GNUS Stock Price: Genius Brands International Inc trades flat following Roblox hype

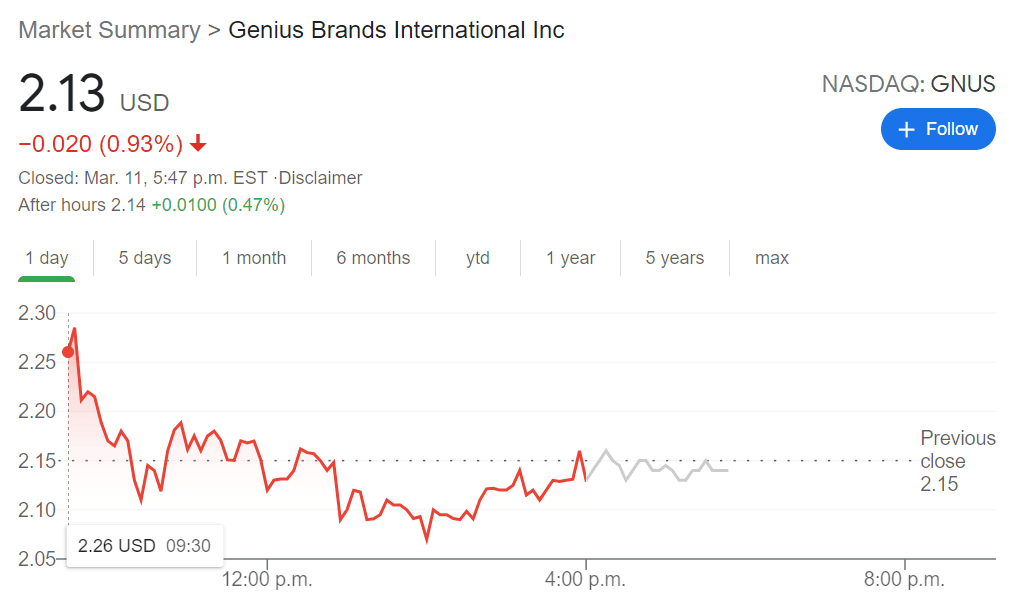

- NASDAQ:GNUS trimmed 0.93% as the broader markets continued to rebound.

- Internet rumors have tied the Kartoon Channel to a major Roblox partnership.

- Genius recently announced a digital channel launch with ad-support.

NASDAQ:GNUS cooled off on Thursday amidst a second straight day of the NASDAQ exchange rebounding by 2.5% following its recent correction. Genius Brands fell by 0.93% to close the trading session at $2.13, which has the stock trading above its 50-day and 200-day moving averages once again. Shares are still over 80% lower than the 52-week high price of $11.73, but if you look at the silver lining, they are still well over 4,000% higher than the 52-week low price of $0.05.

Stay up to speed with hot stocks' news!

The main catalyst for the recent activity in Genius’ stock price is the rumors swirling around the internet about a potential major partnership with the gaming platform Roblox (NYSE:RBLX). The Kartoon Channel already does show some Roblox shows on its streaming app, so a full on partnership is not something that is out of the realm of possibility. Roblox itself made its much-anticipated Wall Street debut on Wednesday, so it is not surprising to see increased news coverage of the company during its initial IPO period. Any report of a partnership would undoubtedly send Genuis’ stock price soaring through the roof as Roblox is one of, if not, the most popular gaming platform amongst the ever important 8-18 age demographic.

GNUS Stock forecast

Genius Brands also announced recently it will launch a digital streaming service that will act in a linear fashion to its Kartoon Channel. The new streaming channel will be a FAST one, meaning it uses the Free Ad-Supported Streaming TV system. Genius continues to build out its streaming infrastructure, and will look to cash in on the lucrative ad revenue that comes with these channels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet