Gold consolidates near $3,300 as trade woes resurface ahead of August 1 tariff deadline

- Gold climbs back above $3,300 after hitting a one-month low on Wednesday.

- Safe-haven demand picks up as markets brace for the final US tariff announcements ahead of the August 1 deadline.

- The technical setup remains range-bound between $3,250 and $3,450 with weak momentum.

Gold (XAU/USD) rebounds sharply on Thursday after falling to a one-month low of $3,268 on Wednesday, pressured by stronger-than-expected US data and the Federal Reserve’s (Fed) decision to keep interest rates unchanged. However, safe-haven demand has since resurfaced, with buyers stepping in to drive a swift recovery.

As of American trading hours, Gold is consolidating near the $3,300 level after touching an intraday high of $3,314.89 during European hours — up nearly 0.70% on the day. The rebound is driven by escalating trade tensions ahead of the August 1 tariff deadline. However, the upside remains capped as the US Dollar Index (DXY) climbs to a fresh two-month high near 100.10 after strong inflation and labour data.

US President Donald Trump is expected to announce final tariffs on several countries that have yet to reach a deal later on Thursday. The tariffs are set to take effect Friday, August 1, keeping market sentiment fragile.

On Wednesday, President Trump unveiled a series of aggressive trade measures, starting with a 25% tariff on all Indian imports, citing national security concerns over India’s growing defense and energy ties with Russia.

He also raised tariffs on Brazilian imports by 40%, bringing the total effective duty to 50%, with selective exemptions on products such as orange juice, fertilizers, and aircraft. Additionally, a 50% tariff was introduced on copper-based products, including pipes and electrical wiring, though raw copper, cathodes, and concentrates were excluded.

Amid renewed tariff threats, some optimism emerged on Wednesday as the United States (US) and South Korea finalized a trade agreement just before the deadline.

Under the deal, the US will impose a 15% tariff on South Korean imports, significantly lower than the previously threatened 25%. In return, South Korea pledged $350 billion in investments in America. So far, the US has finalized trade framework deals with the European Union (EU) and Japan, both of which include strategic investment commitments and tariff alignment across key sectors.

In addition, bilateral agreements have been reached with the United Kingdom, Indonesia, Vietnam, and the Philippines. Meanwhile, a 90-day trade truce with China is set to expire on August 12, with no agreement or extension yet announced.

Market movers: Fed pause, weak yields keep Gold anchored

- US President Donald Trump lashed out Thursday at Jerome Powell after the US central bank continued to hold rates steady again, calling him "too stupid" to be Federal Reserve chairman. "He is TOO LATE, and actually, TOO ANGRY, TOO STUPID, & TOO POLITICAL, to have the job of Fed Chair," Trump said on his Truth Social platform, after the Fed decided to hold its key lending rate steady for a fifth straight meeting.

- The core Personal Consumption Expenditures (PCE) Price Index — the Fed’s preferred inflation measure — rose 0.3% month-over-month in June, matching expectations and up from 0.2% in May. On a yearly basis, core PCE climbed 2.8%, slightly above the 2.7% forecast. The headline PCE index also increased 0.3% MoM and 2.6% YoY, both coming in higher than expected, pointing to persistent inflation pressures.

- Personal spending rose 0.3% in June, just shy of the 0.4% forecast but a solid rebound from May’s 0.1% decline. Personal income increased by 0.3%, beating expectations of 0.2% and recovering sharply from the prior month’s 0.4% drop. Labor market data also showed resilience, with initial jobless claims falling to 218,000 — slightly below the 224,000 estimate — suggesting continued tightness in the job market.

- The Fed kept interest rates steady at 4.25%-4.50% on Wednesday, with two FOMC members dissenting in favor of a cut. Chair Jerome Powell struck a cautious tone in the post-meeting press conference, signaling that it’s “too soon” to consider rate reductions amid lingering inflation pressures, especially those linked to rising tariffs.

- The yield on the 10-year US Treasury hovers near 4.36% on Thursday, while the 30-year yield stands around 4.88%, both slipping nearly 30 basis points from Wednesday’s post-Fed highs. The pullback comes despite the Fed’s hawkish stance, reflecting a cooling in rate-cut expectations as markets reassess the policy outlook.

- Fed Chair Jerome Powell confirmed that no decision has been made regarding a potential rate cut in September, reinforcing the central bank’s “wait-and-see” stance. His cautious remarks triggered a sharp repricing in market expectations: the probability of a September rate cut dropped to 37.2%, down from around 65% earlier in the week, according to data from the CME FedWatch Tool.

- According to a latest report published by World Gold Council (WGC) on July 31, Gold demand (including OTC investment) rose 3% YoY to 1,249 tonnes. In value terms, total gold demand jumped 45% YoY to $132 billion, driven by safe-haven flows into gold ETFs and physical investment. This marked the strongest first half for gold investment since 2020.

- Gold-backed ETFs saw 170 tonnes of net inflows in Q2, adding to 227 tonnes in Q1, making H1 2025 the strongest six-month period since the record-breaking H1 2020. Robust flows came from all major regions, especially China and North America, as uncertainty over US trade policy and geopolitical risks kept institutional demand elevated, the WGC report added.

