GBP/USD steady as BoE hawkish cut seen as last of 2025; Dollar boosted on Waller rumors

- GBP/USD trades flat at 1.3437 as Dollar recovers modestly.

- BoE cuts rates 25 bps in a 5–4 split, signaling a cautious approach; markets see 87% chance of no change in September.

- Trump administration rumored to favor Fed Governor Christopher Waller to replace Powell in 2026.

- St. Louis Fed’s Musalem says inflation remains off-target, but job market risks tilt lower.

The GBP/USD remains steady during the North American session as the Greenback recovers some ground, even though traders seem convinced that the Bank of England’s (BoE) rate cut on Thursday may be the last during the year. At the time of writing, the pair trades at 1.3437, virtually unchanged.

Pound holds gains as markets price out September BoE easing; US Fed leadership speculation and mixed central bank signals dominate sentiment

The latest developments in the financial markets have witnessed the nomination of Dr. Stephen Miren to succeed Fed Governor Adriana Kugler, following her resignation effective today. Also, rumors that Fed Governor Christopher Waller is the top candidate of the Trump administration to take Jerome Powell’s place once his term ends in May 2026 have risen.

In the meantime, the GBP/USD pair has failed to gain traction following the BoE’s hawkish cut, following a 5-4 vote split for easing policy by 25 basis points (bps). Interest rate probabilities signal that the BoE is not expected to ease policy at the September 18 meeting, with 87% odds of keeping the Bank Rate at 4%.

Recently, BoE Chief Economist Huw Pill, one of the dissenters of the BoE’s last meeting, said that the decision was made to lower rates. He added that disinflation is showing an ongoing process and stated that there has been an upward shift in inflation risks over the next two to three years.

In the US, the St. Louis Fed President Alberto Musalem, voter on the FOMC in 2026, said that economic activity appears to be stable and that firms are not yet resorting to layoffs to cut costs. Musalem added that they (the Fed) are missing on the inflation targets, not on the employment mandate, with downside risks to jobs.

What’s on the calendar for the next week?

The UK docket will feature Retail Sales, Employment data, and Gross Domestic Product (GDP) figures. Across the pond, traders will eye the Consumer Price Index (CPI), Retail Sales, the Producer Price Index (PPI), and the University of Michigan (UoM) Consumer Sentiment.

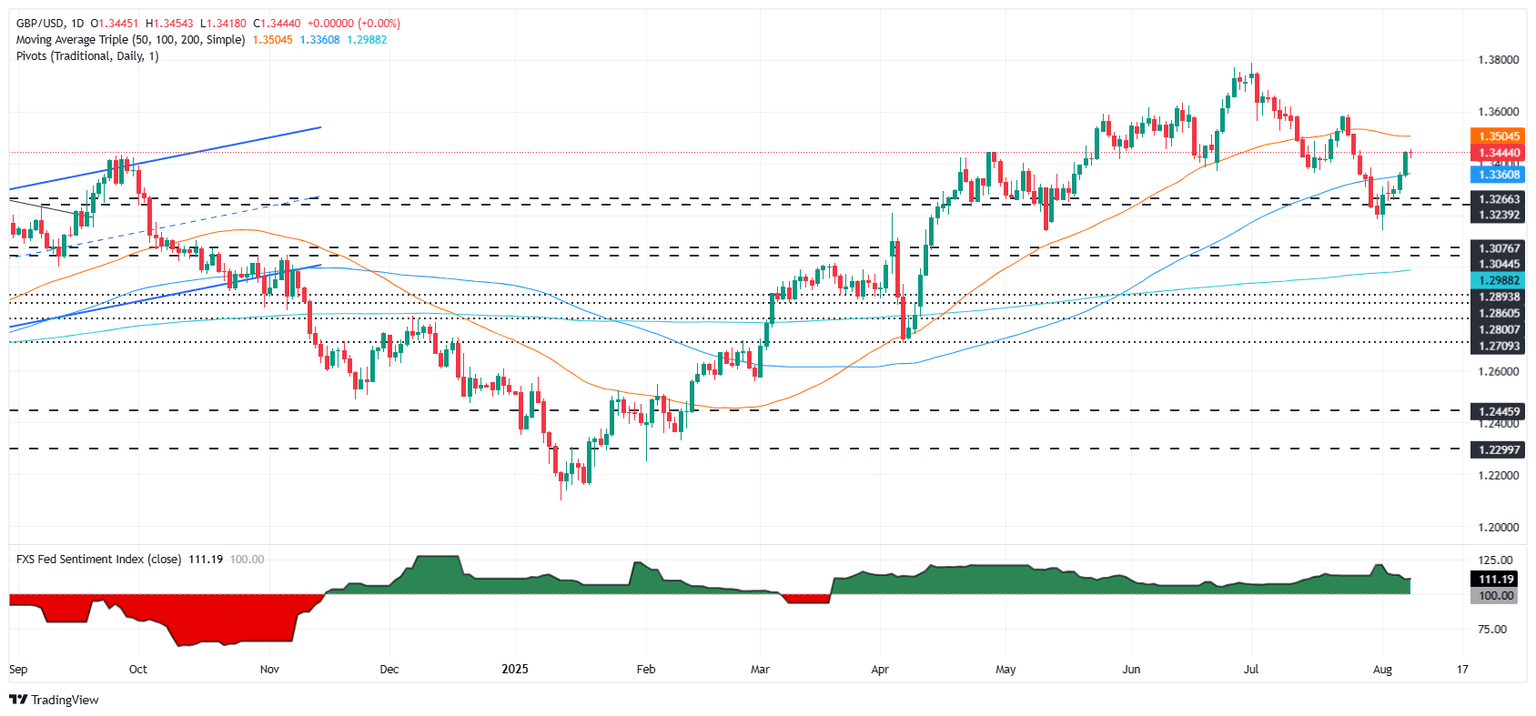

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral to upward-biased after posting five straight days of gains. However, the pair seems capped on the upside by the 50-day SMA at 1.3500. If breached, the next ceiling level would be 1.3550 and 1.3600. On the other hand, consolidation below 1.3450 could clear the way for a pullback. The next area of interest for sellers would be 1.3400, and the 20-day SMA at 1.3389.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.58% | -1.18% | 0.30% | -0.19% | -0.72% | -0.72% | 0.23% | |

| EUR | 0.58% | -0.55% | 0.91% | 0.40% | -0.28% | -0.16% | 0.80% | |

| GBP | 1.18% | 0.55% | 1.49% | 0.95% | 0.27% | 0.39% | 1.35% | |

| JPY | -0.30% | -0.91% | -1.49% | -0.49% | -1.17% | -1.03% | 0.08% | |

| CAD | 0.19% | -0.40% | -0.95% | 0.49% | -0.70% | -0.54% | 0.40% | |

| AUD | 0.72% | 0.28% | -0.27% | 1.17% | 0.70% | 0.13% | 1.10% | |

| NZD | 0.72% | 0.16% | -0.39% | 1.03% | 0.54% | -0.13% | 0.94% | |

| CHF | -0.23% | -0.80% | -1.35% | -0.08% | -0.40% | -1.10% | -0.94% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.