Gold shrugs off impact of US Retail Sales and breaks higher

- Gold pulls back after release of US Retail Sales data but then continues higher and breaks to even higher highs.

- The precious metal is helped by lower interest rate projections globally as inflation ducks.

- XAU/USD confirms its uptrending bias but risks pull back before extension.

Gold (XAU/USD) breaks to higher highs in the $2,690s on Thursday despite suffering a temporary pull-back following the release of higher-than-expected US Retail Sales data. The data had the effect of strengthening the US Dollar (USD) which puts pressure on Gold since the two are negatively correlated.

US Retail Sales rose 0.4% MoM in September from 0.1% in August and above expectations of 0.3%. Retail Sales ex Autos also beat the previous month's upwardly-revised 0.2%, coming out at 0.5% and was well above estimates of 0.1%, according to data from the US Census Bureau.

Gold, however, soon bounced back and broke to new record highs in the $2,690s as it continued to gain a backdraught from a mixture of declining global interest rate expectations and increased safe-haven flows amid heightened tensions in the Middle East are contributing to the rise.

Gold rallies as central banks prepare to lower interest rates

Gold pushed to new highs on Thursday as markets price in a lower trajectory for global interest rates. Inflation is falling faster than expected across the world, increasing the probability that major central banks will accelerate their easing cycles. The expectation of lower interest rates is bullish for Gold as it reduces the opportunity cost of holding the non-interest-paying precious metal, making it more attractive to investors.

Following the release of lower-than-expected inflation data in September in the United Kingdom, the Bank of England (BoE) is now widely expected to decide to lower its bank rate by 25 basis points (bps) (0.25%) from 5.00% to 4.75% at its November meeting.

Likewise, the Bank of Canada (BoC) is now widely expected to aim for a “bazooka” at its policy rate and shoot off 50 pbs (0.50%) at its next policy meeting in October.

On Thursday, the European Central Bank (ECB) decided to cut interest rates by 25 bps (0.25%) after inflation fell below its 2.0% target for the first time since 2021 and economic activity has evinced a marked slowdown. This, and the fact that several Asian central banks have already made cuts recently, is supporting the rally in Gold.

That said, the upside for Gold may be limited as US Federal Reserve (Fed) officials continue backtracking after being expected to adopt a more aggressive easing approach a few weeks ago.

On Tuesday, Bank of San Francisco Fed President Mary Daly’s speech scored a neutral 5.8 on the FXStreet FedTracker, which uses a custom AI to gauge the tone of Fed officials’ speeches on a dovish-to-hawkish scale from 0 to 10. This was above her long-running average of 4.5.

Federal Reserve Bank of Atlanta President Raphael Bostic, meanwhile, scored a 6.2 on the FedTracker, which was also above his average of 5.1. Bostic opined the “US economy is doing well,” and that he did not see a recession on the horizon.

