Gold Price Analysis: Lack of healthy support levels exposes XAU/USD to $1850 – Confluence Detector

Traders remain nervous as two starkly different narratives on the coronavirus continue to play out, keeping the sentiment around gold (XAU/USD) undermined. The risk sentiment seesaws amid the covid vaccine optimism and rapid rise in infections and new shutdowns in the US.

Meanwhile, if the risk aversion deepens amid resurfacing global economic concerns over the covid growth, the safe-haven US dollar is likely to draw bids and weigh negatively on gold.

Let's see if the charts also back gold’s bearish narrative?

Gold: Key resistances and supports

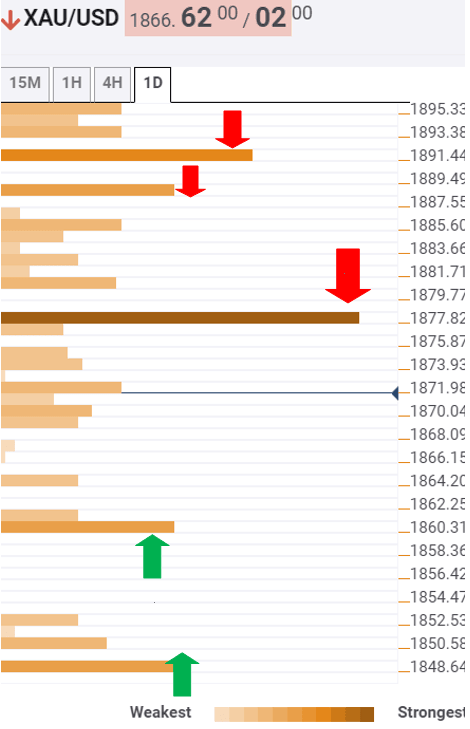

The Technical Confluences Indicator shows that the XAU/USD pair remains exposed to the additional downside amid a lack of health support levels.

Therefore, the next relevant cushion for the gold bulls is seen at $1860, the previous month low.

A failure to defend the latter could threaten the critical support at $1849, which is the convergence of the September low and pivot point one-month R1.

Alternatively, the bulls need a sustained break above the powerful $1878 barrier, in order to stage a temporary reversal. That level is the meeting point of the Fibonacci 61.8% one-day, Fibonacci 23.6% one-week and one-month.

Acceptance above the aforesaid critical resistance could see a brief advance towards the Fibonacci 38.2% one-month level at $1888.

Bulls will then challenge $1891, where the SMA10 one-day lies.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.