Gold just shy of 1% recovery ahead of Nonfarm Payrolls

- Gold price reclaims $3,262 after consolidating three consecutive days of losses.

- Traders trimmed some Gold holdings after headlines that China is considering trade talks with the US.

- Though the caveat is that with possibly China entering trade talks with the US, tail risks could balloon to outside proportions.

Gold (XAU/USD) trades around $3,262 on Friday at the time of writing and ending a three-day losing streak which preceded the bounce this Friday. The three-day correction was the sum of a whole string of headlines that all had one theme in common: easing on tariffs. Besides the executive orders United States (US) President Donald Trump had signed this week to give relief to the car sector, the main driver for the turnaround in the Gold rally is news that China is considering to start talking with the Trump administration on a potential trade deal, Bloomberg reports on Friday.

Although the initial market reaction is bearish for Gold with these possible tariff talks getting underway, a quite big tail risk needs to be outlined. The best example is the current ongoing trade talks between Japan and the US, where Japan is the biggest foreign US debt holder by $1,125.9 billion. Japanese Finance Minister Katsunobu Kato said this Friday that the Japanese holdings are a tool for negotiating with the Trump administration, explicitly raising for the first time its leverage as a massive creditor to the United States, Reuters reported.

Daily digest market movers: US debt is an issue for Trump

- China’s Commerce Ministry said in a Friday statement that it had noted senior US officials repeatedly expressing their willingness to talk to Beijing about tariffs, and urged officials in Washington to show “sincerity” toward China. “The US has recently sent messages to China through relevant parties, hoping to start talks with China,” the ministry added. “China is currently evaluating this”, Bloomberg reports.

- National Economic Council Director Kevin Hassett said the Trump administration is making progress in tariff talks and expects news by the end of Friday, Reuters reports.

- When looking at US debt holders, with Japan coming in first with $1,125.9 billion in holdings, China comes in second with a total of $784.3 billion, while the total US debt amounts to around $26,025.4 billion.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in May's meeting stands at 6.4% against a 93.6% probability of no change. The June meeting sees a 57.8% chance of a rate cut. Should the Nonfarm Payrolls release later this Friday fall substantially, rate cut bets for June and even May might see a lift in sentiment, where a substantial upside beat of estimates would mean a further delay in any rate cuts from the Federal Reserve (Fed). Nonfarm Payrolls are expected to be released at 12:30 GMT, with the consensus at 130,000 against the previous 228,000.

- Another chapter in the take-over story with Gold Road Resources Ltd. Shares were suspended from trading in Sydney, with the miner citing “media speculation regarding a potential change of control transaction”. The suspension will be lifted when the market opens on May 6, unless the company issues an announcement before then, the Perth-based miner said in an exchange filing Friday, Bloomberg reports.

Gold Price Technical Analysis: China and Japan hold leverage over Trump

Although the Gold rally may be stalling and a return to the all-time highs at $3,500 will not happen soon, the tail risk of a shock event is still present. That comes with possible trade talks starting between China and the US, opening up risk for a full escalation if talks are not going the way they are supposed to. The pressure is not only on for China, where the tariffs are eroding economic growth, but for President Donald Trump as well as he has nothing to show in terms of trade deals after 100-days of turmoil.

