Gold clings to modest weekly gains, remains capped below $3,400

- Gold edges lower after hitting a two-week high of $3,409 on Friday.

- Gold futures soar to record highs after US imposes tariffs on 1-kg and 100-oz Gold bars.

- Technicals show Gold struggling below $3,400 but holding above key moving averages.

Gold (XAU/USD) is trading slightly lower on Friday after peaking at $3,409 earlier in the day, its highest level in two weeks amid a cautious market mood. At the time of writing, the metal is hovering near $3,400 during the American trading session and is on track to post modest weekly gains of around 1%.

The precious metal remains underpinned by concerns over the economic impacts from US tariffs, persistent inflation worries, and growing speculation that the Federal Reserve (Fed) will lower the interest rate in September. However, a modest rebound in the US Dollar (USD), relatively stable Treasury yields, and a broader risk-on sentiment across global equity markets are capping further upside, as bulls struggle to decisively break above the key psychological barrier at $3,400.

While spot prices held steady with modest gains, Gold futures surged to fresh record highs after the Financial Times reported that the US has imposed new tariffs on 1-kg and 100-oz Gold bars. The December COMEX contract surged to an all-time high of $3,534.10 before paring gains slightly, fueled by concerns over potential supply chain disruptions and higher import costs. The bullish momentum spilled over into the Indian market as well, where MCX October Gold futures climbed to a new record above 1,02,000 INR per 10 grams, driven by a weak Indian Rupee, tariff-led supply risks, and robust investment demand.

As first reported by the FT, a ruling issued on July 31 by US Customs & Border Protection (CBP) now classifies one-kilogram and 100‑ounce Gold bars under the tariff code 7108.13.5500, bringing them under a higher import duty. These standard bullion bars are mainly refined in Switzerland. The move is expected to ramp up pressure on Switzerland, one of the world’s largest precious metal hubs, which accounts for approximately $61.5 billion in annual Gold exports to the United States. It marks another blow for Switzerland, which is already facing a 39% tariff on a wide range of exports under the Trump administration’s reciprocal trade measures.

Market movers: US Dollar steadies, yields rebound and risk-on mood lifts equities

- The US Dollar Index (DXY), which tracks the value of the Greenback against a basket of six major currencies, is holding firm above 98.00 on Friday but remains pinned near a two-week low.

- US Treasury yields firm up, with the 10-year steady near 4.25% and the 30-year at 4.82%, rebounding from multi-week lows, capping bullish momentum in Gold.

- The US and Russia are discussing a possible ceasefire deal in Ukraine, which could allow Russia to keep control of occupied regions. The proposed ceasefire, reportedly to be discussed at a possible Trump-Putin summit in the UAE as early as next week, has sparked diplomatic concerns, particularly from Ukraine and EU leaders who fear being sidelined in the process.

- Federal Reserve official Musalem, speaking Friday, outlined the current challenges facing the US economy without offering a direct view on interest rate policy. He described the labor market as still balanced but warned that weakening economic activity could put jobs at risk. Musalem also cautioned that while tariffs may lead to a temporary boost in inflation, their effects are likely to fade over time as companies adapt through cost-cutting and supplier negotiations. He stated that there is a reasonable probability of some inflation persistence, and acknowledged that the Fed is currently missing its inflation target while still meeting its employment mandate. He also warned that the central bank could miss both its inflation and employment objectives if labor market conditions deteriorate.

- Global equities are heading for strong weekly gains, reinforcing a risk-on tone that’s pressuring Gold. The STOXX 50 and STOXX 600 are set to close the week up 3.3% and 1.9%, respectively — their best performance since April. In Asia, the MSCI Asia Pacific Index rose 0.4%, marking a five-day winning streak, while Japan’s Nikkei 225 surged 2.2%. The UK’s FTSE 100 is also on track to end the week in positive territory. Meanwhile, US stocks edged higher on Friday, capping a week dominated by tariff headlines. The Dow Jones Industrial Average is up more than 1% on the day, while the Nasdaq Composite, which hit a record high on Thursday, has gained over 3%.

- US labor market data continues to flash signs of cooling, reinforcing expectations of a Fed rate cut. Initial Jobless Claims rose to 226K last week, higher than both the 221K consensus and the previous 218K reading. This follows last Friday’s July Nonfarm Payrolls (NFP) report, which surprised to the downside with a gain of just 73K jobs, well below the 110K expected.

- The latest US economic data has cast doubt over the resilience of the world’s largest economy, reinforcing dovish market expectations. According to the CME FedWatch Tool, traders are now pricing in around a 90% probability of a 25-basis-point rate cut at the September FOMC meeting, as soft labor data and slowing growth strengthen the case for policy accommodation.

- On Thursday, US President Donald Trump announced the nomination of White House economic adviser Stephen Miran to temporarily fill the vacancy on the Federal Reserve Board. The opening follows the resignation of Fed Governor Adriana Kugler, effective August 8. Miran’s appointment requires Senate confirmation, making his participation in the upcoming September 16–17 FOMC meeting uncertain. “In the meantime, we will continue to search for a permanent replacement,” Trump said, adding a layer of political uncertainty to the Fed's near-term policy path.

- Atlanta Fed President Raphael Bostic said on Thursday that the July jobs report has shifted thinking around how the Fed is progressing on its employment mandate. He acknowledged that the latest data suggests labor market risks are now higher than previously assessed. While Bostic reiterated that he still sees one rate cut this year as appropriate, he added that “a lot of data” is due before the September FOMC meeting, leaving the door open for adjustments.

