Gold Price Analysis: XAU/USD’s path of least resistance appears north, $1798 in sight – Confluence Detector

Gold (XAU/USD) is consolidating last week’s rally to two-month highs of $1784, in the wake of the persistent weakness in the US Treasury yields across the curve. Resurgent haven demand for the US dollar, amid concerns over the US President Biden’s $2.25 trillion infrastructure stimulus and covid infections, appears to be capping the upside in gold. However, gold bulls remain motivated, as China steps up bullion imports.

How is the metal positioned on the technical graphs?

Gold Price Chart: Key resistance and support levels

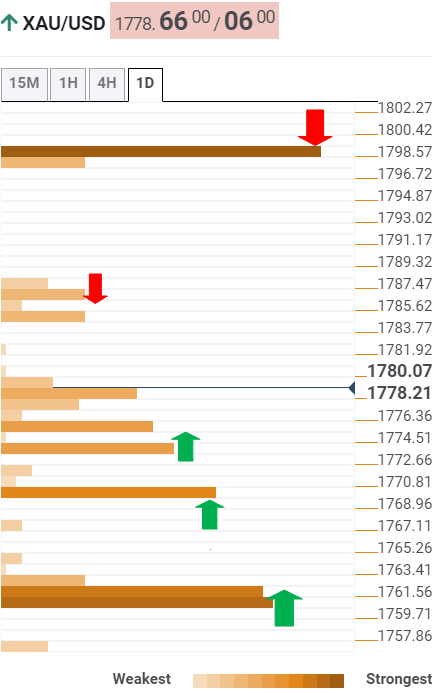

The Technical Confluences Detector shows that gold remains poised for additional upside amid a lack of healthy resistance levels until $1798.

That barrier is the confluence of the pivot point one-week R1 and pivot point one-month R2.

Ahead of that resistance, the XAU bulls need to chew offers around $1784, the confluence of Friday’s high and pivot point one-day R1.

Alternatively, powerful support is envisioned around $1774, where the Fibonacci 38.2% one-day coincides with the Bollinger Band one-day Upper.

The next significant support is aligned at $1769, the intersection of the Fibonacci 61.8% one-day and 23.6% one-week.

Further south, $1760 is the level to beat for the XAU bears. At that level, the Fibonacci 38.2% one-week and the previous month high converge.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.