Gold Price Analysis: XAU/USD pares intraday losses, bearish potential intact

- The risk-on mood prompted fresh selling around gold on Monday.

- Sustained USD selling helped limit the downside for the commodity.

- The set-up favours bearish traders, albeit warrants some caution.

Gold failed to capitalize on the previous session's intraday bounce and witnessed some fresh selling on the first day of a new trading week, albeit lacked any follow-through. The commodity remained well within Friday's trading range and was last seen hovering around the $1823 region.

The prevalent risk-on environment was seen as a key factor that undermined the safe-haven XAU/USD. The negative factor, to some extent, was offset by a weaker tone surrounding the US dollar, which extended some support to the dollar-denominated commodity and helped limit any deeper losses.

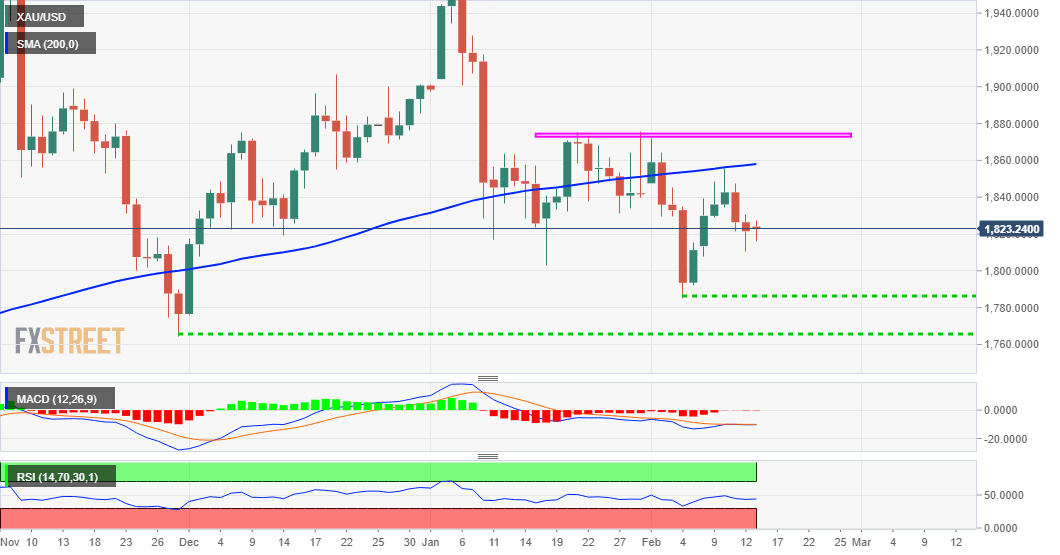

Given the recent failure near the very important 200-day SMA, the near-term bias remains tilted in favour of bearish traders. That said, some resilience ahead of the $1800 mark warrants caution for aggressive bearish traders and before positioning for any further depreciating move.

Meanwhile, technical indicators on 4-hourly/daily charts are holding in the bearish territory and support prospects for an extension of the recent downfall. However, traders might still wait for sustained weakness below the $1810 area to confirm the bearish outlook.

A subsequent slide below the $1800 mark should pave the way for a fall towards monthly lows, around the $1785 region. The XAU/USD might eventually drop to test the $1764 area, levels tested in November 2020.

On the flip side, any meaningful recovery attempt might be seen as a selling opportunity and remain capped near the $1842-44 resistance zone. This is followed by resistance near the $185-55 region (200-DMA), which if cleared might negate the negative bias and prompt some short-covering rally.

The momentum could then push the yellow metal back towards the $1875-76 heavy supply zone, above which bulls might aim back to reclaim the $1900 mark for the first time since January 8.

XAU/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.