GBP/USD rallies above 1.2700 amid speculations of Fed’s easing cycle, soft US Dollar

- GBP/USD experiences a significant uptick, climbing 0.70% above the 1.2700 mark.

- Federal Reserve Chairman Jerome Powell's comments on restrictive monetary policy and high core inflation fail to bolster the US Dollar.

- Market futures now anticipate over 130 basis points of rate cuts by the Fed in 2023, leading to a drop in US Treasury bond yields.

GBP/USD climbed more than 90 pips late during Friday’s North American session, or 0.70%, after reaching a daily low of 1.2609. Speculations that the Federal Reserve has finished its tightening cycle sparked more than 100 basis points of cuts by the Fed next year, a headwind for the Greenback. The pair is trading at 1.2711.

British Pound gains against the US Dollar, driven by market expectations of Federal Reserve rate cuts and dovish signals

The main reason behind the GBP/USD’s advance is a softer greenback. Even though the US Federal Reserve’s Chairman Jerome Powell pushed back against rate cut expectations, he wasn’t unable to move the needle and boost the US Dollar, which measured by the US Dollar Index, which measures the currency against six other peers, dropped 0.38%, at 103.12.

Powell said the monetary policy is “well into restrictive territory,” seen as a green light for investors, who seeing risk, turned to high beta currencies like the British Pound (GBP). At the same time, Wall Street paired its losses and soared late in the session. Even though he acknowledged that inflation is easing, he said that core prices remain “too high.”

Money market futures see the Federal Fund Rates (FFR) at around 4.11% by the end of next year, implying more than 130 basis points of rate cuts. Consequently, US Treasury bond yields plunged, with 2s and 10s slashing more than ten basis points each, at 4.56% and 4.22%, respectively.

On the data front, manufacturing business activity in the US took a toll for thirteen straight months, remaining in recessionary territory at 46.7, unchanged compared to October but below forecasts of a 47.6 improvement.

Across the Atlantic, the S&P Global Manufacturing PMI improved, though it remained in recessionary territory. In contrast, Bank of England’s (BoE) officials remained hawkish. Margaret Greene said that she sees signs of inflation persistence, as she said a “core” services inflation, excluding energy prices, sits at 6%, which could refrain the BoE from discussing rate cuts.

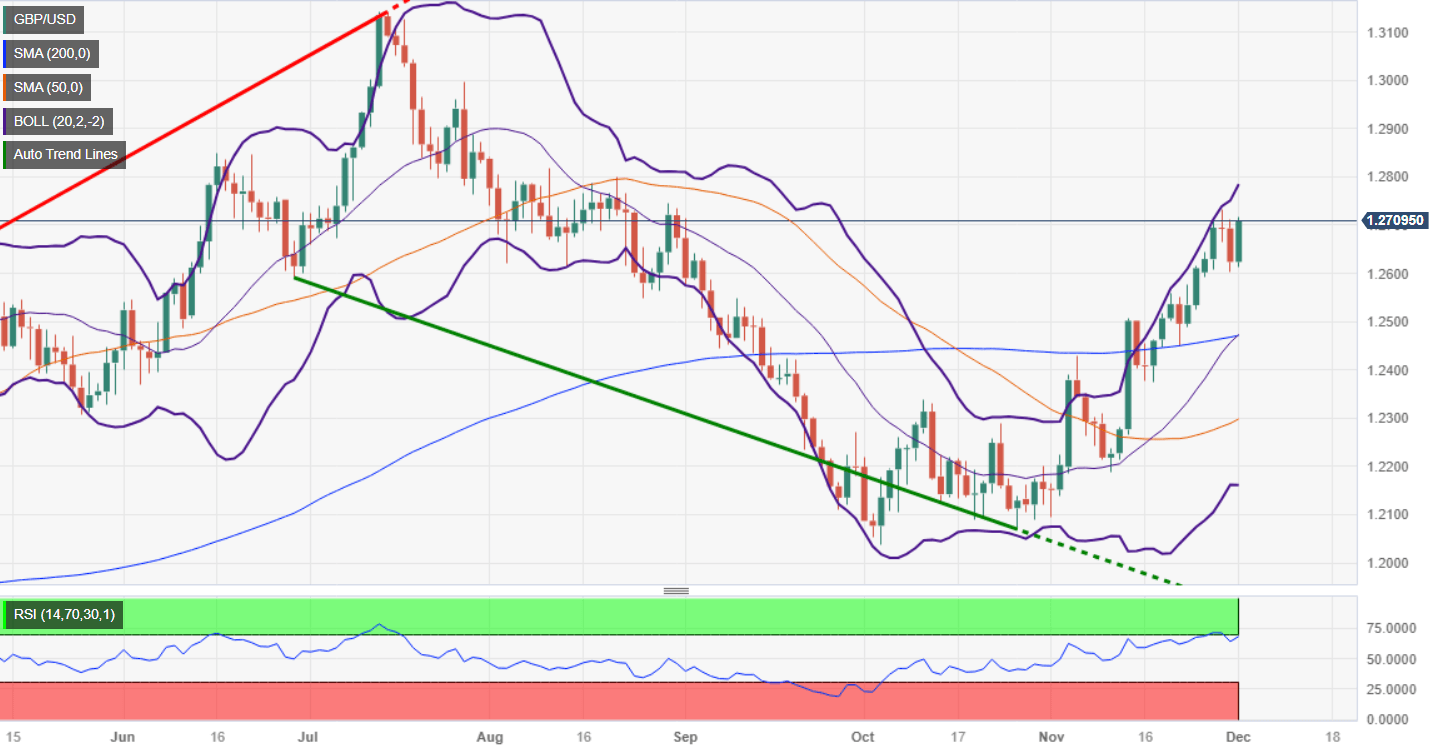

GBP/USD Price Analysis: Technical outlook

On Friday, the GBP/USD rise above the 1.2700 figure formed a bullish engulfing candle pattern, implying that bulls are in charge. Yet, to cement their case, they must breach the August 30 high of 1.2746 to threaten to challenge the 1.2800 figure. In that case, the pair would’ve broken two resistance levels, which could pave the way toward 1.3000. On the other hand, if the major stalls and achieves a daily close below 1.2700, that could keep the pair in consolidation within the 1.2600/1.2740ish range.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.