gold price bulls have the upper hand amid Trump's tariffs-inspired risk-off impulse

- US President Donald Trump imposed a 10% baseline tariff on all imports and higher duties on some of the country's biggest trading partners, sending shockwaves through global financial markets. In response, China’s Commerce Ministry stated that it will resolutely take countermeasures to safeguard its rights and interests.

- The developments raise the risk of a widening trade war, which could upset global free trade and impact negatively on the world economy. This, in turn, boosted demand for traditional safe-haven assets. Apart from this, the emergence of heavy US Dollar selling pushes the Gold price to a fresh record high on Thursday.

- Investors now seem worried that Trump's protectionist policies could potentially send the US economy into a recession and are pricing in a 70% chance that the Federal Reserve (Fed) will lower borrowing costs in June. Moreover, the anti-risk flow drags the US Treasury bond yields lower across the board, undermining the USD.

- On the economic data front, the US ADP reported on Wednesday that private-sector employers added 155K jobs in March – far more than the 105K expected and the previous month's revised reading of 84K. This, however, did little to impress the USD bulls amid concerns about the economic fallout from Trump's trade policies.

- Traders now look forward to the US economic docket – the release of the usual Weekly Jobless Claims and the US ISM Services PMI. Apart from this, trade-related headlines might influence the USD and provide some impetus to the XAU/USD pair ahead of the closely-watched US Nonfarm Payrolls (NFP) report on Friday.

Gold price seems poised to prolong a multi-month-old uptrend while above the $3,100 pivotal support

From a technical perspective, the Relative Strength Index (RSI) on the daily chart continues to flash overbought conditions and holds back the XAU/USD bulls from placing fresh bets. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before positioning for an extension of a multi-month-old strong uptrend. Nevertheless, the broader setup seems tilted firmly in favor of bullish traders and suggests that the path of least resistance for the Gold price remains to the upside.

Hence, any corrective slide below the Asian session low, around the $3,123 area, could be seen as a buying opportunity. This, in turn, should help limit the downside for the XAU/USD pair near the $3,100 mark, which should now act as a key pivotal point. A convincing break below, however, might prompt some long-unwinding and drag the Gold price to the $3,076 area, or the weekly swing low touched on Monday, en route to the $3,057-3,058 region, the $3,036-3,035 zone and the $3,000 psychological mark.

Economic Indicator

ISM Services PMI

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector, which makes up most of the economy. The indicator is obtained from a survey of supply executives across the US based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that services sector activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Apr 03, 2025 14:00

Frequency: Monthly

Consensus: 53

Previous: 53.5

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) reveals the current conditions in the US service sector, which has historically been a large GDP contributor. A print above 50 shows expansion in the service sector’s economic activity. Stronger-than-expected readings usually help the USD gather strength against its rivals. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are also watched closely by investors as they provide useful insights regarding the state of the labour market and inflation.

BRANDED CONTENT

Not all brokers provide the same benefits for Gold trading, making it essential to compare key features. Knowing each broker’s strengths will help you find the ideal fit for your trading strategy. Explore our detailed guide on the best Gold brokers.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.