Gold bounces off one-week low, remains below $4,200 as traders await Fed decision

- Gold drifts lower amid some repositioning trade ahead of the crucial FOMC rate decision.

- Dovish Fed expectations keep a lid on the recent USD recovery and support the commodity.

- Geopolitical risks might contribute to limiting the downside for the safe-haven precious metal.

Gold (XAU/USD) reverses an intraday dip to the $4,170 area, or a one-week low, though it remains on the defensive through the first half of the European session on Tuesday. Traders seem reluctant to place aggressive directional bets and opt to wait for the outcome of a two-day FOMC policy meeting on Wednesday. Investors will keep a close eye on updated economic projections, including the so-called dot plot, and Federal Reserve (Fed) Chair Jerome Powell's post-meeting press conference for cues about the future rate-cut path. This, in turn, will play a key role in influencing the US Dollar (USD) demand and providing a fresh directional impetus to the non-yielding yellow metal.

In the meantime, firming expectations that the US central bank will lower borrowing costs this week and bets for more rate cuts in 2026 keep a lid on the attempted USD recovery from its lowest level since late October, touched last week. Apart from this, persistent geopolitical uncertainties stemming from the protracted Russia-Ukraine war could act as a tailwind for the safe-haven Gold and help limit deeper losses. Moreover, the recent range-bound price action witnessed over the past week or so makes it prudent to wait for strong follow-through selling before positioning for a further depreciation for the XAU/USD pair. Traders now look to the US macro data for some impetus later this Tuesday.

Daily Digest Market Movers: Gold lacks a firm direction as traders await more Fed rate cut cues

- The US Personal Consumption Expenditures (PCE) Price Index released last Friday did little to influence expectations for further policy easing by the Federal Reserve (Fed). In fact, traders are currently pricing in an over 85% chance that the US central bank will cut interest rates by 25 basis points at the end of a two-day policy meeting on Wednesday.

- The dovish outlook fails to assist the US Dollar to capitalize on the recent modest recovery move from its lowest level since late October and turns out to be a key factor that acts as a tailwind for the non-yielding Gold. Traders, however, seem reluctant and opt to wait for more cues about the Fed's future rate-cut path before placing fresh directional bets.

- The yield on the benchmark 10-year US government bond rose to a 2-1/2-month top on Monday amid speculations that Fed Chair Jerome Powell's comments during the post-meeting press conference might point to a higher bar for further rate reduction. This continues to act as a headwind for the non-yielding Gold through the Asian session.

- US President Donald Trump may walk away from supporting the Ukrainian war efforts against Russia, the American leader’s son said while speaking at a West Asia conference. This comes amid slow progress in Russia-Ukraine ceasefire talks and keeps geopolitical risks in play, which is seen as another factor supporting the safe-haven commodity.

- Traders now look forward to Tuesday's US economic docket – featuring the release of the ADP Weekly Employment Change and JOLTS Job Openings. The data might influence the USD price dynamics and provide some impetus to the XAU/USD pair, though traders might opt to wait on the sidelines heading into the key central bank event risk.

