Gold Futures: Upside looks capped

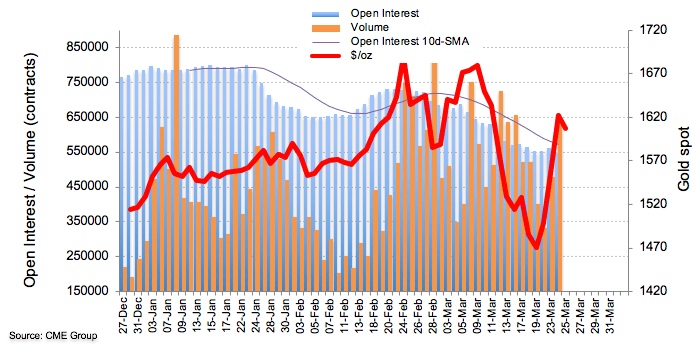

Traders scaled back their open interest positions by around 12.7K contracts on Tuesday, according to preliminary data from CME Group. Volume, instead, rose for the second session in a row, this time by nearly 150K contracts.

Gold looks capped around $1,650/oz

Prices of the ounce troy of the precious metal appears to have met strong resistance in the $1,650 area. Declining open interest in gold coupled with positive price action hints at the likeliness that further gains look limited around the $1,650 per ounce for the time being, opening the door at the same time for a potential consolidation or correction lower.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.