Gold Price Analysis: XAU/USD’s downside appears cushioned ahead of Yellen’s hearings – Confluence Detector

Having tested the $1800 level, Gold (XAU/USD) extends Monday’s swift recovery ahead of the much-awaited Treasury Secretary nominee Janet Yellen’s Senate hearings. Yellen is set to endorse a bigger coronavirus relief package.

Meanwhile, President-elect Biden will push for the $1.9 trillion stimulus plan once he takes the office on January 20. Expectations of additional fiscal support to fight the pandemic recession continue to bode well for the inflation-hedge, gold. Let’s take a look at how the metal is positioned on the charts.

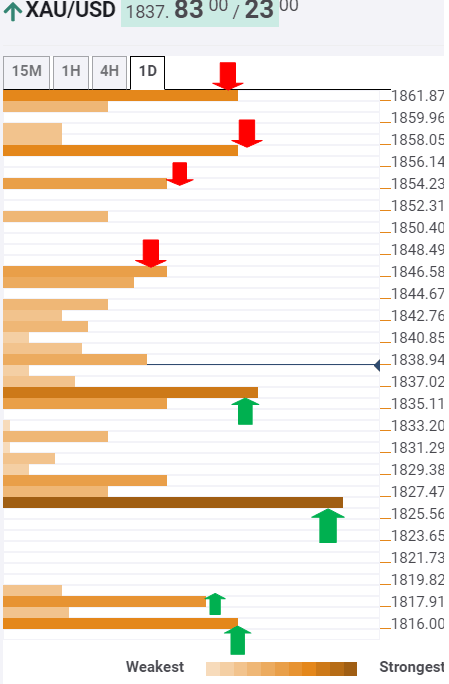

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold sees healthy support levels, with the immediate cushion seen at $1836, which is the confluence of the SMA5 four-hour, Fibonacci 38.2% one-week and Bollinger Band one-hour Middle.

The next major support awaits at the Fibonacci 23.6% one-week at $1828, below which $1826 could challenge the bears’ commitment. At that level, the Fibonacci 61.8% one-month coincides with the Fibonacci 38.2% one-day.

Further south, the intersection of the previous week low and Fibonacci 61.8% one-day at $1818 will guard the downside before testing the $1816 cap – pivot point one-month S1.

Alternatively, the bulls need to crack the Fibonacci 61.8% one-week at $1846 to extend the recovery momentum from over one-month lows of $1803.

The next significant resistance is aligned at $1854, the pivot point one-week R1. A break above the latter could expose $1858, which is the convergence of the Fibonacci 38.2% one-month and and SMA50 four-hour.

The SMA50 one-day at $1860 is the level to beat for the XAU bulls.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.