- No major US economic data is scheduled for release on Friday, keeping the market focus on Fed commentary. Later in the day, St. Louis Fed President Alberto Musalem is set to speak, with investors watching closely for any additional clues on the central bank’s rate outlook following a week of cautious remarks from policymakers.

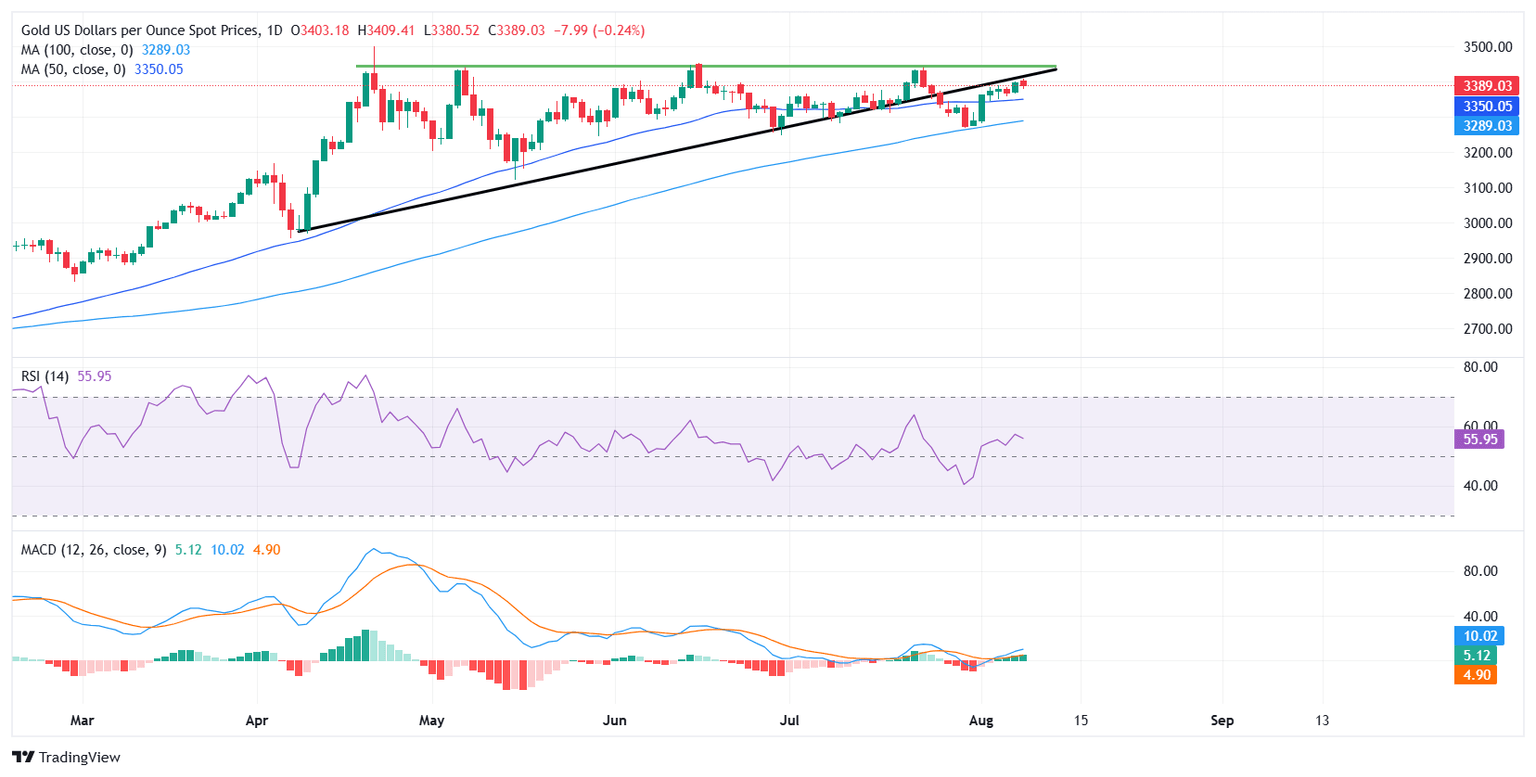

Technical analysis: XAU/USD holds above key SMAs but faces stiff resistance near $3,400

Gold (XAU/USD) remains capped below the key $3,400 resistance as bears continue to defend the psychological barrier. After peaking at $3,409 — a two-week high — earlier on Friday, the metal struggled to sustain upward momentum. Price action continues to respect a broader ascending triangle formation, though the structure weakened slightly last week when Gold briefly broke below the rising trendline. That dip, however, found strong buying interest just above the 100-day Simple Moving Average (SMA) at $3,289, helping bulls regain footing and maintain the overall bullish structure.

The Relative Strength Index (RSI) on the daily chart sits at 55, hovering in neutral territory, suggesting neutral-to-mildly bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator remains positive, with the MACD line holding above the signal line, hinting at improving momentum. However, the Average Directional Index (ADX) remains low, suggesting the current trend lacks strength.

For bulls to regain control, a daily close above the $3,400-$3,410 region is essential, which could open the door for a potential run toward $3,450, with all-time highs around $3,500 back on the radar. On the downside, key support lies at the 50-day SMA near $3,349, followed by the 100-day SMA at $3,289 — a breakdown below which could invalidate the current bullish structure and shift bias in favor of the bears.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.