Gold stalls after US housing data disappoints, Fed Powell testifies

- Gold trades in a muted range as markets digest disappointing US housing data and a hawkish Powell.

- Fed Powell testifies before the Senate Banking Committee, where he continues to express optimism about the US economy, with rate cuts still priced in for September, which limits bullion gains.

- XAU/USD edges lower as risk sentiment continues to support risk-sensitive assets, pushing prices back below the 50-day Simple Moving Average.

Gold (XAU/USD) has returned to a well-defined range on Wednesday, as markets continue to show signs of optimism following Tuesday's ceasefire between Israel and Iran.

At the time of writing, Gold is holding above $3,300 as markets digest the latest release of US macroeconomic data and remarks made on the second day of testimony from Federal Reserve Chair Jerome Powell.

With tensions in the Middle East appearing to remain subdued, Wednesday’s economic data releases and comments from Powell have served as an additional catalyst for Bullion.

US New Home Sales data for May, released at 14:00 GMT, fell below expectations, indicating that the housing market may be coming under pressure. Analysts had anticipated the May report to show 690,000 single-family homes sold. The actual figures showed 623,000 units sold, while the monthly percentage change declined 13.7%, a sharp decrease from the prior 9.6% increase.

Meanwhile, Jerome Powell continues to speak before the US Senate Committee on Banking, Housing, and Urban Affairs, where any shift in tone or mention of inflation risks could drive interest rate-sensitive assets, including Gold. So far, Powell has remained optimistic about the resilience of the US economy, despite the risks posed by high interest rates and weaker economic data.

Daily digest market movers: Gold price drivers, Fed expectations, risks ahead

- Federal Reserve Chair Powell continues his two-day testimony to Congress on Wednesday, following his appearance before Congress the previous day, during which he answered questions on the economy, inflation, and the potential timing of rate cuts. For Gold, which moves inversely to interest rates and the US Dollar, Powell’s comments are particularly influential.

- Powell reiterated that the Fed is in "no hurry to cut rates," noting that inflation data has been uneven and that tariff-related price pressures are likely to appear in the data for June or July.

- Powell’s tone remained consistent with the June 18 Federal Open Market Committee (FOMC) meeting, where policymakers projected two rate cuts in the latter part of the year. Despite that, market participants remain divided on the timing and certainty of those cuts, with pricing still sensitive to incoming data.

- Powell also added, “If it turns out that inflation pressures do remain contained, we will get to a place where we cut rates sooner rather than later, but I wouldn’t want to point to a particular meeting.” He clarified that a meaningful deterioration in the labor market would also affect the Fed’s decision-making, but emphasized, “We don’t need to be in any rush because the economy is still strong, the labor market is strong.” This underscores the data-dependent stance, keeping Gold sensitive to incoming figures.

- US consumer confidence data released Tuesday added to that uncertainty. The Conference Board’s Consumer Confidence index fell to 93.0 in June, down from 98.4 in May. A more cautious consumer outlook could imply softer spending ahead, which may weigh on the Fed’s growth projections and influence the timing of interest rate adjustments

- Geopolitical risk has abated for now, with the Israel-Iran ceasefire holding for a second consecutive day. While the situation remains fragile, the lack of new escalations has drawn safe-haven flows away from Gold, placing more emphasis on macroeconomic and policy factors for direction.

- Looking ahead, the release of US Personal Consumption Expenditures (PCE) data, the Fed’s preferred inflation gauge, on Friday will be critical. A soft print could revive expectations for a near-term rate cut and offer a fresh tailwind for Gold.

