Gold Price Analysis: XAU/USD eyes next two strong supports, as $1726 beckons – Confluence Detector

Gold (XAU/USD) has stalled its bounce and meanders near multi-day lows, with the risks tilting to the downside, as the US dollar resumes its overnight recovery while Treasury yields catch a fresh bid.

The US rates spiked on Thursday after a catastrophic Treasury auction, weighing heavily on the non-yielding gold. Markets now look forward to the US Core PCE Index, Michigan Consumer Sentiment data and the yields dynamic ahead of the US House vote on the $1.9 trillion stimulus package.

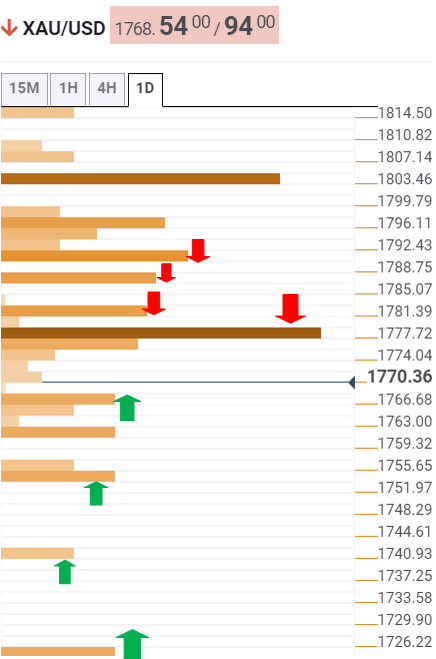

Gold Price Chart: Key levels of note

The Technical Confluences Indicator shows that the path of least resistance appears to the downside for gold, with the XAU bears eyeing the previous week low of $1761 on a failure to defend the immediate cushion at $1765, the confluence of the previous day low and previous low on four-hour.

Further south, the pivot point one-week S1 at $1753 could offer some support, below which a minor cap at $1741 could be probed.

A sharp sell-off below the latter cannot be ruled out, exposing the pivot point one-week S2 at $1726

On the flip side, recapturing the $1777 hurdle is critical to reviving the recovery rally. That level is the meeting point of the previous high four-hour and Fibonacci 23.6% one-week.

The next relevant barrier awaits at $1782, the Fibonacci 38.2% one-day, above which the bulls could challenge the intersection of the Fibonacci 38.2% one-month and SMA10 four-hour at $1787.

The Fibonacci 61.8% resistance at $1790 is the level to beat for the XAU bulls.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.