- Central banks added 166 tonnes of Gold to their reserves in Q2, down 33% from Q1, but still 41% above the 2010-2021 average. Despite the slowdown, the World Gold Council notes that 95% of surveyed central banks expect global reserves to rise over the next year, reinforcing Gold’s role as a strategic reserve asset.

Technical analysis: XAU/USD consolidates between $3,250-$3,450 range as momentum weakens

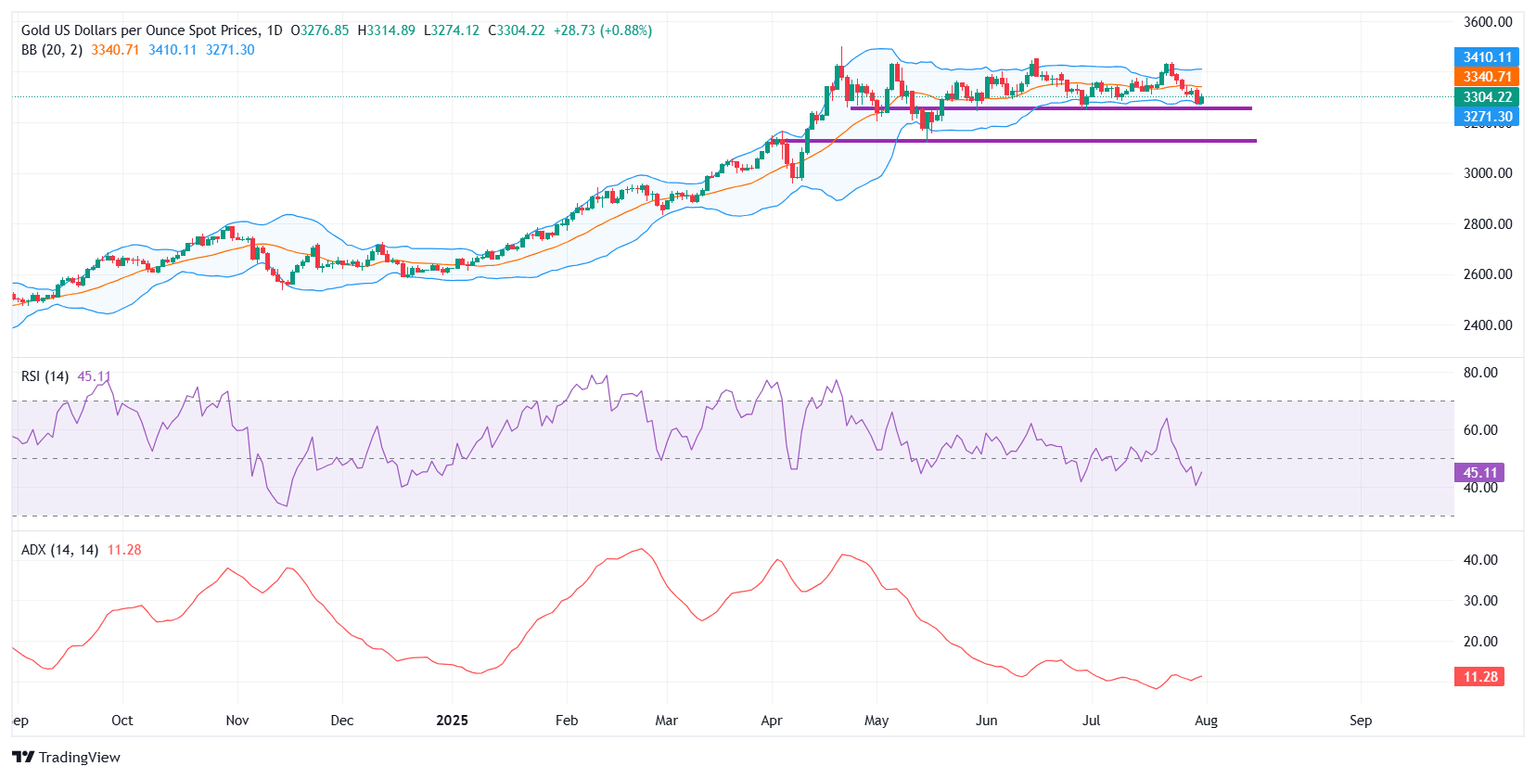

On the daily chart, XAU/USD is trading in a sideways range after reaching an all-time high of $3,500.14 on April 22. Since then, prices have been consolidating between $3,250 and $3,450, showing no strong directional trend.

The $3,250 level remains the first key support, which has previously acted as a strong demand zone. A breakdown below this could expose the next support around $3,150. On the upside, immediate resistance is seen near $3,350, which lines up with the middle Bollinger Band and also serves as the 20-day Simple Moving Average (SMA).

The Relative Strength Index (RSI) is currently at 44, reflecting neutral to mildly bearish momentum, with further room to fall before entering oversold territory. Meanwhile, the Average Directional Index (ADX) is extremely low at 11.28, suggesting a weak trend and overall market indecision.

This implies Gold may continue to trade range-bound in the near term unless a decisive breakout above $3,350 or a breakdown below $3,250 takes place.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.