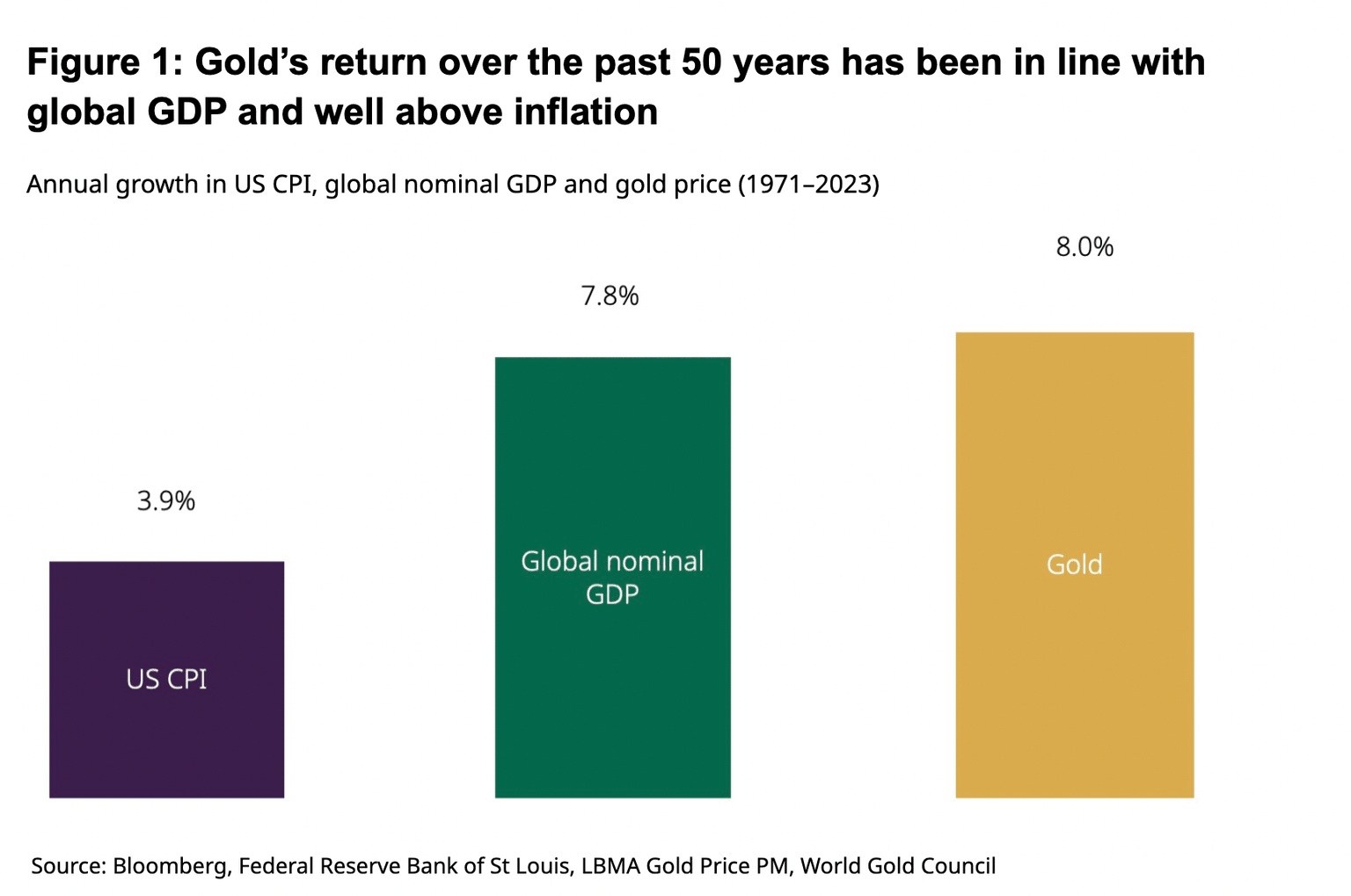

World Gold Council publishes paper showing Gold averaged 8.0% annual returns

The World Gold Council (WGC) published a paper on Thursday showing that Gold achieved an average 8.0% annualised returns over the last 50 years, which was a similar level to the average rate of increase in global Gross Domestic Product (GDP) over the period.

The research claimed to contradict recieved wisdom that Gold was only really useful as a "store of value" that protected investors against inflation.

Instead WGC argued that "Gold’s long-run return has been well above inflation for over 50 years (Figure 1), more closely mirroring global gross domestic product (GDP), a proxy for the economic expansion driver used in our other gold pricing models."

