GBP/USD struggles to recover 1.2680 after UK CPI miss softens Pound Sterling bids

- GBP/USD is waffling on the day, selling off across the board.

- UK November CPI inflation eased back more than expected.

- GBP finds some relief in easing US Dollar bids.

The GBP/USD is capped below 1.2680 after a below-expectations print of UK Consumer Price Index (CPI) inflation sent the Pound Sterling (GBP) lower against the US Dollar (USD), dragging the pair back down through the 1.2700 handle and pinging 1.2630.

The Pound Sterling was easily the single worst performer of the major currency bloc on Wednesday, declining against all the other major currencies and shedding around half a percent following a half-hearted recovery from the day’s lows to get hung up just below 1.2680.

The UK’s latest Core CPI print missed market expectations early Wednesday. CPI inflation in November increased by 5.1% over the previous year, coming in below the market’s expected 5.6% versus October’s annualized 5.7% print.

Monthly CPI inflation declined unexpectedly, printing at -0.2% versus the market’s forecast of 0.1%, compared to October’s MoM flat read of 0.0%.

US Existing Home Sales improved in November, helping to bolster broad-market risk appetite and push the US Dollar back down, propping up the Pound Sterling and arresting the day’s declines in the GBP/USD. Existing Home Sales in the US showed 3.82 million pre-existing homes changed hands, above the 3.77 million forecast and rebounding from the 3.79 million print from October.

US Consumer Confidence also improved, showing consumers are cautiously optimistic about the economic outlook through December. The index of consumer economic expectations rose to 110.7 from November’s 101.0 (revised down slightly from 102.0).

The back half of the trading week will wrap up with US Gross Domestic Product (GDP) growth figures on Thursday, expected to hold steady at 5.2% in the third quarter, followed by Friday’s US Personal Consumption Expenditure (PCE) Price Index, as well as third-quarter UK GDP & Retail Sales.

UK GDP for the third quarter is forecast to hold flat at 0.0%, while UK Retail Sales in November are expected to have improved from -0.3% to 0.4%.

US PCE figures are expected to hold steady at 0.2% MoM in November.

GBP/USD Technical Outlook

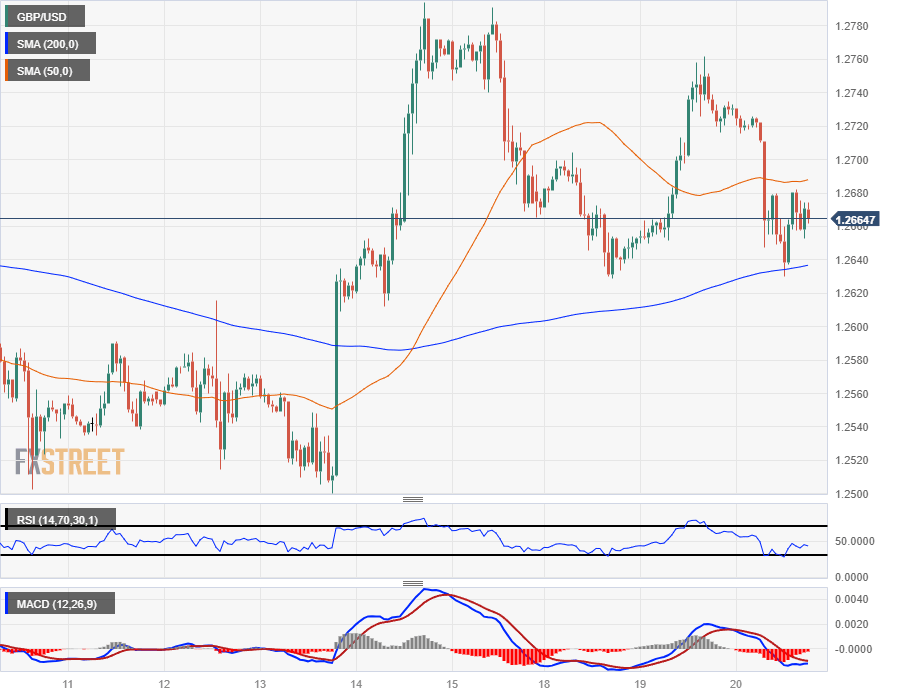

The Pound Sterling’s decline against the US Dollar saw the GBP/USD decline into the 200-hour Simple Moving Average (SMA) near 1.2635, and a limited rebound sees the pair constrained in the midrange between the 200-hour SMA and the 50-hour SMA near 1.2690.

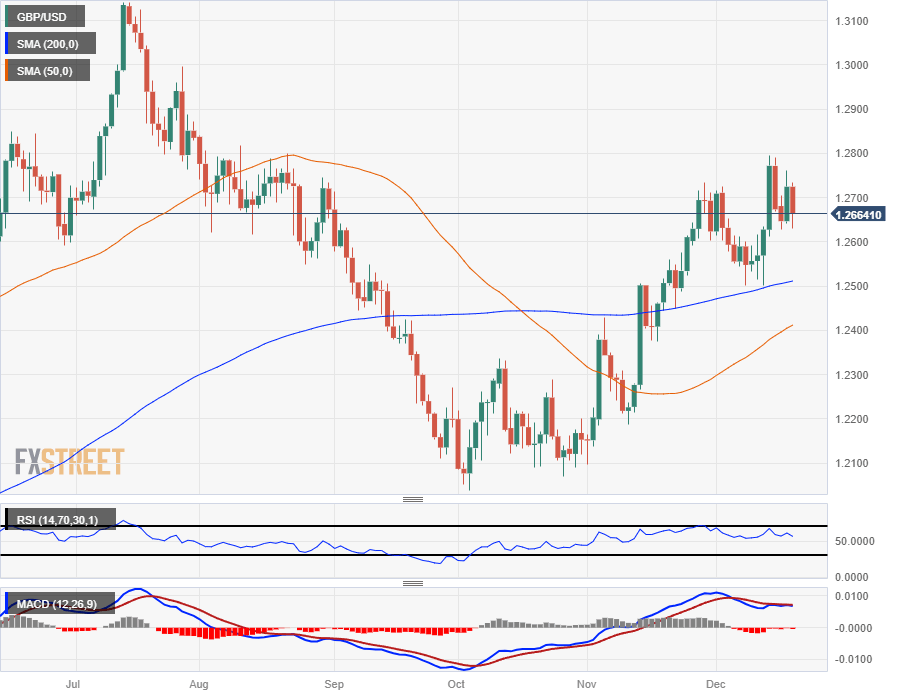

The GBP/USD is still on the top side of the 200-day SMA on the daily candlesticks, but a lack of bullish momentum is seeing the pair sag from recent highs into the 1.2800 handle, and a pullback risks a bearish extension back into low territory near the 50-day SMA at the 1.2400 handle.

GBP/USD Hourly Chart

GBP/USD Daily Chart

(This article was corrected on December 20 at 19:55 to clarify in the first paragraph that the GBP/USD pair fell back below 1.2700, not 1.2270; also to specify UK Core CPI, not CPI in paragraph three)

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.