GBP/USD surges after Fed rate cut, traders focus on Powell's next steps

- GBP/USD climbs above 1.3360, up 0.46%, after the Fed’s decision and vote split.

- Federal Reserve lowers rates to 3.50%–3.75%, aligning with market expectations.

- Dot plot signals only one 25-bp rate cut likely in 2026, keeping traders cautious.

GBP/USD climbs on Wednesday after the Federal Reserve (Fed) decided to cut rates, as expected, on a 9-3 vote split, which witnessed two members voting for holding rates, while Fed Governor Stephen Miran voted for a 50-basis-point cut. At the time of writing, the pair trades at 1.3350, up 0.46%

Federal Reserve’s 9-3 vote split sparks GBP/USD rally, with traders watching key levels

The FOMC vote split was 9–3: Governor Stephen Miran dissented in favor of a 50-bps cut, whereas Jeffrey Schmid and Austan Goolsbee preferred to keep rates unchanged.

The Summary of Economic Projections (SEP), including the updated dot plot, showed that most officials project the fed funds rate to stand near 3.4% next year, implying just one 25-bp reduction in 2026, according to the median.

The dot plot showed that 12 of the 19 members of the Federal Reserve expect the Fed funds rate to be below 3.50% next year. Eight of those twelve sit around the 3%-3.50% range, two expect rates around 2.75%-3%, one at 2.50%-2.75%, and Miran at around 2%-2.25%.

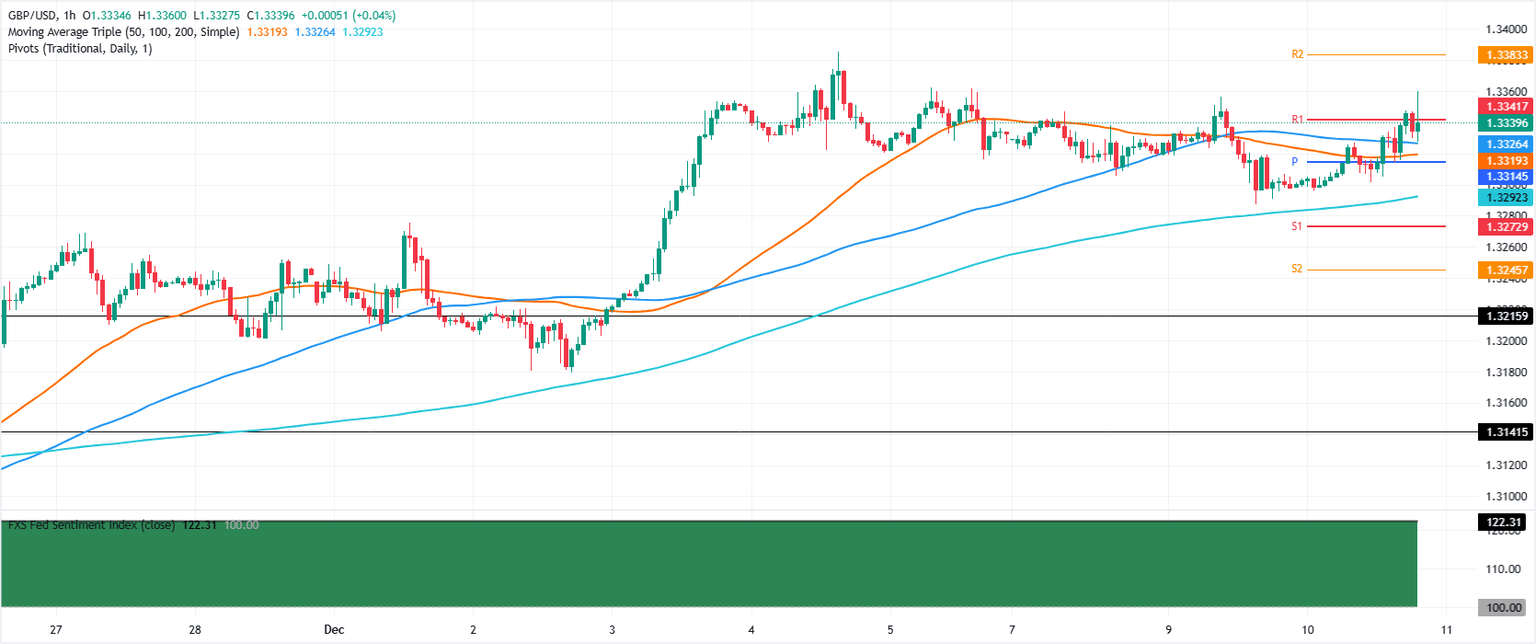

GBP/USD reaction – Hourly chart

GBP/USD pushed to the upside, bouncing off 1.3326 and hit 1.3360, before retreating somewhat ahead of Fed chair Jerome Powell's press conference. A breach of the daily high will expose the December 4 high of 1.3385 ahead of 1.3400. On the downside, if the pair slides below 1.3320, expect a test of the day's low of 1.3295, with eyes set on 1.3250.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.