Gold tanks over 1% on Thursday after President Trump clouds tariff planning

- US President Trump made contradictive tariff comments during his first cabinet meeting.

- Bullion faces pressure from firm selling, profit-taking, squeezing out recent buyers in Gold.

- Although US yields drop off further, the precious metal has lost support for now.

Gold’s price (XAU/USD) ekes out more losses and faces already more than 1% loss ahead of the American trading session on Thursday. The leg lower came after United States (US) President Donald Trump casted doubts and confusion during a cabinet meeting on Wednesday about what levies will be applied, when and to which countries.

President Trump said “tariffs will go on, not all, but a lot of them” and added that levies on Canada and Mexico imports will go into effect on April 2. Reciprocal tariffs should be installed on April 2 too. The US President confirmed a 25% tariff would be imposed on Europe as well on autos and other things but he did not provide further details.

Daily digest market movers: All falls apart

- Overnight markets braced for Nvidia’s (NVDA) earnings. Nvidia's quarterly sales will be about $43 billion, slightly above analysts' estimates, but gross profit margins will be tighter than expected due to the rollout of a new chip design called Blackwell. The mixed outlook came in with bad timing as concerns about slowing spending on AI and the potential impacts of US tariffs could mean more headwinds for the company.

- The CME Fedwatch Tool projects a 33.0% chance that the interest rates will remain at the current range in June, with the rest showing a possible rate cut.

- On the US data front, the second reading of the US Gross Domestic Product (GDP) for the fourth quarter is due at 13:30 GMT. Projections are that the GDP annualized will remain stable at 2.3%. The quarterly headline preliminary Personal Consumption Expenditures (PCE), which precedes the monthly PCE on Friday, is expected to continue stable at 2.3% as well. The core PCE number should come in at 2.5%, also unchanged.

Technical Analysis: Buy the dip or stay away for now

On Wednesday, a few analysts warned that greedy price action was taking place in Gold, with traders willing to buy at any given price to remain part of the rally. With the current correction, several traders will be facing a squeeze and might soon see their stop losses exercised. This idiosyncratic action will result in more selling pressure and might even see a firm drop lower in Bullion to possibly even $2,860 on the day.

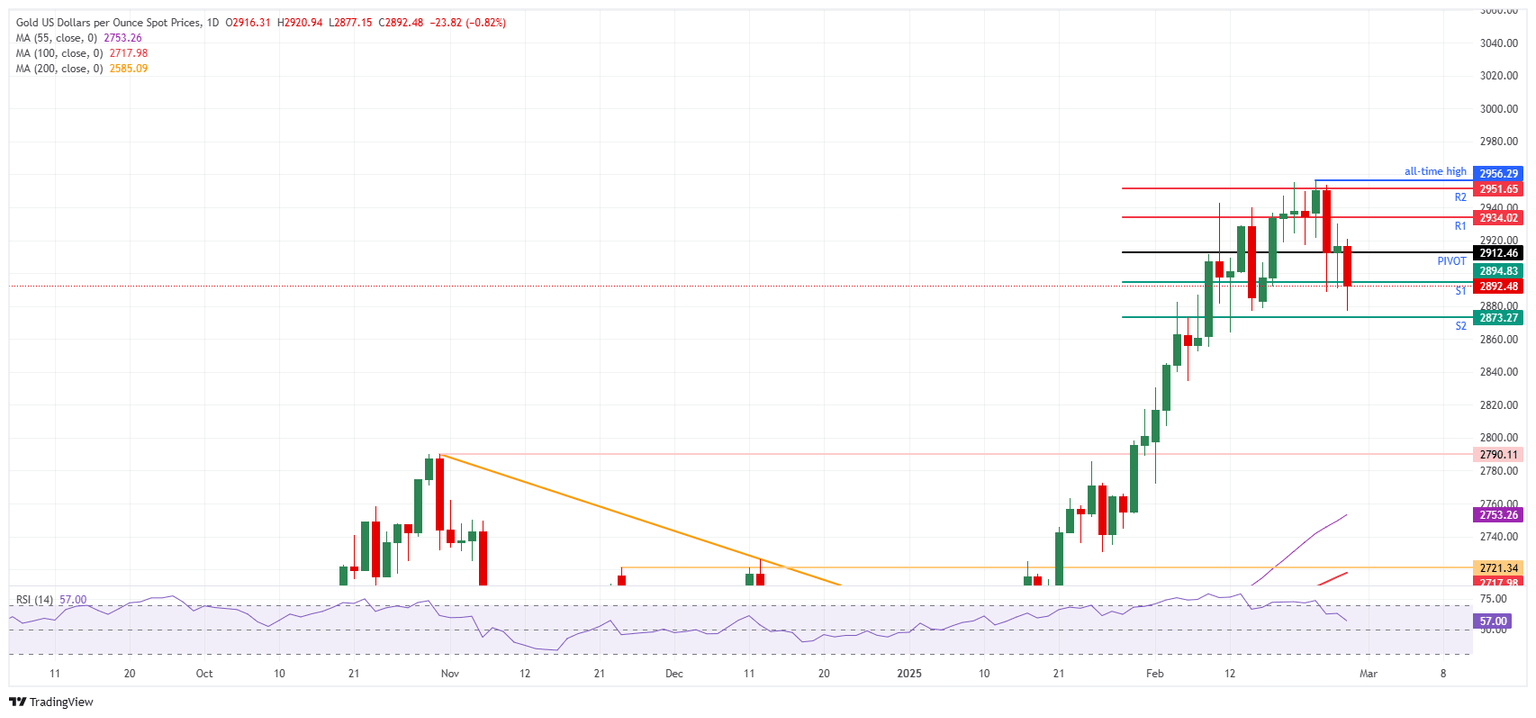

The main element to trigger a turnaround comes at the daily Pivot Point of $2,912. Should Gold fully recover back above that level, it would confirm that traders are buying the current dip. Once through there, $2,934 and $2,951 are levels on the upside to look out for in the form of the intraday R1 and R2 resistances.

On the flip side, Tuesday’s low at $2,890 is starting to give way. Further down, watch out for $2,873 (the S2 support), which could open the door for a test to $2,860.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.