GBP/USD soars toward 1.34 as traders question Fed’s independence

- Hassett reveals Trump is exploring legal options to remove Powell, reigniting concerns over the Fed’s political independence.

- DXY drops 1.09% to March 2022 lows as equities slump and investors flee the Greenback.

- CB Leading Index falls more than expected; US economic signals weaken amid rising trade and policy uncertainty.

The Pound Sterling (GBP) rallies sharply by over 0.70% on Monday as investors grew distrustful of United States (US) policymakers after White House Economic Adviser Kevin Hassett stated that President Donald Trump is seeking ways to sack Federal Reserve (Fed) Chair Jerome Powell. Consequently, traders penalize the Greenback, pushing GBP/USD close to the 1.3400 figure.

Pound rallies toward 1.34 as Trump eyes Powell firing, US Dollar crashes on Fed independence fears

The market mood turned sour as Washington threatened the Fed’s independence again. US equities are sinking, while the US Dollar Index (DXY), which reflects the buck’s value against a basket of six currencies including Cable, plummets over 1.09% to 98.31, levels last seen in March 2022.

Chicago Fed President Austan Goolsbee said he hopes the US does not move to an environment where the central bank's ability to set monetary policy independently of political pressure is questioned.

A scarce economic calendar witnessed the release of the US Conference Board (CB) Leading Index for March which declined -0.7% below forecasts of -0.5% to 100.5. Justyna Zabinska-LaMonica, Senior Manager, Business Cycle Indicators at The Conference Board, said, “The US LEI for March pointed to slowing economic activity ahead.” She added that the decline could be attributed to “soaring economic uncertainty ahead of pending tariff announcements.”

Across the pond, the UK economic docket is light, yet traders are eyeing the release of S&P Flash PMI final readings on April 23. In the US, Fed speakers would grab the headlines, and traders would eye S&P Flash PMIs.

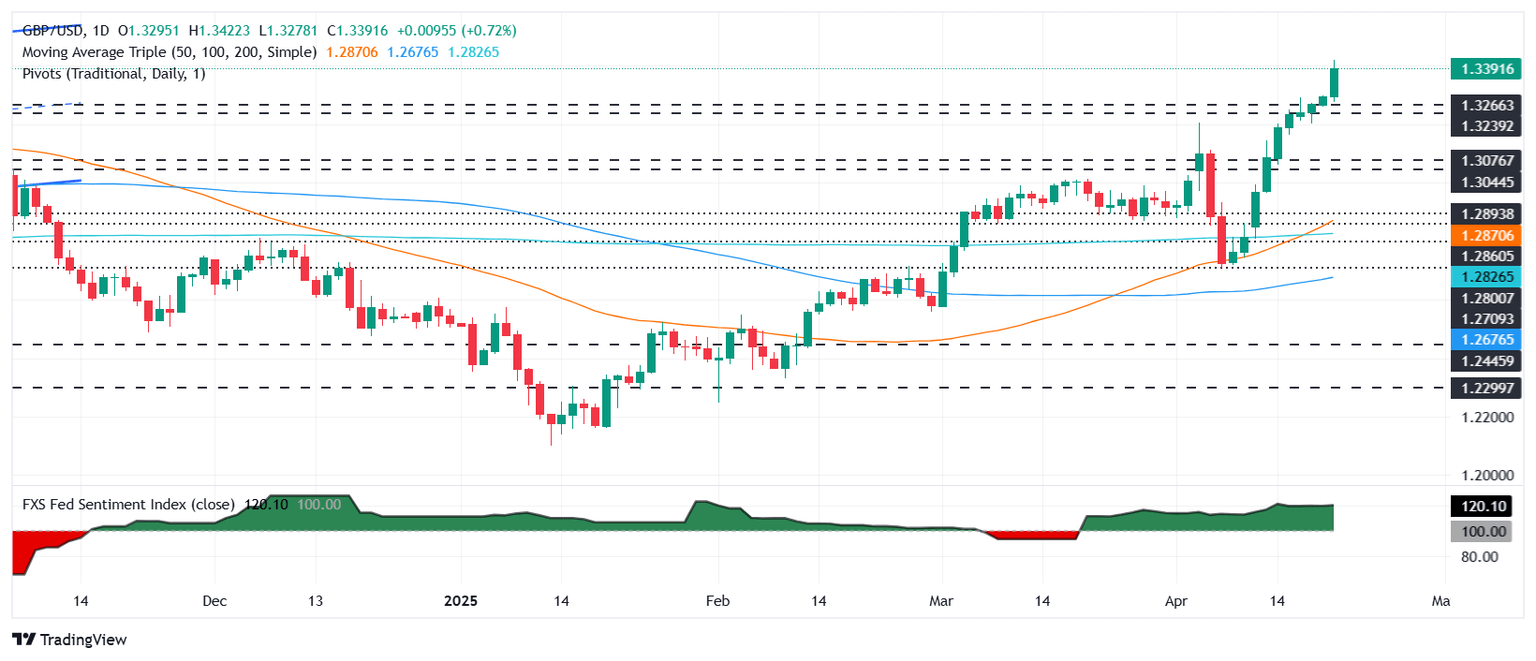

GBP/USD Price Forecast: Technical outlook

GBP/USD uptrend remains intact, with investors eyeing a daily close above the September 26 high of 1.3434, which could set the stage to challenge 1.3450 ahead of buyers driving the exchange rate towards 1.35. It should be said that the Relative Strength Index (RSI) has turned overbought, but the slope has broken the last peak, an indication of buying pressure building.

Conversely, sellers need GBP/USD to remain below 1.3400 to remain hopeful of pulling the exchange rate below 1,3300, which is crucial to pave the way for a pullback. In that outcome, the next support would be April 18 low at 1.3248, followed by the 1.32 mark.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.