Gold hovers near five-week high as Greenback remains weak despite strong US GDP

- Gold hovers near a more than five-week peak as buyers retain control.

- A Softer US Dollar and subdued Treasury yields underpin bullion ahead of key US data.

- Traders now look to Friday’s July PCE inflation report for fresh monetary policy cues.

Gold (XAU/USD) extends its advance for a third straight session on Thursday, trading near a more than five-week high, buoyed by a softer US Dollar (USD) and subdued Treasury yields. The precious metal had come under pressure on Wednesday when a stronger Greenback limited gains, but the overnight pullback in the US Dollar, along with lower bond yields, has helped bullion regain momentum.

At the time of writing, XAU/USD is consolidating gains near the $3,411 mark as traders digest the latest United States (US) economic data. The second estimate of Q2 Gross Domestic Product (GDP) showed a 3.3% annualized expansion, beating the 3.1% forecast and up from 3.0% previously. The GDP Price Index and headline PCE Prices (prelim) both printed at 2.0%, slipping from 2.1%. Meanwhile, the preliminary Core PCE Price Index rose 2.5% QoQ, just below the 2.6% expected, while Initial Jobless Claims fell to 229,000, slightly better than the 230,000 consensus and down from a revised 234,000.

Beyond the data, broader market sentiment continues to underpin Gold, with investors turning to the metal as a hedge against concerns over the Federal Reserve’s (Fed) independence amid political pressure. Persistent inflation worries in the US are also keeping bullion attractive as a store of value, while ongoing trade frictions and global growth risks add to safe-haven demand.

Market movers: Softer US Dollar and yields support Gold, all eyes on US data

- The US Dollar Index (DXY), which tracks the value of the Greenback against a basket of six major currencies, is trading below 98.00 and remains confined within this month’s narrow range. The Greenback stays under pressure as US protectionist trade policies, political interference with the Fed’s independence, and expectations of a dovish Fed weigh on sentiment.

- US Treasury yields remain under pressure across the curve. The 10-year note fell toward a two-week low, holding near 4.23%, while the 30-year yield remains under pressure for a second straight session, hovering around 4.91%. The rate-sensitive 2-year yield trades at 3.62%, after hitting its lowest level since May on Wednesday. Meanwhile, the 10-year TIPS yield — a gauge of real rates — eased to 1.79%, reinforcing support for Gold as lower real yields reduce the opportunity cost of holding the non-yielding asset.

- US Pending Home Sales: Contracts to buy previously owned homes fell 0.4% in July, a deeper decline than the 0.1% drop expected, though an improvement from the 0.8% fall in June. The data highlights continued weakness in the housing market, weighed down by high borrowing costs and affordability challenges.

- According to the CME FedWatch Tool, markets are pricing an 87% probability of a 25-basis-point (bps) interest rate cut in September, with a total of 50 bps of easing anticipated by year-end. Fed Chair Jerome Powell’s dovish remarks at the Jackson Hole Symposium, noting that conditions “may warrant” rate cuts, have strengthened expectations of a policy shift. However, the outlook remains data-dependent, with upcoming inflation and labor market releases set to guide the Fed’s path.

- US President Donald Trump’s effort to remove Fed Governor Lisa Cook is heading to the courts, but the White House is already preparing a replacement. On Tuesday, Trump said, “We have some very good people for that position,” while noting that Treasury Secretary Scott Bessent is overseeing the selection process for the new Fed Chair. Reports suggest that Stephen Miran, nominated to replace Adriana Kugler on the Fed Board, could instead be redirected to Cook’s seat for a longer term. In the meantime, Senate hearings for Miran’s nomination to replace Kugler are expected next week.

- In an interview with CNBC on Wednesday, New York Fed President John Williams described the US as a “slowing economy, not a stalling economy,” noting GDP growth has eased to around 1%-1.5% and hiring momentum has cooled. He stressed that policy remains in a “modestly restrictive” stance, with rates above neutral, and reiterated that if the economy evolves as expected, interest rates will eventually need to move closer to neutral, meaning cuts could be appropriate over time.