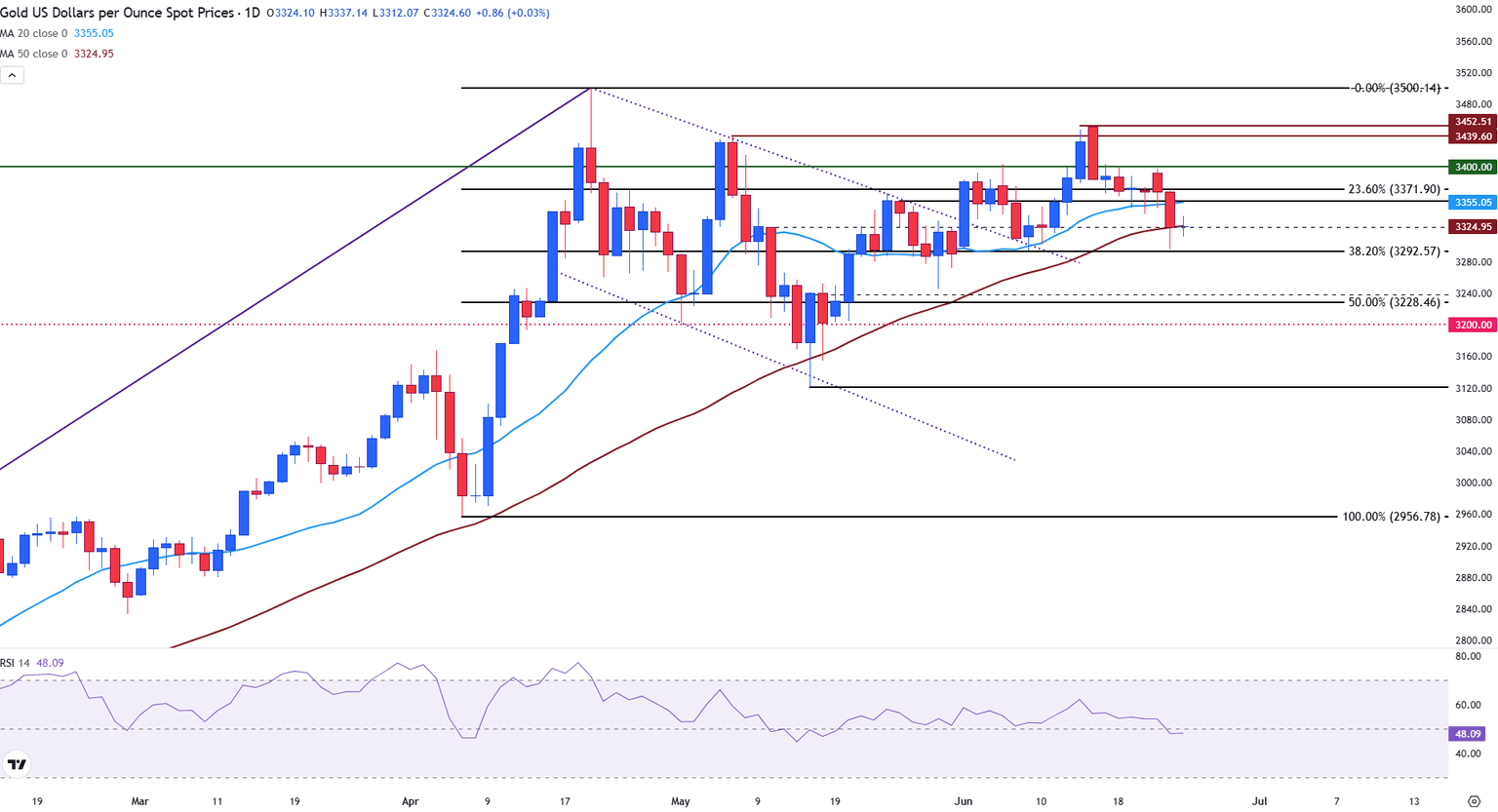

Gold technical analysis: XAU/USD clings to the 50-day SMA, remains above $3,300

Gold price is currently trading above the key psychological support level of $3,300, with the Relative Strength Index (RSI) indicator flattening near the 48 mark on the daily chart, suggesting a lack of momentum and indecision among traders.

At the time of writing, XAU/USD is trading in line with the 50-day Simple Moving Average (SMA), at $3,325.

Gold (XAU/USD) daily chart

For the price to extend its recovery, a move above the 20-day SMA at $3,355 is required. If bulls succeed in clearing this barrier, the next level of resistance will likely reside at the $3,400 psychological level.

However, if risk appetite improves, demand for safe havens could continue to decline in the short term. If the Gold price faces a deeper pullback below the $3,300 round level, the midpoint of the rally from the April 7 low to the April 22 high (the 50% Fibonacci retracement level) could come into play as support at $3,228.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.