Gold Price Analysis: XAU/USD downside more compelling below $1904 strong cushion – Confluence Detector

Gold (XAU/USD) attempts a bounce on the $1900 level but the risks remain skewed to the downside amid a broad-based US dollar rebound, as the haven demand returns. The reports that the Johnson and Johnson COVID-19 vaccine study has been paused fuelled the risk-off lows

Further, the delay in a potential US fiscal stimulus deal adds to the worries about the US economic recovery and benefits the US dollar bulls. Markets now await fresh stimulus news and US CPI release for next gold trades.

How is gold positioned technically?

Gold: Key resistances and supports

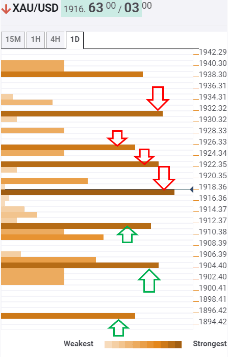

The Technical Confluences Indicator suggests that the XAU bulls are attempting a tepid bounce while challenging a fierce resistance at $1918. That level is the confluence of the Fibonacci 23.6% one-week, previous high one-hour and pivot point one-day S1.

Acceptance above the latter could put the next upside barrier at risk, $1923, where the Fibonacci 23.6% one-day coincides with SMA200 four-hour.

Further up, the convergence of the daily high and SMA10 four-hour at $1925 will cap the recovery attempt. Strong resistance at $1932, the previous week high, will be the level to beat for the bulls.

Alternatively, a break below the $1911 (previous low four-hour) support is needed for the sellers to challenge the critical downside target of $1904 (Fibonacci 38.2% one-month).

A sharp drop below the latter cannot be ruled towards $1895, the Fibonacci 61.8% one-week and SMA100 four-hour intersection.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.