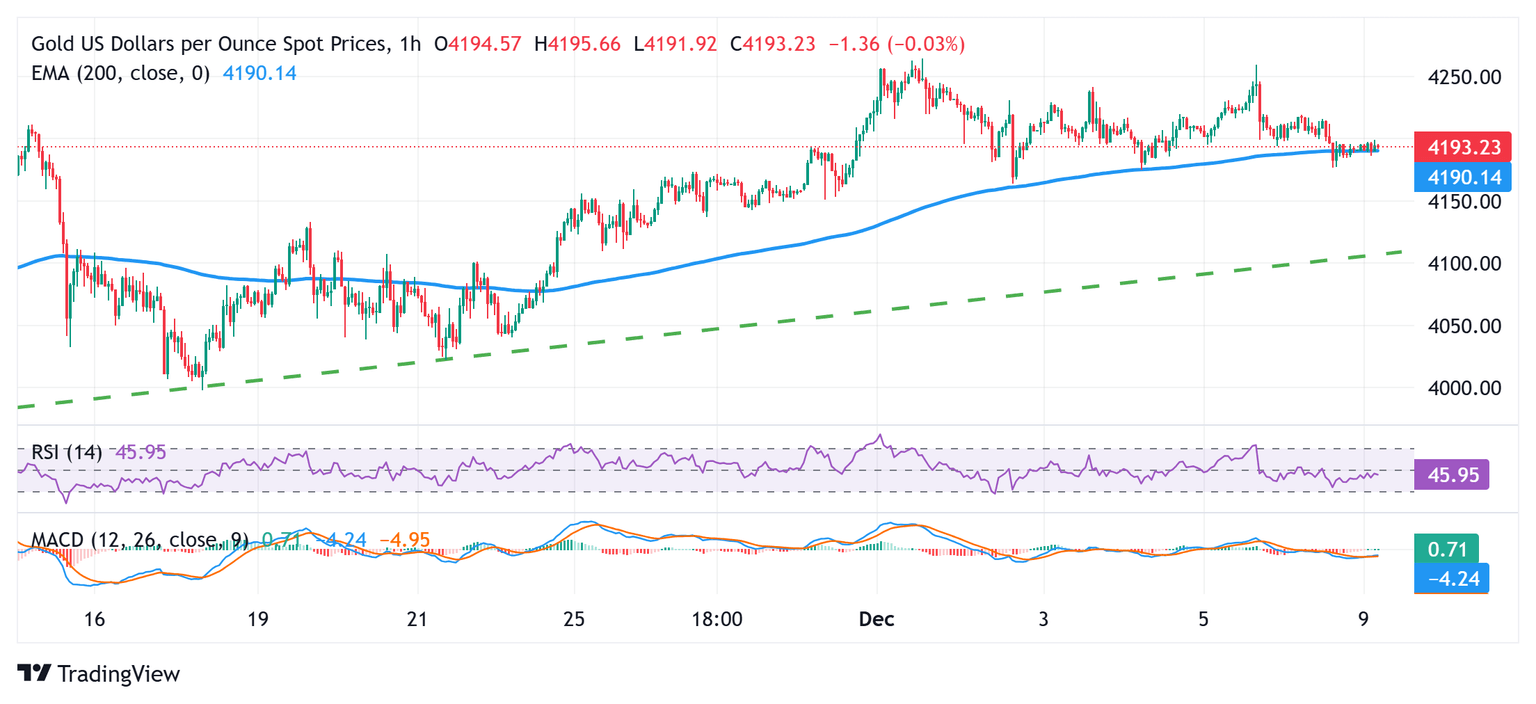

Gold might continue to find support ahead of monthly low, around $4,164-4,163

The commodity has been showing some resilience below the 200-hour Exponential Moving Average (EMA) since the beginning of this month. Given that oscillators on the daily chart are holding in positive territory, a subsequent move back above the $4,200 mark could lift the Gold price to the next relevant hurdle near the $4,245-4,250 region. The latter represents the top end of a one-week-old range, above which the XAU/USD pair could surpass the $4,277-4,278 intermediate hurdle and aims to reclaim the $4,300 mark.

On the flip side, the monthly low, around the $4,164-4,163 zone could offer immediate support. A convincing break below could make the Gold price vulnerable to accelerate the fall towards testing sub-$4,100 levels. The latter represents a short-term ascending trend-line extending from late October, which, if broken decisively, will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

Economic Indicator

Fed Monetary Policy Statement

Following the Federal Reserve's (Fed) rate decision, the Federal Open Market Committee (FOMC) releases its statement regarding monetary policy. The statement may influence the volatility of the US Dollar (USD) and determine a short-term positive or negative trend. A hawkish view is considered bullish for USD, whereas a dovish view is considered negative or bearish.

Read more.Next release: Wed Dec 10, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.