GBP/USD Price Forecast: Tumbles below 1.2700 after hot UK CPI

- GBP/USD declines following a surge in UK inflation, raising prospects of a less accommodative Bank of England.

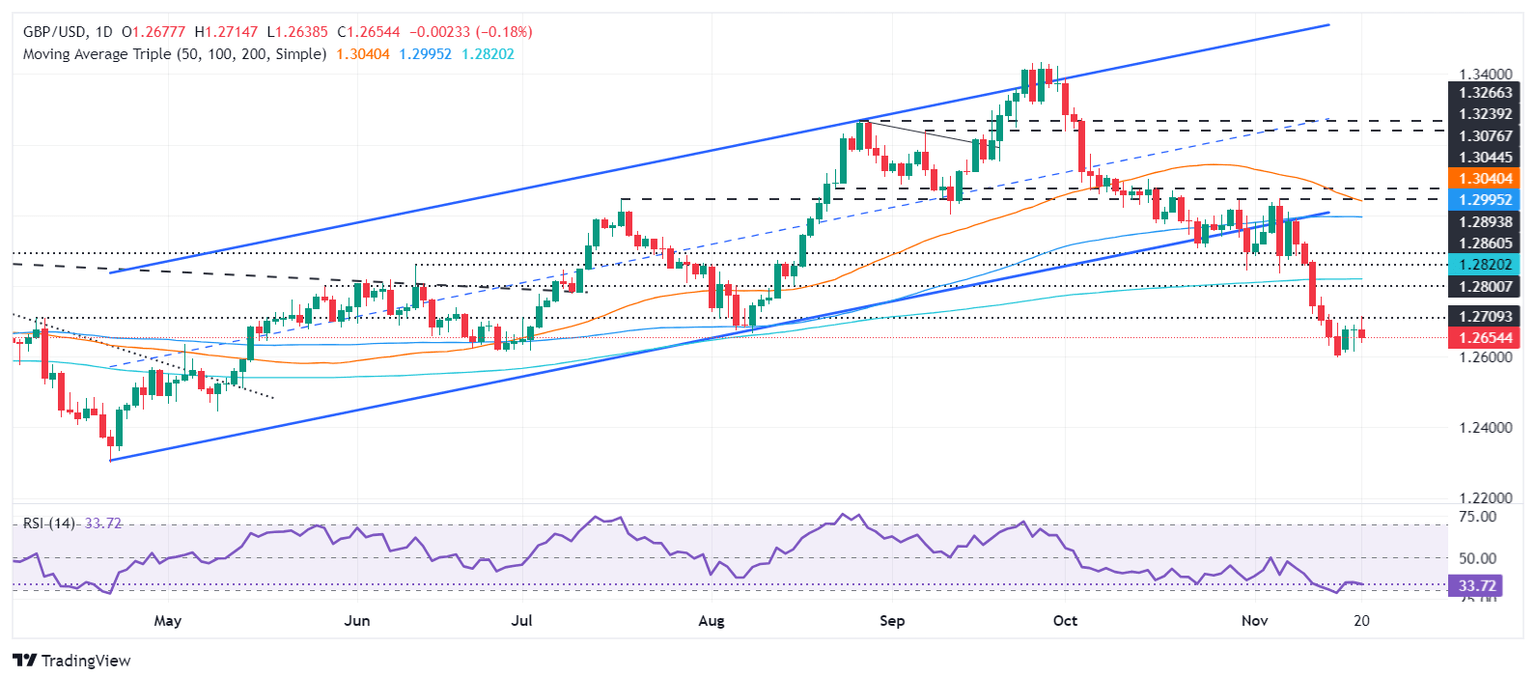

- Technicals indicate bearish momentum with the pair now targeting further support levels, including the May low of 1.2445.

- RSI trends toward oversold territory, suggesting continued downward pressure in the near term.

The Pound Sterling lost ground versus the US Dollar on Wednesday following a hot UK inflation report, which increased the chances that the Bank of England (BoE) would pause its easing cycle. The GBP/USD trades at 1.2643, down 0.30% after hitting a high of 1.2714.

GBP/USD Price Forecast: Technical outlook

After diving below the 200-day Simple Moving Average (SMA), the GBP/USD turned bearish, carving successive series of lower highs and lower lows and clearing intermediate support at 1.2664, the August 8 daily low. If sellers push the exchange rate below 1.2600, this will exacerbate a drop toward the May 9 swing low of 1.2445, ahead of the yearly low of 1.2299.

Conversely, if GBP/USD rises above 1.2700, this could pave the way for challenging the 200-day SMA at 1.2818. Once cleared, the next stop would be November’s 6 low turned resistance at 1.2833, ahead of 1.2850 and 1.2900.

Oscillators, such as the Relative Strength Index (RSI), suggest that sellers remain in charge. With the RSI still below its neutral line and aiming toward oversold conditions, the GBP/USD might extend its losses.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.61% | 0.18% | 0.31% | 0.35% | 0.66% | 0.72% | 0.18% | |

| EUR | -0.61% | -0.43% | -0.31% | -0.27% | 0.03% | 0.09% | -0.43% | |

| GBP | -0.18% | 0.43% | 0.10% | 0.16% | 0.46% | 0.52% | -0.01% | |

| JPY | -0.31% | 0.31% | -0.10% | 0.05% | 0.35% | 0.40% | -0.12% | |

| CAD | -0.35% | 0.27% | -0.16% | -0.05% | 0.31% | 0.37% | -0.16% | |

| AUD | -0.66% | -0.03% | -0.46% | -0.35% | -0.31% | 0.06% | -0.46% | |

| NZD | -0.72% | -0.09% | -0.52% | -0.40% | -0.37% | -0.06% | -0.53% | |

| CHF | -0.18% | 0.43% | 0.00% | 0.12% | 0.16% | 0.46% | 0.53% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.