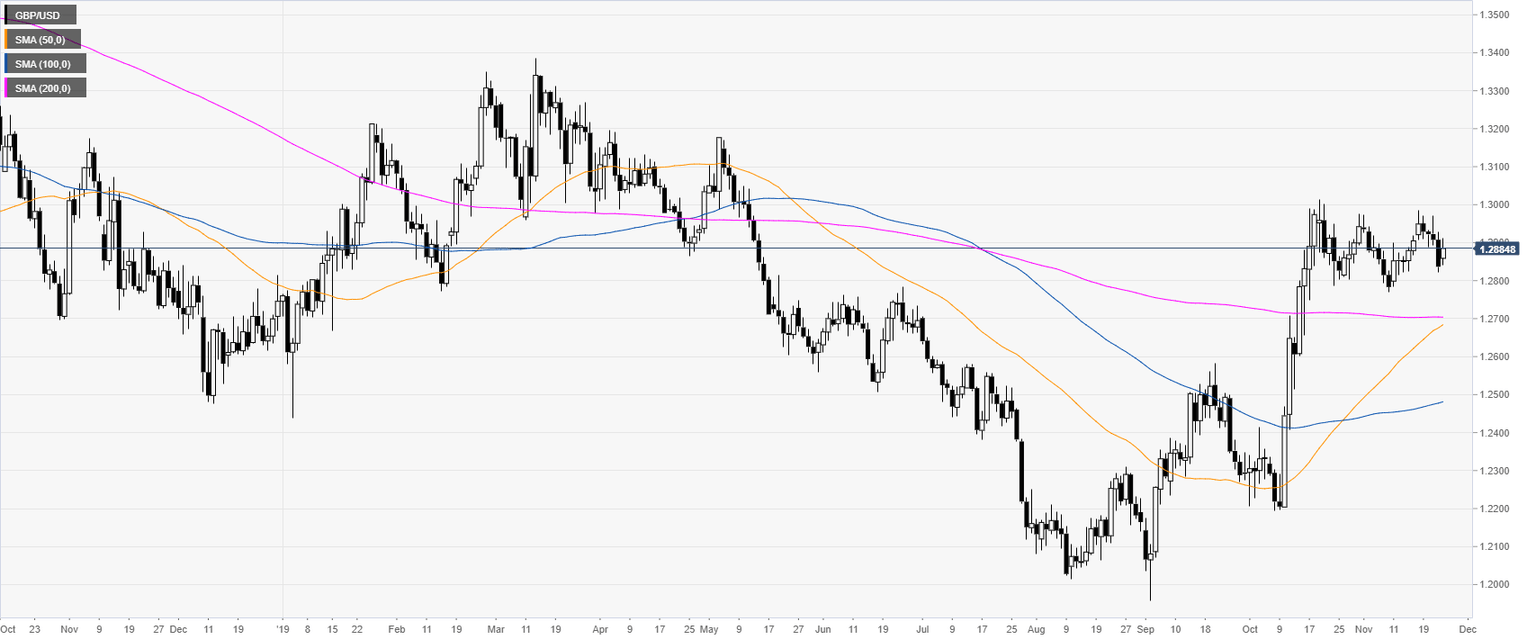

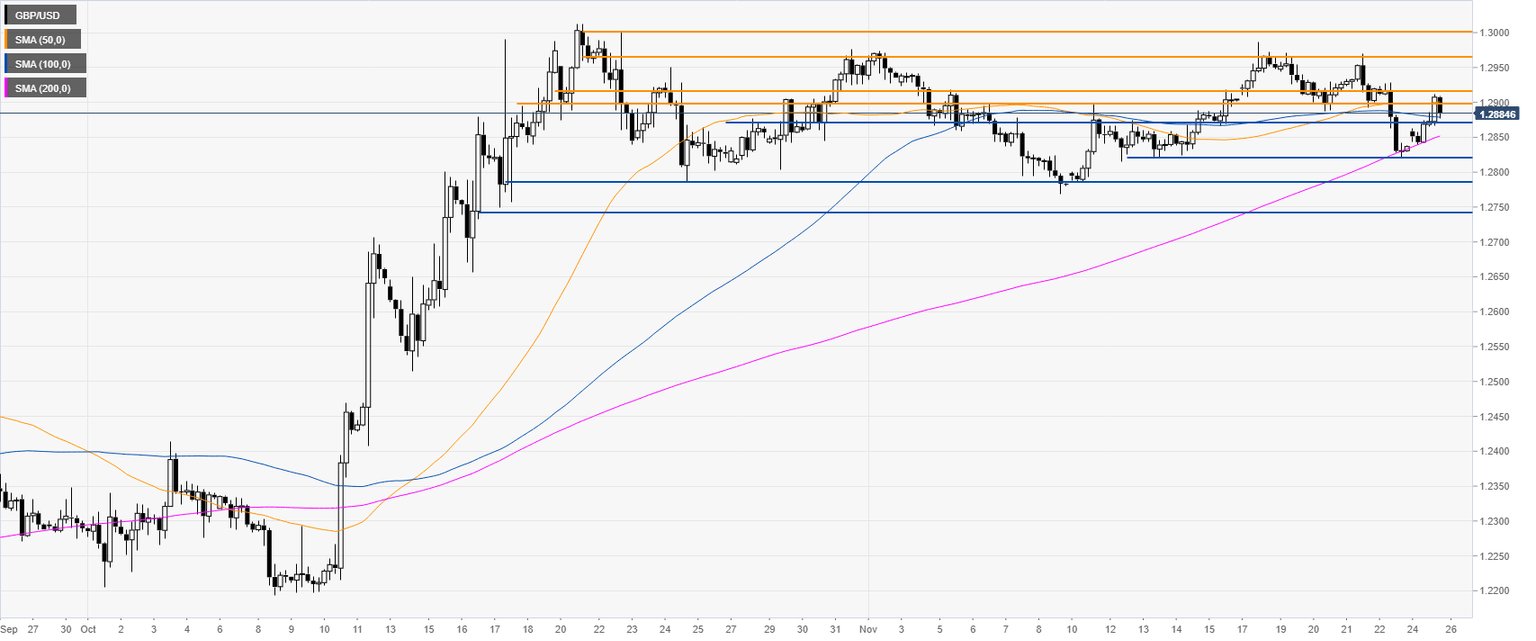

GBP/USD Technical Analysis: Cable easing from daily highs, trading back below the 1.2900 handle

- The cable is starting the week with a small recovery, which aimed at the 1.2900 handle.

- The level to beat for buyers is the 1.2900/1.2916 resistance zone.

GBP/USD daily chart

GBP/USD four-hour chart

GBP/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst