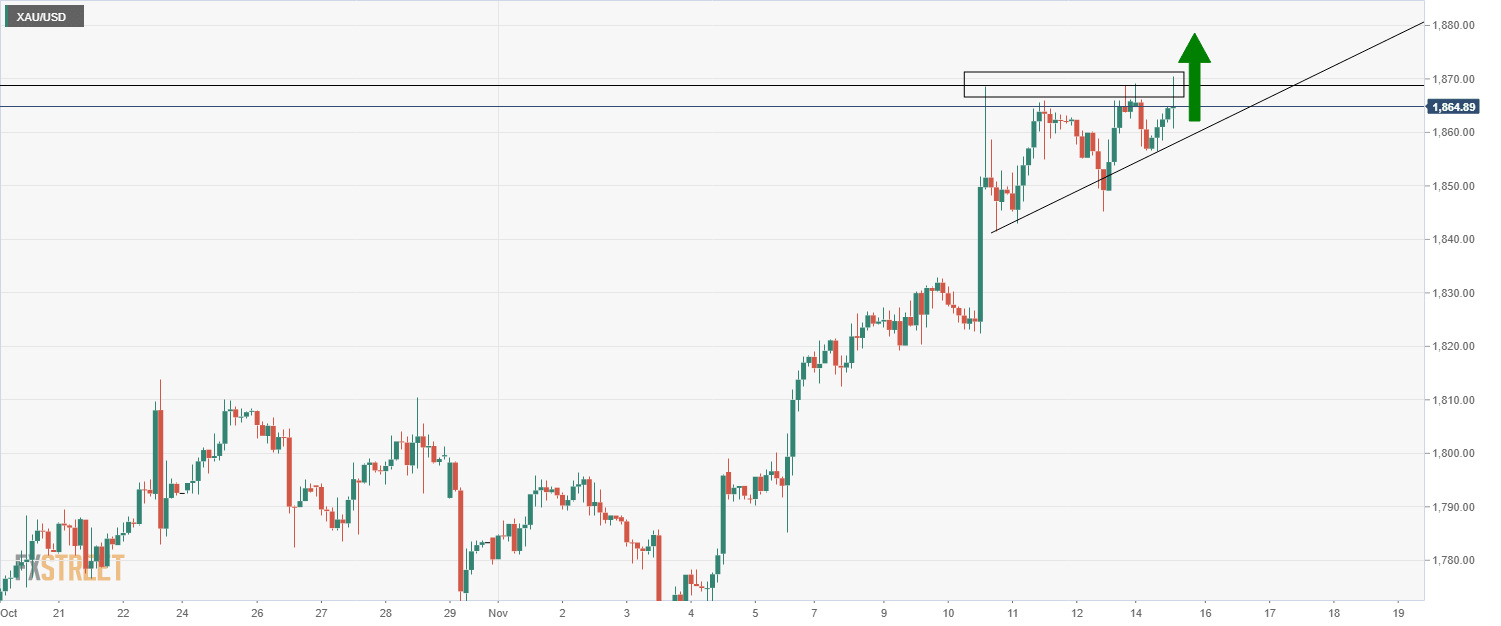

Gold Price Analysis: XAU/USD probing multi-month highs at $1870 amid bullish bank calls

- Spot gold is currently probing multi-month highs at $1870.

- The precious metal will take its cue mostly from Fed-related developments this week.

Spot gold (XAU/USD) is higher this morning and trading above $1865 as it continues to trade with a bullish bias. The dip under $1860 during Monday’s Asia Pacific trading hours attracted good demand. Spot prices have been flirting with multi-month highs at $1870 printed last week, as gold continues to benefit from bullish bank commentary, with Goldman Sachs the latest to forecast the precious metal moving back to the $2000 level. Technically speaking, the picture for gold looks bullish. If the precious metal can break above resistance at $1870, its next move will likely be towards $1900.

Real Yields

Real yields across developed markets remain close to record lows, with the US 10-year TIPS currently around -1.17% and the German inflation-linked 10-year yield currently under -2.0%. The fact that real yields are so low (and financial conditions thus so accommodative) despite the recent acceleration of headline inflation rates across developed markets has resulted in central banks like the Fed and ECB facing criticism for being too dovish. In other words, letting inflation run out of control and keeping interest rates low anyway, thus pushing real yields excessively low. Whether or not central banks are making a dovish policy mistake, gold is a big beneficiary, as lower real yields reduce the opportunity cost of holding gold. US real yields are on Monday trading with a slight downside bias, which helped the spot metal off earlier lows.

Ahead

Ahead, the main themes for precious metals like gold this week are all Fed-related; US President Joe Biden’s decision on who will be nominated as the next Fed Chair may be announced and large number of Fed policymakers will be speaking publically. Markets will be attuned to any change in tone on inflation after last week’s upside Consumer Price Inflation (CPI) surprise. Any hawkish vibes from FOMC members might present a challenge for spot gold prices.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset

-637725793476088440.png&w=1536&q=95)