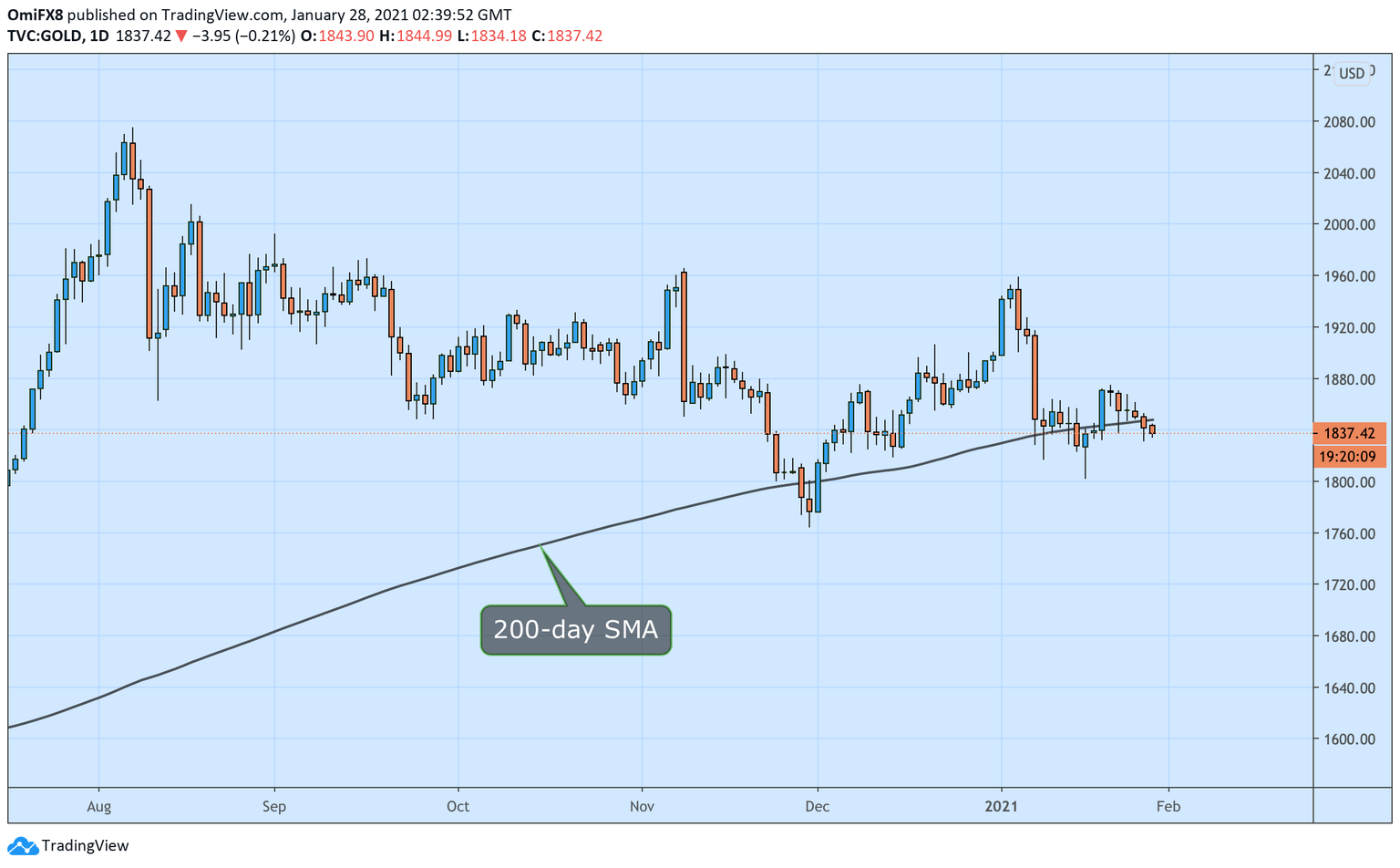

Gold Price Analysis: XAU/USD trades below the 200-day SMA

- Gold sellers look to establish a foothold below the 200-day SMA.

- That may invite stronger selling pressure, leading to a deeper decline toward November lows.

Gold is currently trading below the 200-day Simple Moving Average (SMA) at $1,848, having closed below the long-term technical line on Wednesday.

It remains to be seen if the latest break below the widely-tracked average is sustained. The SMA was breached in late November and couple of times earlier this month. However, sellers failed to establish a foothold under the average support then.

Should sellers succeed this time, more bears may join the market, yielding a deeper decline. Major support is seen at $1,764 (November low).

A close above the lower high of $1,875 created on Jan. 21 would confirm a reversal higher and expose resistance at $1,959 (Jan. 6 high).

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.