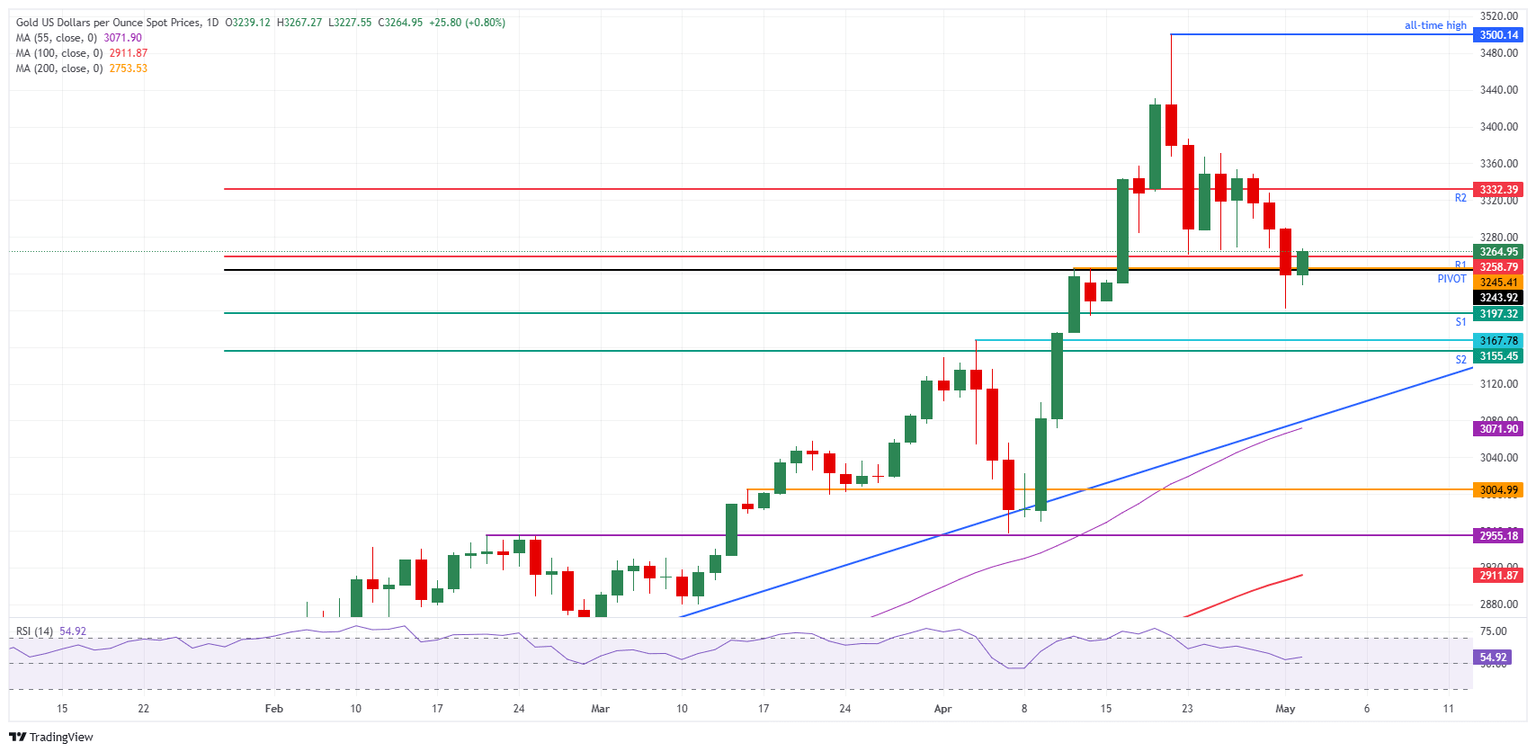

The Gold price is currently at a very heavy technical area, with first the daily pivot falling in line with the technical pivotal level from the high of April 11 at $3,245. Very close, the first R1 resistance at $3,254 is already presenting itself. For a solid breakout, $3,332 as R2 resistance is the upside level to look out for and which would deliver confirmation that the three-day losing streak is done.

On the downside, the S1 support is providing a cushion at $3,197 and coincides with Thursday’s low. Further down, the technical pivotal floor near $3,167 (April 3 high) comes into play, advancing the S2 at $3,155.

XAU/USD: Daily Chart

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

BRANDED CONTENT

Finding the right broker for trading Gold is crucial, as not all brokers offer the same advantages. Explore our list of top-performing brokers to discover the best options for seamless and cost-effective Gold trading.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.