GDX anticipates a double correction within sustained bullish trend [Video]

![GDX anticipates a double correction within sustained bullish trend [Video]](https://editorial.fxsstatic.com/images/i/stock-02_XtraLarge.jpg)

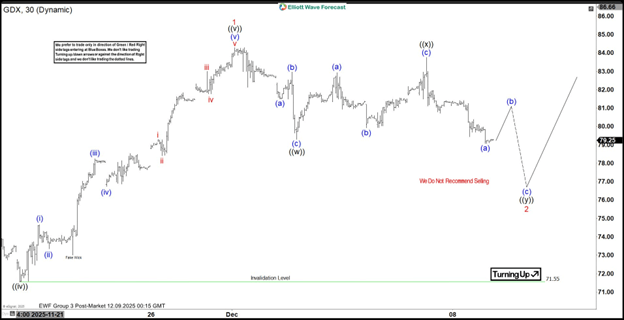

The short-term Elliott Wave outlook for the Gold Miners ETF (GDX) indicates that the cycle from the October 28, 2025 low concluded as a five-swing diagonal structure. From that pivotal low, wave ((i)) advanced to 73.06 before a corrective pullback in wave ((ii)) reached 68.20. The ETF then extended higher in wave ((iii)), achieving 79.97, while subsequent dips in wave ((iv)) found support at 72.45. The final leg, wave ((v)), advanced to 84.03, thereby completing wave 1 of a higher degree sequence as the 30 minutes chart below shows.

Following this advance, the market entered a corrective phase. Wave 2 is unfolding as a double three Elliott Wave structure, reflecting a complex consolidation. From the termination of wave 1, wave (a) declined to 81.48, while wave (b) rebounded modestly to 82.96. A further decline in wave (c) reached 79.30, completing wave ((w)) of the correction. The subsequent rally in wave ((x)) ended at 83.76, forming a zigzag pattern. Thereafter, the ETF resumed its decline in wave ((y)), which is also subdividing internally as a zigzag. From wave ((x)), wave (a) fell to 79.07, while the current wave (b) rally is expected to fail in either three, seven, or eleven swings, setting the stage for another decline in wave (c). This move should complete wave ((y)) of 2 in the larger degree.

In the near term, as long as the pivot at 71.55 remains intact, and more importantly, the October 28 low at 67.35 holds firm, dips are expected to attract buyers. These corrective swings should provide opportunities for renewed upside, reinforcing the broader bullish outlook for GDX.

Gold Miners ETF (GDX) 30-minute Elliott Wave chart from 12.5.2025

GDX Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com