Gold Price Analysis: Bulls looking to test hourly resistance structure

- The price of gold is testing the bear's commitments at daily support.

- The hourly time frame is key to determining the bias from here.

On a day where stocks have fallen and the US dollar has risen, the precious metals are under pressure again.

The following is an analysis of the intermarkets affecting the value of gold on Thursday and illustrates the importance of XAU/USD hourly structure at this juncture.

First and foremost, the dollar has risen on a day where the stock markets have seen traders hitting the bid.

The negative correlation between the S&P 500 and DXY is compelling and should be noted:

S&P 500 and DXY, hourly chart

Gold, daily chart

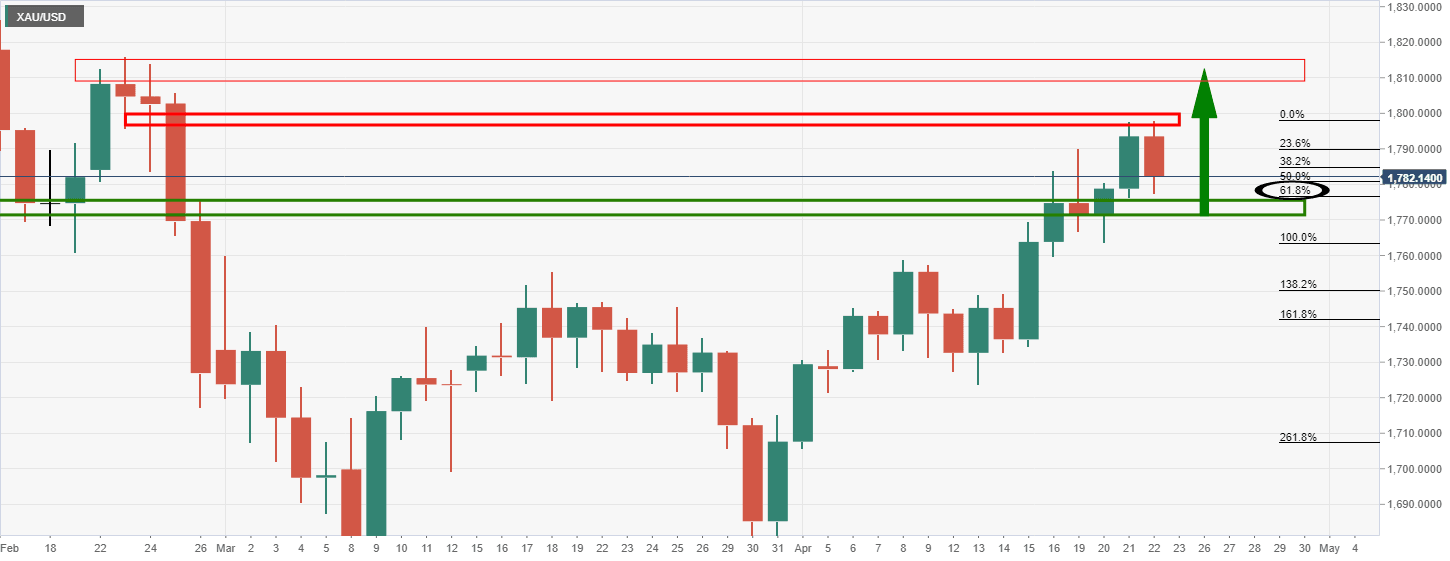

The price of gold has reached a 61.8% Fibonacci retracement of the prior bullish impulse where support would be expected to arrive with the confluence of the prior structure looking left.

Moreover, from the perspective in the forex space, the greenback is starting to stall at resistance also and would be expected to give back significant ground to prior highs on the hourly chart as follows:

As illustrated, a bearish W-formation has been charted on the hourly time frame which would be expected to draw in the price to at least a 38.2% Fibo retracement level.

That being said, a 50% mean reversion aligns perfectly with other prior resistance structure which has a confluence of the 21-EMA as well.

A downside correction in the greenback would be favourable for a bullish case for gold.

With that being said, the hourly time frame for gold is bearish while the price is still below critical resistance.

Bearish below, bullish above

Bulls will need to break the 10-EMA as well as the structure and rise above a 61.8% Fibonacci retracement, or, there is still the probability of a deeper move to the downside and to fully test the bear's commitments at daily support.

Gold, 1-hour chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637547173043897523.png&w=1536&q=95)