GBP/USD slipping back towards 1.2600 as Pound Sterling sheds weight

- The GBP/USD is faltering on Monday as risk aversion seeps back into market sentiment.

- The US Dollar is front-running the rest of the FX market as investors pull back into safe havens.

- The Pound Sterling has shed three-quarters of a percent against the US Dollar on Monday.

The GBP/USD is down nearly eight-tenths of a percent on Monday as the Pound Sterling (GBP) gives up ground to the US Dollar (USD) in a broad-market risk-off bid that has investors pulling back into the safe haven Greenback.

The new trading week has kicked off with a fresh bout of risk aversion as investors come face-to-face with a global slowdown looming over economies across all three major market sessions.

There's little of note on the economic calendar for the Pound Sterling to kick off the new week, and the rest of the week remains lightly-populated as well. The US Dollar is set to drive market reactions to data heading through the rest of the week, which culminates in another reading of the US Nonfarm Payrolls (NFP) report on Friday.

US data to feature heavily this week, Friday's NFP looms ahead

US Factory Orders in October declined more than investors expected, printing at -3.6% versus the expected -2.6%, and September's manufactured goods purchases also saw a downside revision from 2.8% to 2.3%. Economic activity is beginning to show hardening weak spots, both in the US and across the globe.

Investors appear to be remembering that despite an economic slowdown accelerating the chance of rate cuts from the Federal Reserve (Fed), a global recession is, in fact, bad for business, and souring economic data is seeing investors pulling back into safe havens.

The Pound Sterling will get another chance at redemption, or at least preventing further declines, when the UK's BRC Life-For-Like Retail Sales for the year into November prints early Tuesday at 00:01 GMT. Markets are expecting a tick down in UK comparative retail sales from 2.6% to 2.5%.

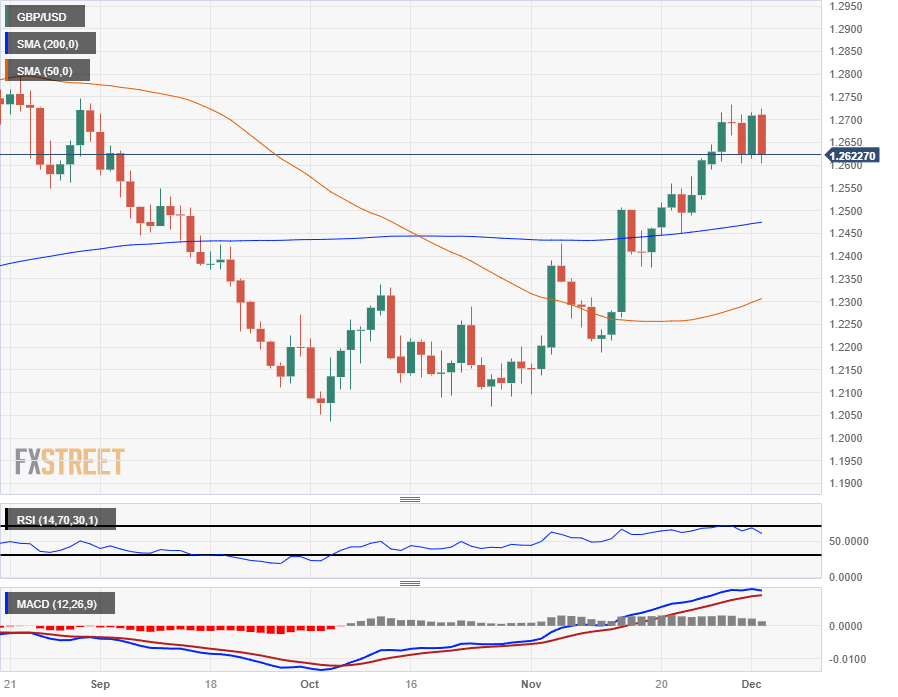

GBP/USD Technical Outlook

The Pound Sterling (GBP) saw refreshed selling pressure on Monday against the US Dollar (USD), with the GBP/USD opening up the trading week slipping from early bids near 1.2720 back down towards 1.2600.

Intraday charts are seeing a technical snag at the 200-hour Simple Moving Average (SMA), but the GBP/USD remains firmly bearish in the near term as the pair trades on the south side of the 50-hour SMA.

Daily candlesticks for the GBP/USD are getting mired in the midrange, with recent upside momentum facing a technical ceiling at the 1.2700 handle. The GBP/USD has been on the climb ever since crossing the 200-day SMA near 1.2450 back in mid-November, but bullish momentum appears to be draining and the pair is primed for at least a minor pullback.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.