Gold Price Analysis: XAU/USD’s path of least resistance appears down, levels to watch – Confluence Detector

Gold (XAU/USD) looks south, feeling the feeling of gravity amid a sharp rebound in the US Treasury yields. The benchmark 10-year rates recaptured the 1.50% key level amid stronger US jobs data and President Biden’s vaccine optimism.

The revival of the reflation trades amid the US stimulus passage and vaccine progress is likely to bode well for the returns on the markets at the expense of the non-interest-bearing gold.

How is gold positioned technically?

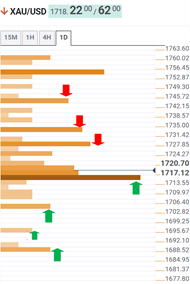

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold is flirting with a critical downside cap at $1716, which is the intersection of the SMA10 one-day and Fibonacci 38.2% one-week.

Further downside pressure could target the $1703 support, where the Fibonacci 23.6% one-week.

The pivot point one-day S3 at $1693 will get tested, below which the previous week low at $1687 will be eyed.

On the flip side, a powerful resistance is $1728, the confluence of the SMA10 four-hour and Fibonacci 38.2% one-day.

The next relevant resistance awaits at $1732/33, the meeting point of the Fibonacci 61.8% one-day and one-week.

The pivot point one-week R1 at $1743 is the level to beat for the XAU bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.