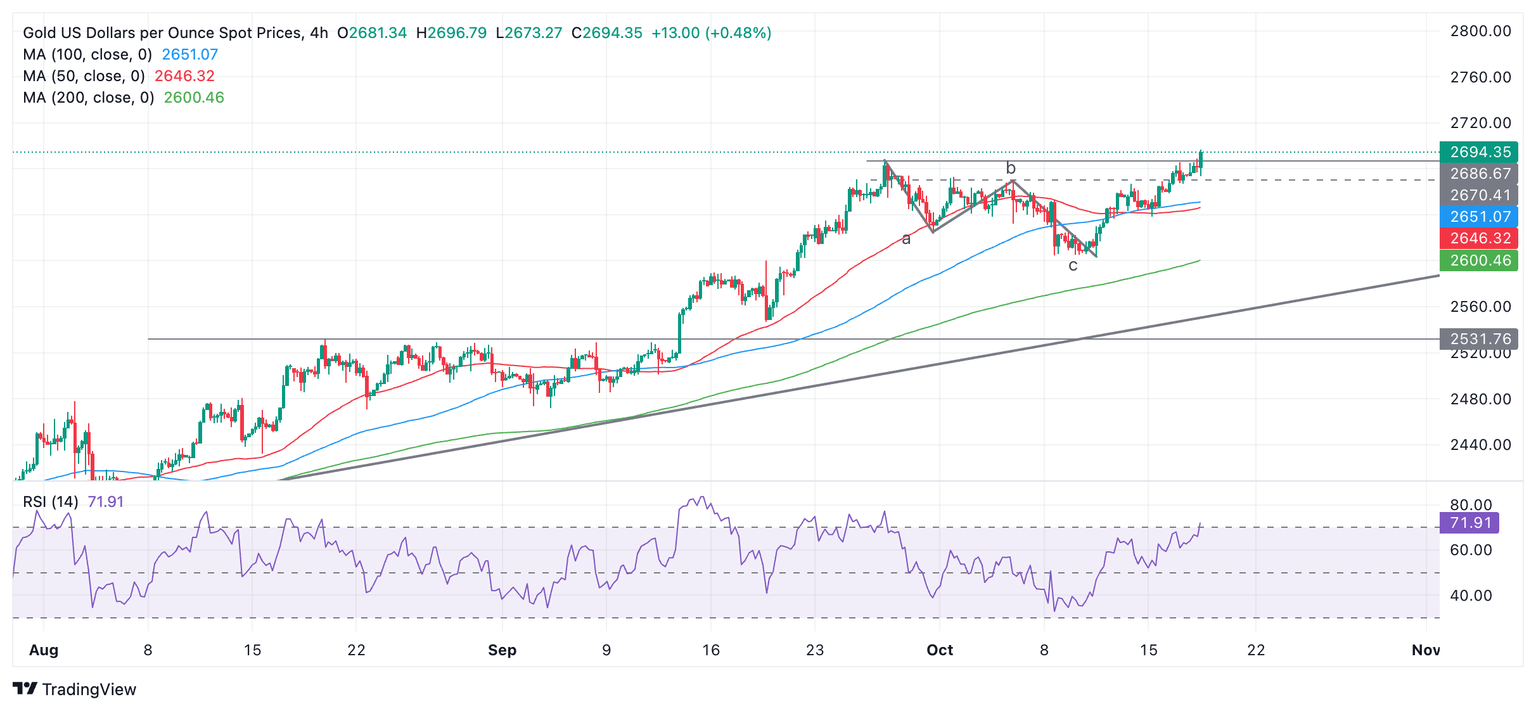

Technical Analysis: Gold pulls back after breaking to higher high

Gold rallies and breaks to a new all-time high. The establishment of a higher high reconfirms the uptrend and suggests the odds favor yet more upside to come.

XAU/USD 4-hour Chart

The most recent leg higher since the October 10 low looks like a three-wave zig-zag pattern that is complete, with the first and last waves more or less of equal length. Thus, it is possible that the precious metal could pull back lower temporarily – perhaps to the $2,670 mark, or even $2,650s – however, given the old adage that “the trend is your friend,” it will probably resume its uptrend thereafter. Eventually it is likely to reach the next target at $2,700, a round number and psychological level.

The Relative Strength Index (RSI) is still not overbought, suggesting there is further room for growth to the upside.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Oct 17, 2024 12:30

Frequency: Monthly

Actual: 0.4%

Consensus: 0.3%

Previous: 0.1%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.