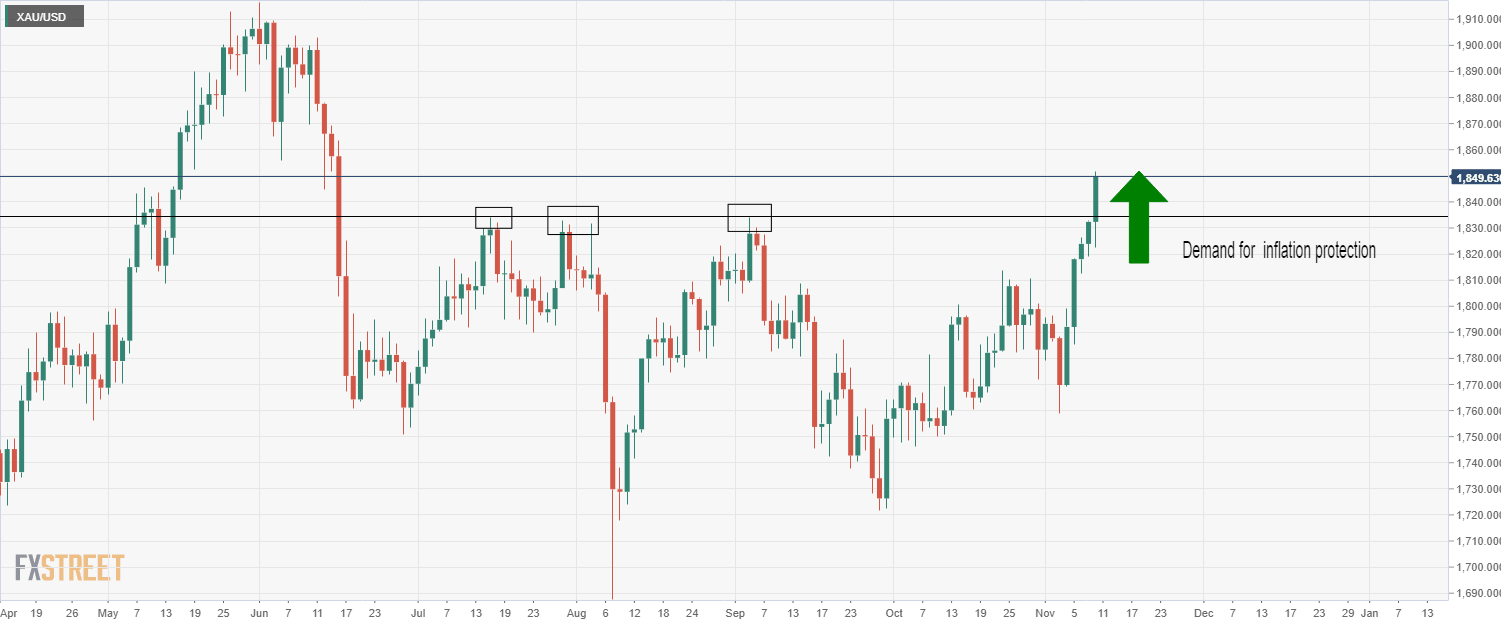

Gold Price Analysis: XAU/USD surges to multi-month highs above $1850 in wake of hot US inflation numbers

- Spot gold has surged to fresh multi-month highs in the $1850s after much higher-than-expected US inflation figures.

- The YoY rate of headline inflation rose to 6.2%.

Spot gold (XAU/USD) prices have spiked higher in response to the latest US Consumer Price Inflation (CPI) report. Prior to the data release, XAU/USD was just under $1828, but it now trades well above the $1850 mark with on-the-day gains of about more than 1.0%. Spot prices are up around 1.7% from earlier session lows around $1823.

Crucially, the recent surge higher in spot gold prices has taken the precious metal above a key area of resistance and to its highest levels since June. Over the summer months, spot prices had been unable to break beyond the $1835 level, but it seems this level has now been busted. Any retracement back towards the mid-$1830s may be used as a buying opportunity for gold bulls.

Hot US Inflation

The YoY rate of headline CPI rose to 6.2% in October (expected was 5.8%) from 5.4% in September, amid a much faster than expected MoM increase of 0.9% (expected was 0.6%). Core measures of inflation also came in higher than expectations, with the YoY rate rising to 4.6% from 4.0% in September, and the MoM rate accelerating to 0.6% from 0.2% in September.

The data has put significant upwards pressure on US yields, particularly at the front end, with the 2-year yield current up nearly 8bps on the day above 0.48% and the 5-year yield up about 7bps to above 1.14%. The rise in yields is being driven by a sharp surge in inflation expectations. This explains the sharp rise in gold – demand for inflation hedges, which could also explain why Bitcoin is now up 1.5% on the day.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset