Gold hits record high above $3,700 as weak USD and Fed rate cut bets bolster demand

- Gold extends its record-breaking rally and marks a fresh ATH near $3,703.

- A broadly weak US Dollar and subdued Treasury yields keep the metal well supported ahead of Wednesday’s Fed decision.

- US Retail Sales rose 0.6% MoM in August, sharply beating expectations of a 0.2% increase.

Gold (XAU/USD) marked a fresh all-time high around $3,703 on Tuesday after consolidating just below that level for most of the day. At the time of writing, the XAU/USD is easing modestly to trade around $3,687 but remains close to record territory. A broadly weak US Dollar (USD) and subdued Treasury yields continue to underpin the rally, while safe-haven flows add support as traders position ahead of Wednesday’s Federal Reserve (Fed) monetary policy decision.

The Greenback remains under broad pressure with the US Dollar Index (DXY) falling to multi-week lows, reflecting broad-based weakness as markets fully price in a 25-basis-point (bps) Fed rate cut. Meanwhile, US Treasury yields stay subdued across the curve, reducing the opportunity cost of holding non-yielding assets like Gold.

With the September rate cut widely seen as a done deal, investors will be closely watching the Fed’s updated economic projections and dot plot. Markets will be parsing Fed Chair Jerome Powell’s press conference for clues on how far and how fast the easing cycle could extend. A cautious or less dovish tone could trigger a near-term pullback, while confirmation of a steady easing path may keep bullion firmly bid above recent highs.

The latest US Retail Sales report showed stronger-than-expected consumer spending in August, easing recession fears. According to the US Census Bureau, Retail Sales rose 0.6% MoM in August, beating the market consensus of a 0.2% increase. July’s reading was also revised upward to 0.6% from the initially reported 0.5%, underscoring firm consumption momentum entering the third quarter.

Market movers: Markets eye Fed decision amid political pressure

- Retail Sales excluding Autos jumped 0.7% on the month, well above the expected 0.4%, while the critical Retail Control Group, which feeds directly into GDP calculations, also advanced 0.7%, topping forecasts of 0.4%. On a yearly basis, total Retail and Food Services Sales rose 5.0%, up from July’s upwardly revised 4.1% pace.

- The Fed’s monetary policy meeting takes place under unusual strain, with US President Donald Trump seeking greater sway over monetary decisions and legal challenges targeting the central bank’s leadership.

- Trump ramped up pressure on the Fed ahead of Wednesday’s decision, urging Chair Powell on Truth Social to deliver a rate cut larger than anticipated. The US President argued that a more aggressive move is long overdue and would provide a strong boost to the housing market.

- On Monday, a US appeals court blocked an attempt to remove Fed Governor Lisa Cook, ruling that President Trump’s claims did not meet the “for cause” threshold required by law. Cook is therefore expected to vote at Wednesday’s policy meeting.

- In a narrow 48-47 Senate vote, Stephen Miran, a top economic adviser to President Trump, was confirmed to the Federal Reserve Board on Monday. Miran is expected to be seated in time to participate in Wednesday’s vote. Some analysts believe that he may advocate for a larger rate cut than markets currently expect, raising questions over political influence on the Fed’s policy path.

- Geopolitical tensions add another layer of support for Gold. Beyond the macro backdrop of a weaker US Dollar and subdued Treasury yields, heightened geopolitical risk is reinforcing safe-haven flows. Israel launched a major ground offensive in Gaza City on Tuesday, escalating its conflict with Hamas, while Ukraine intensified drone and missile strikes on Russian refineries, disrupting energy infrastructure.

Technical analysis: XAU/USD at record highs, bulls eye $3,700 barrier

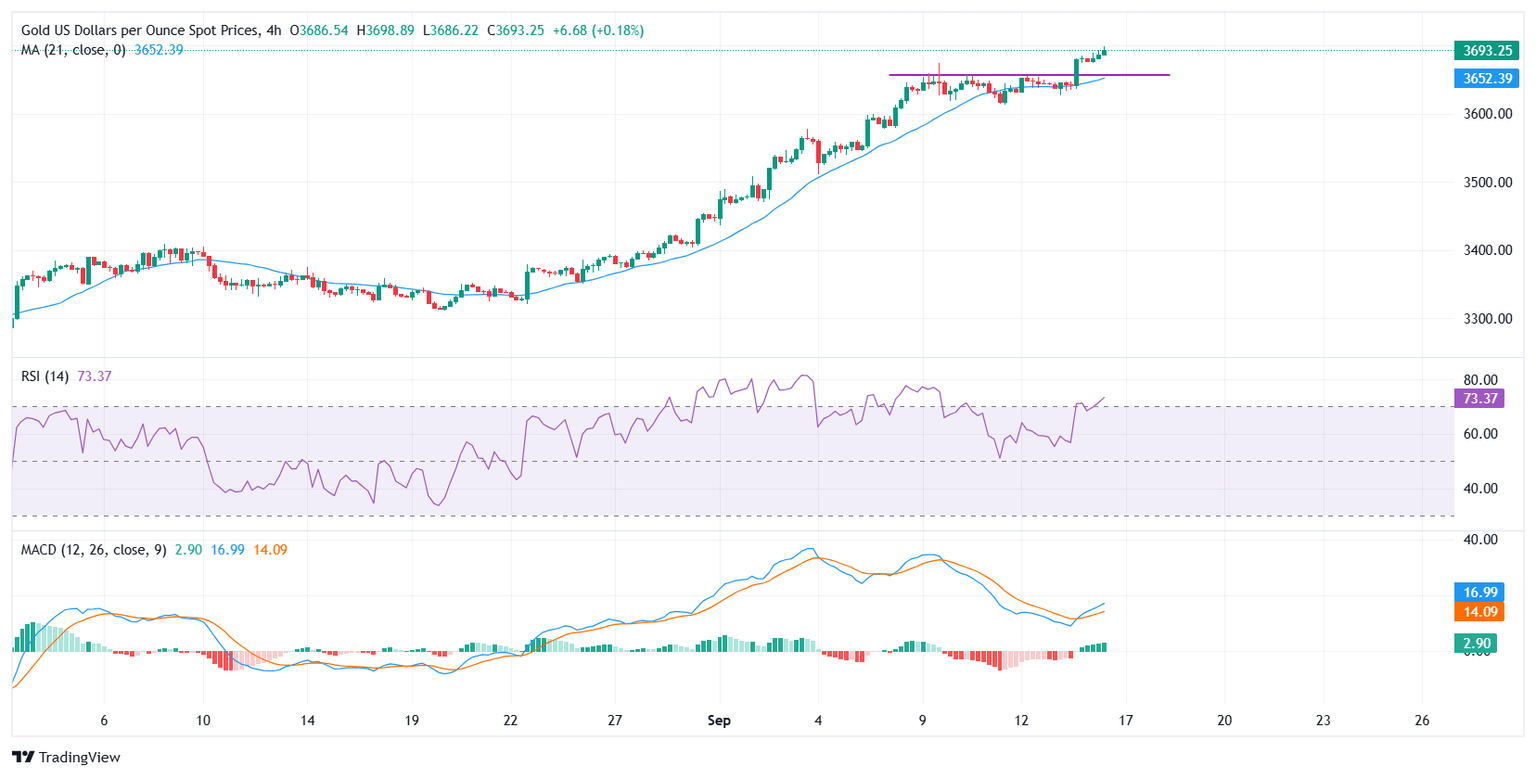

XAU/USD spent most of last week consolidating in a narrow range between $3,620 and $3,650 after notching a record high at around $3,675 on September 9. The consolidation phase ended with Monday’s breakout above $3,650, putting bulls firmly back in control.

At the time of writing, the metal is trading around $3,695, just shy of the $3,700 psychological barrier. The former peak at $3,675 now acts as immediate support, followed by the 21-period Simple Moving Average on the 4-hour chart near $3,652. A decisive break below this zone could expose $3,620 as the next downside level. On the upside, a sustained break through $3,700 would open the way for an advance toward $3,730-$3,750.

The Relative Strength Index (RSI) is holding at 73, firmly in overbought territory. This suggests that while buying momentum is strong, the market may be vulnerable to short-term pullbacks or profit-taking around the $3,700 barrier.

Meanwhile, the Moving Average Convergence Divergence (MACD) has turned higher after last week’s sideways grind. The MACD line has crossed above the signal line, with the histogram printing green bars, underscoring the bullish setup.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.70% | -0.43% | -0.44% | -0.12% | -0.00% | 0.00% | -0.83% | |

| EUR | 0.70% | 0.27% | 0.12% | 0.58% | 0.74% | 0.69% | -0.13% | |

| GBP | 0.43% | -0.27% | -0.10% | 0.31% | 0.49% | 0.42% | -0.41% | |

| JPY | 0.44% | -0.12% | 0.10% | 0.41% | 0.52% | 0.28% | -0.33% | |

| CAD | 0.12% | -0.58% | -0.31% | -0.41% | 0.12% | 0.09% | -0.71% | |

| AUD | 0.00% | -0.74% | -0.49% | -0.52% | -0.12% | 0.04% | -0.88% | |

| NZD | -0.01% | -0.69% | -0.42% | -0.28% | -0.09% | -0.04% | -0.78% | |

| CHF | 0.83% | 0.13% | 0.41% | 0.33% | 0.71% | 0.88% | 0.78% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.