Gold Price Analysis: XAU/USD remains two steps away from $1800 and beyond – Confluence Detector

Gold (XAU/USD) is attempting a tepid bounce after falling 1% on Thursday amid a sharp recovery staged by the US dollar. Risk-aversion gripped the markets on Bloomberg report that the Biden administration is proposing higher taxes on the wealthy to pay for its social plan. Flight to safety lifted the safe-haven greenback at the expense of stocks and gold. However, the losses in the yellow metal were limited by the sell-off in Treasury yields as well.

The focus now remains on the dynamics in the yields and the dollar for fresh trading impetus. In the meantime, let's take a look at how gold is positioned on the technical charts?

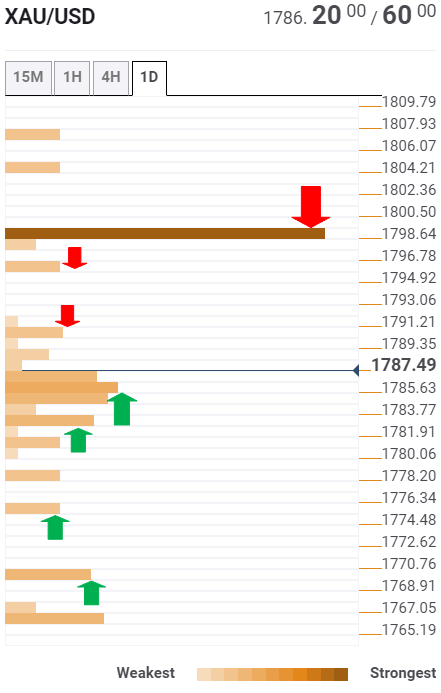

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold looks to recapture the Fibonacci 61.8% resistance at $1791.

A break above which would clear the path towards $1796, the pivot point one-day R1.

Further up, the XAU buyers need to find acceptance above $1800 to take on the further upside. That level is the confluence zone of the previous day high, pivot point one-week R and pivot point one-month R2.

Alternatively, gold is likely to find solid demand around $1786, where a cluster of minor support levels lies, which comprises of the previous high four-hour and Fibonacci 38.2% one-day.

The next support is seen at the previous week high of $1784, below which the convergence of the Fibonacci 23.6% one-day and SMA5 one-day at $1781 could get tested.

The Fibonacci 23.6% one-week at $1771 could be challenged if the previous day low of $1777 gives way.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.