Gold Price Analysis: XAU/USD eyes key $1803 support amid US dollar strength – Confluence Detector

Gold (XAU/USD) remains under pressure while below the $1850 level, with the $1800 support back in sight amid a lack of new developments on the US fiscal stimulus. Renewed US-China tensions combined with fresh coronavirus lockdowns dent risk appetite, boosting the haven demand for the US dollar across the board.

The rebound in the US Treasury yields and surge in the platinum group metals (PGM) further weigh on gold prices. How is the bright metal positioned on the charts?

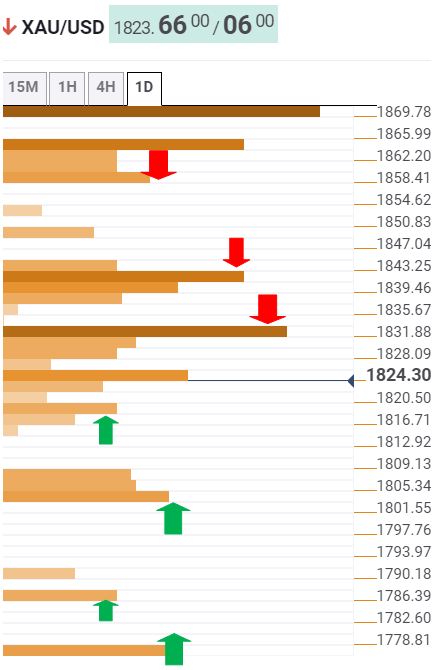

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold could meet initial support at $1818, which is the Fibonacci 38.2% one-week.

The previous month low of $1803 will be next on the sellers’ radars. Further south, $1775 (the previous week low) could be challenged.

The pivot point one-month S1 at $1778 would be the last line of defense for the XAU bulls.

Alternatively, recapturing the $1833 barrier, the confluence of the SMA10 one-day and Fibonacci 38.2% one-day, is critical to reviving the recovery momentum towards $1842 (Fibonacci 23.6% one-month), the next upside target.

The next bullish target awaits at $1858, the intersection of the SMA200 one-day and pivot point one-day R2.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.