Gold Price Analysis: XAU/USD bears sink their teeth into the market on hawkish Powell pivot

- Spot gold prices have dropped back to the $1830 area in recent trade amid pre-Fed profit-taking and technical selling.

- All eyes are on the Fed's policy announcement at 1900GMT and press conference with Fed Chair Jerome Powell at 1930GMT.

Update: At $1,817.59, gold (XAU/USD) is moving towards the close and down some 1.65% after falling from a $1,850.11 high to test a low of $1,814.98. The drop came on the back of a hawkish twist at the Federal Reserve event on Wednesday.

Initially, the Federal Open Market Committee Statement offered little in the way of surprising truths with regards to the Fed's path of the balance sheet runoff and rate increases and markets responded in kind with little enthusiasm. However, volatility kicked in just ahead of the Fed's chair presser.

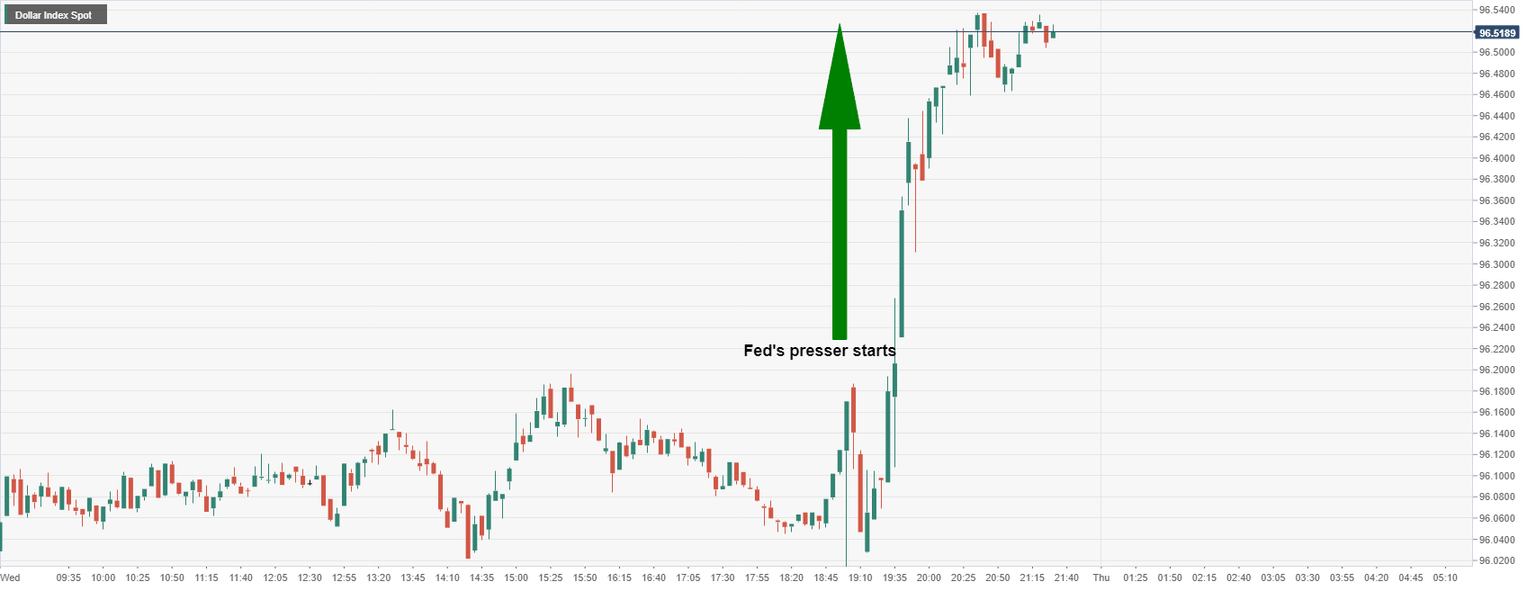

Jerome Powell surprised markets with a hawkish pivot, commenting that the Fed could raise rates at every meeting if need be. Additionally, Powell said in the presser that the Fed could move faster and sooner than they did the last time which helped the US dollar to extend on pre presser gains as US 2-year yields jumped the biggest one day gain since 2020:

As a consequence, the benchmark US 10-year yield rose to 1.855%. The US 30-year yields were moved to 2.172% and on the front end of the curve, US 2-year yields shot up to 1.095%.

DXY M5 chart

End of update

Spot gold (XAU/USD) prices have been under selling pressure in recent trade, dropping from the mid-$1840s prior to the US open to around the $1830 as the Fed monetary policy announcement at 1330GMT looms. A combination of pre-Fed profit-taking and short-term, intra-day technical selling have been cited as the reason for XAU/USD’s recent drop, with gold not receiving any impetus from subdued FX or bond markets, which are both in their typical pre-Fed lull. Starting with the technicians; since last week, gold had been supported by an uptrend, but this uptrend broke a few hours back, triggering some technical selling and a drop back to the $1830 support area.

Moving on to the pre-Fed profit-taking; gold has been performing well in recent weeks and is up more than 2.5% from its lows in the $1780 area printed back on the first day of the year. That solid run of recent gains has come despite a US dollar that has been strengthening (over the last two weeks, anyway) and US bond yields, which have remained well support close to multi-month/year highs. The run higher this year in US bond yields (the 10-year is more than 25bps higher on the year already) has come amid increased bets on Fed hawkishness, something that would normally hit gold.

However, sharp equity market downside (since the start of the year) and geopolitical tensions appear to have infused gold with some safe-haven demand. But that doesn’t mean Fed tightening isn't still a threat to gold and it seems as though on Wednesday, traders were eager to book some profit on long XAU/USD positions just in case the Fed hits markets with a hawkish surprise (which would likely be gold negative). In a scenario where a hawkish surprise sends the US dollar and yields surging, key areas of support to watch for gold include last week’s low in the $1805 area, then the annual low just above $1780. In a bullish gold scenario, Tuesday’s highs just above $1850 would be the key resistance to watch.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset