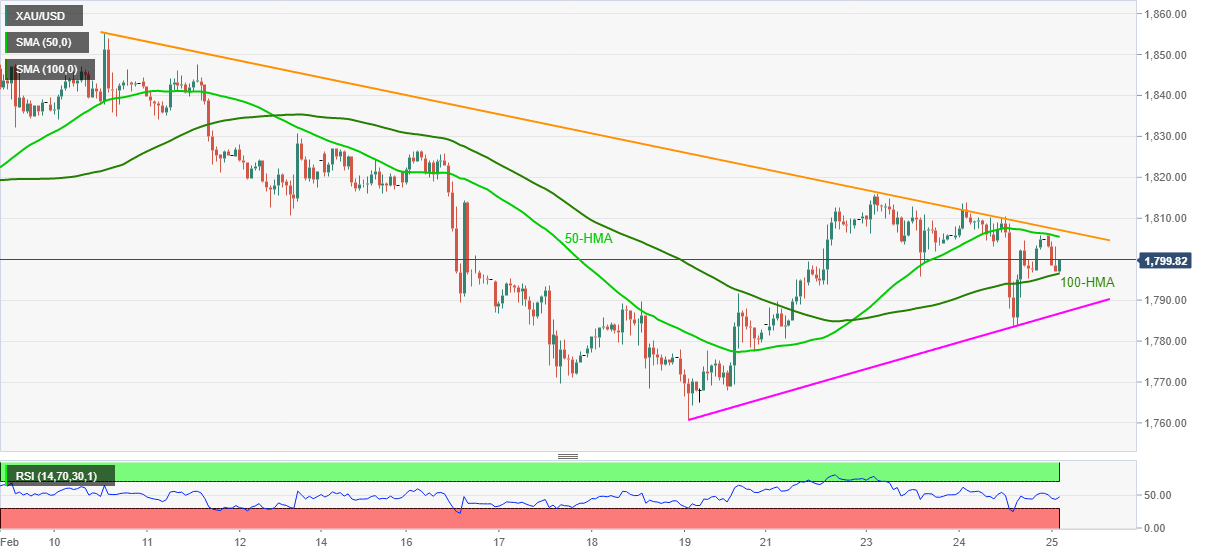

Gold Price Analysis: XAU/USD sellers flirt with $1,800, eye weekly support line

- Gold bounces off intraday low, remains weak for the third day.

- Two-week-old resistance line guards immediate upside, 100-HMA offers adjacent support.

Gold struggles to keep $1,800, recently bouncing off 100-HMA, during the early Thursday. Even so, the yellow metal declines for the third consecutive day while following a downward sloping trend line from February 10.

Given the absence of oversold RSI conditions on the hourly (1H) chart, coupled with the sustained trading below the stated resistance line, gold sellers are likely to keep the reins.

As a result, the quote’s downside past-100-HMA level of $1,796 becomes imminent. However, an ascending support line from last Friday, at $1,786 now, can challenge the bullion bears afterward.

On the flip side, a 50-HMA level of $1,805 can offer immediate resistance ahead of the short-term falling trend line, currently around $1,807.

If at all, the gold buyers manage to cross $1,807, they need to refresh the weekly high above $1,816 to direct the bulls to the February 10 high of $1,855.

To sum, gold lacks upside momentum below the key resistance line and hence the latest pullback may keep sellers hopeful.

Gold hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.