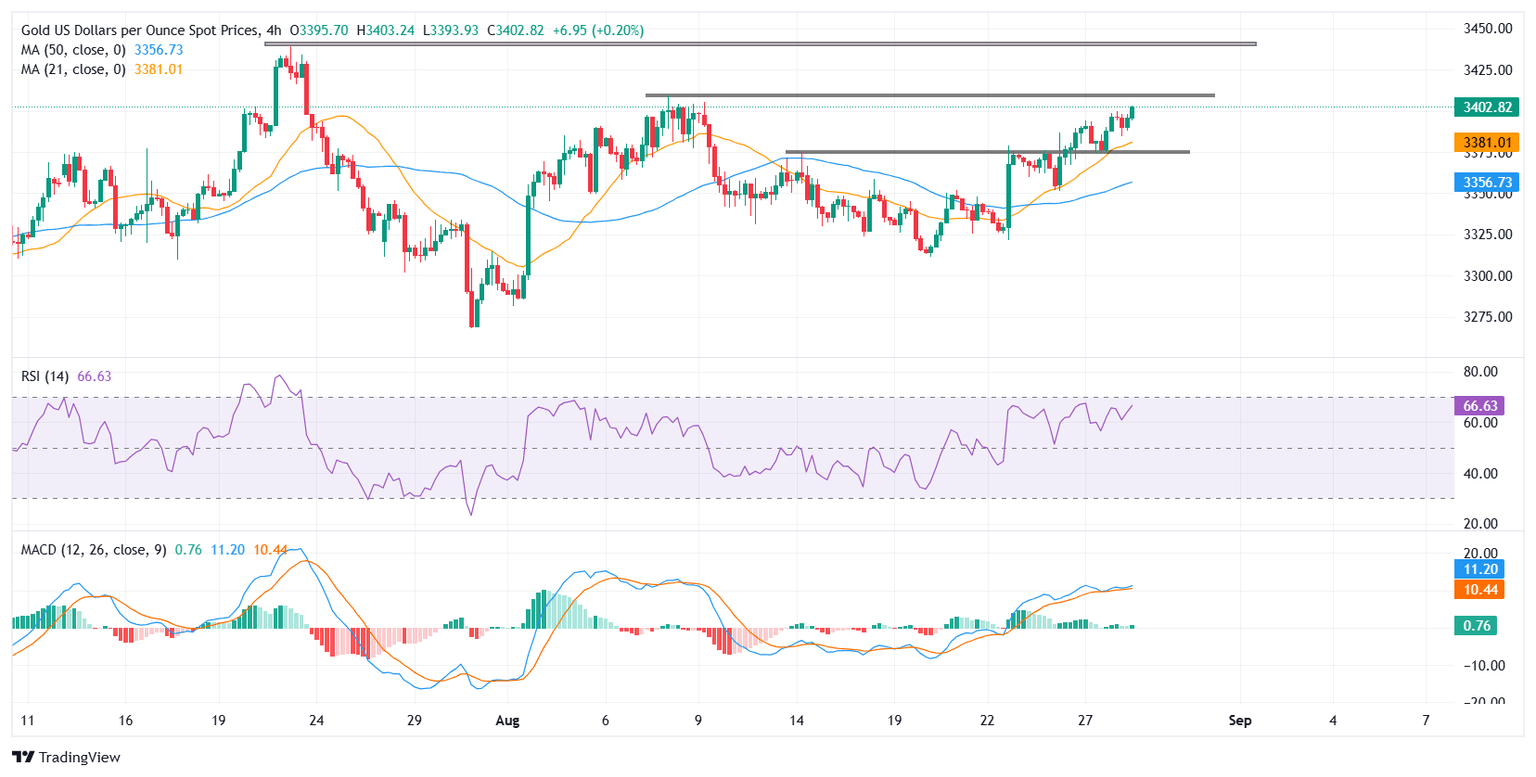

Technical analysis: Bulls eye break above $3,400

On the 4-hour chart, Gold has been forming higher highs and higher lows since bottoming near $3,310 earlier in the month, reflecting a constructive short-term trend. The metal is now testing the critical $3,400 level, which coincides with a previous supply zone. The August 8 high at $3,409 marks immediate resistance, and bulls will need a decisive break above this barrier to confirm further upside momentum. A sustained move above $3,400 could pave the way for a return to the late-July peak near $3,440.

On the downside, initial support is seen at $3,375, where the 21-period moving average (MA) aligns with a horizontal support zone. A deeper pullback would bring the 50-period MA at $3,356 into focus as the next support level.

Momentum indicators on the 4-hour chart back the bullish bias. The Relative Strength Index (RSI) is hovering near 66, just below overbought territory, showing steady upside momentum without signaling immediate exhaustion. The Moving Average Convergence Divergence (MACD) remains in positive territory, with the MACD line still above the signal line, but the green histogram bars are fading, indicating a loss of momentum. This suggests that while the broader trend remains constructive, buying pressure is no longer accelerating, and the market may require a decisive catalyst to sustain the upside.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.