Gold miners ETF expects continuation of bullish trend [Video]

![Gold miners ETF expects continuation of bullish trend [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-on-weight-scale-gm165418687-21879510_XtraLarge.jpg)

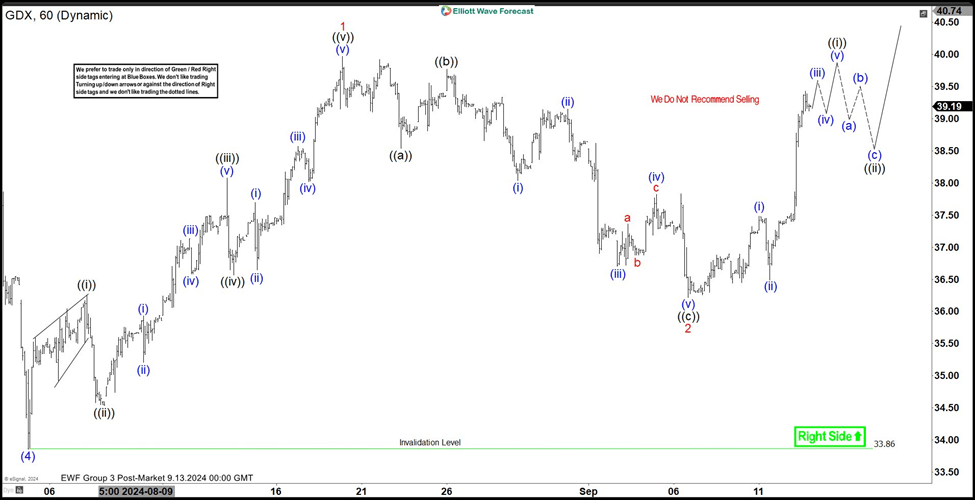

Short term Elliott Wave view on Gold Miners ETF (GDX) suggests that decline to 33.86 ended wave (4). The ETF has turned higher in wave (5). Internal subdivision of wave (5) is unfolding as a 5 waves impulse Elliott Wave structure. Up from wave (4), wave ((i)) ended at 36.25 and dips in wave ((ii)) ended at 34.54. The Index extended higher in wave ((iii)) towards 38.08 and pullback in wave ((iv)) ended at 36.56. Final leg wave ((v)) ended at 39.97 which completed wave 1 in higher degree.

The ETF then pullback in wave 2 with internal subdivision as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 38.54 and wave ((b)) rally ended at 39.77.Down from wave ((b)), wave (i) ended at 38.04 and wave (ii) ended at 39.15. Wave (iii) lower ended at 36.7 and wave (iv) ended at 37.83. Wave (v) lower ended at 36.22 which completed wave ((c)) of 2 in higher degree. The ETF has turned higher in wave 3. Up from wave 2, wave (i) ended at 37.48 and wave (ii) pullback ended at 36.49. Near term, as far as pivot at 33.86 low stays intact, expect pullback to find buyers in 3, 7, or 11 swing for further upside.

Gold miners ETF (GDX) 60 minutes Elliott Wave chart

GDX Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com