Gold Price Analysis: XAU/USD bulls target $1,914 after Nonfarm Payrolls – Confluence Detector

- XAU/USD has staged a recovery in response to weak Nonfarm Payrolls figures.

- The Confluence Detector shows that gold faces significant resistance only at $1,914.

- Gold prices pull back as traders book profits – What's next? [Video]

Bad news for the US economy is good for gold – Nonfarm Payrolls rose by only 559,000 in May, below 664,000 expected and on top of only meager upward revisions. The disappointing data keeps America still short some 7.6 million jobs of pre-pandemic levels. If this slow pace persists, the Federal Reserve will likely continue printing $120 billion per month for longer. Some of that flows to the precious metal.

The next big event is inflation, due out only on Thursday, leaving room for technicals to have a substantial impact.

Where next for gold from here?

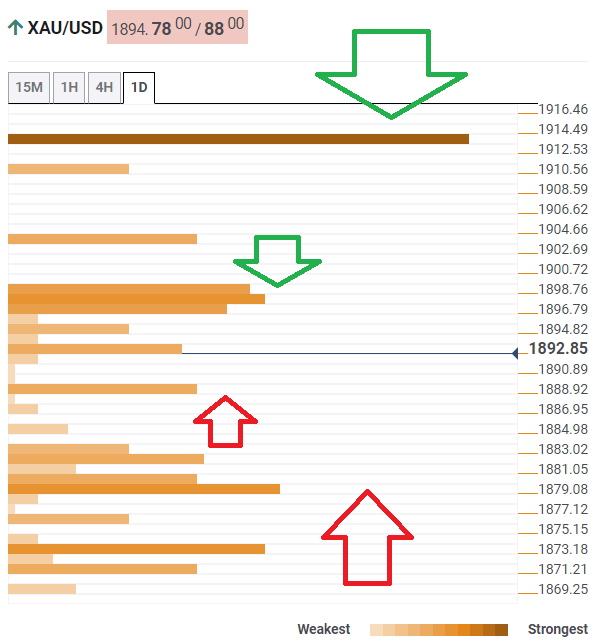

The Technical Confluences Detector is showing that XAU/USD faces some resistance at $1,897, which is the convergence of the Simple Moving Average 50-4h, the Fibonacci 38.2% one-week and the SMA 5-one-day.

The upside target is $1,914, which is where the previous monthly high and the previous weekly high converge.

Some support is at $1,888, a level of confluence between the Fibonacci 61.8% one week and the SMA 50-1h.

Further down, the next cushion is $1,879, which is the Fibonacci 23.6% one-month and the Pivot Point one-week Support 1 hit the price.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.