Gold Price Analysis: Something for both the bears and bulls

- Gold bugs are losing their grip and focus is on the downside.

- Bears can seek a full test of familiar Fibs and potentially take on confluence areas in a deeper retracement.

Gold prices are trapped between support and resistance but there is a bearish bias until a full test of at least the 38.2% Fibonacci retracement level.

The following is a top-down analysis that illustrates where there could be, first, a bullish opportunity in a healthy correction, to second, a subsequent downside extension.

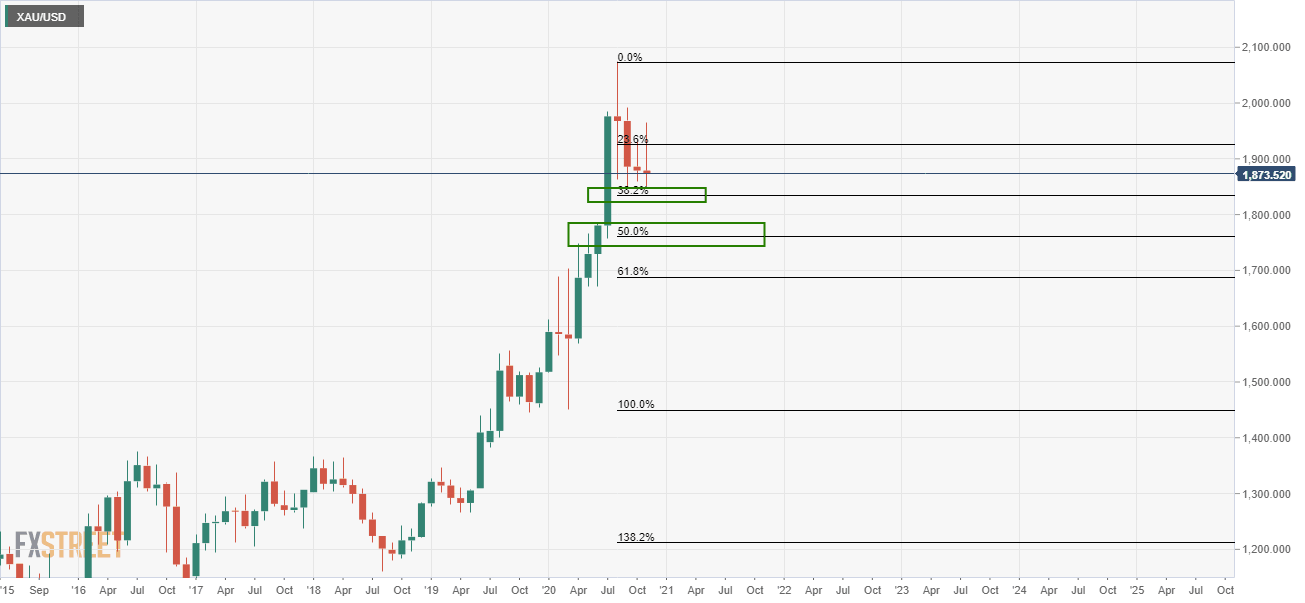

Monthly chart

Bears seeking a fuller retracement, eye the 38.2% Fibo and a 50% mean reversion thereafter.

At a stretch, the 61.8% Fibo has a confluence with prior resistance structure.

Weekly chart

The weekly chart shows that the price has been firmly rejected in the prior structure and marks a trendline resistance as well.

Support holds and could equate to a meanwhile upside correction prior to the next bearish impulse.

Daily chart

The bulls can target at least a 50% mean reversion to prior structure or a fuller retracement to the 61.8% Fibo.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.