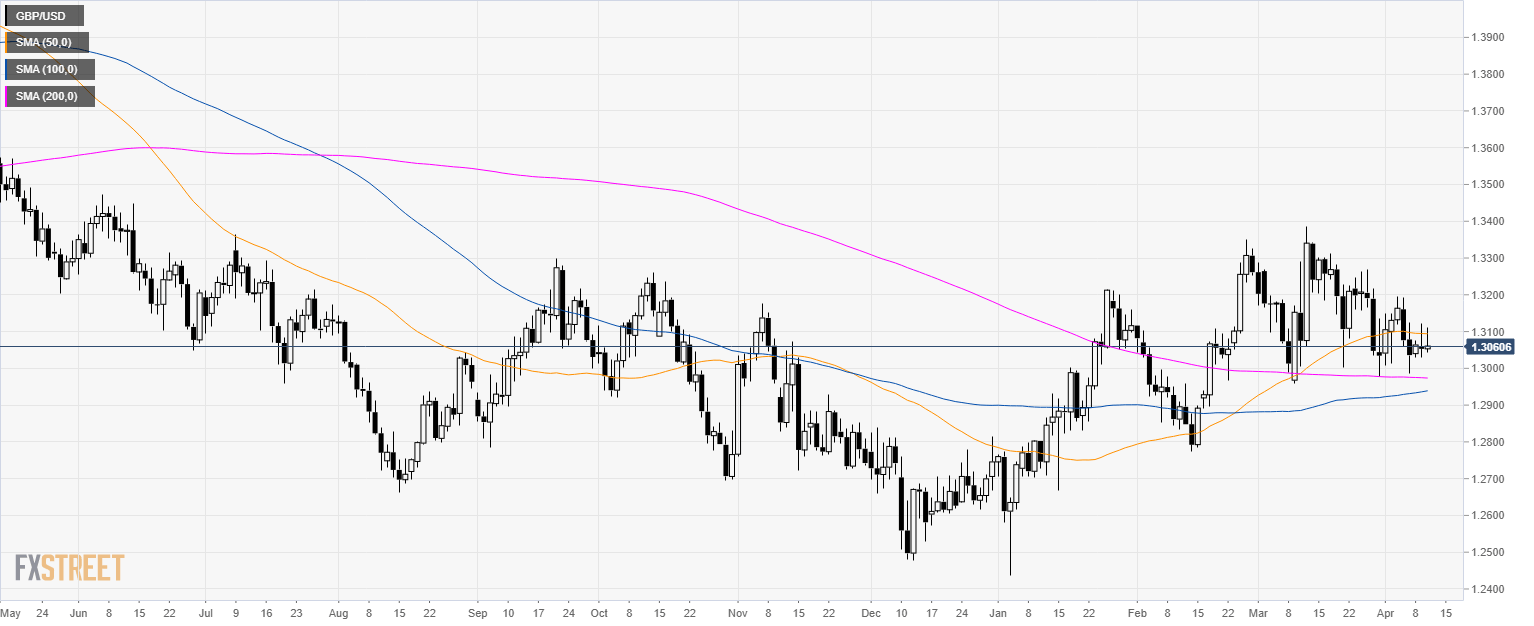

GBP/USD Technical Analysis: Cable directionless amidst Brexit chaos

GBP/USD daily chart

- GBP/USD is consolidating above the 200-day simple moving average (SMA) while rejecting the 1.3100 level and the 50 SMA.

- GBP/USD is trading below its main SMAs suggesting bearish momentum in the medium-term.

GBP/USD 30-minute chart

- GBP/USD is trading below its main SMAs suggesting bearish momentum in the short-term.

- The main support to the downside is seen at 1.3000 and 1.2960 level.

- Immediate resistance is seen at 1.3080 and 1.3120 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst