GBP/USD Price Analysis: To remain inside the woods till the release of Fed’s interest rate policy

- GBP/USD is displaying a sideways auction as the focus has shifted to Fed policy.

- The BoE policymakers are preparing for a 12th consecutive interest rate hike to tame double-digit UK inflation.

- The current variation of the Rising Channel lacks strength and is signaling a loss in the upside momentum.

The GBP/USD pair is demonstrating a sideways performance after around 1.2470 after a recovery move from 1.2440 in the early Toyo session. The Cable has defended its crucial support of 1.2440 for now, however, uncertainty will remain ahead of the interest rate policy by the Federal Reserve (Fed).

S&P500 futures have added more losses in early Asia after an extremely bearish Tuesday as concerns over a delay in the United States debt ceiling and deepening fears of a recession ahead of the Fed policy have dented the confidence of investors.

The US Dollar Index (DXY) is consolidating below 102.00 after a healthy correction from 102.30 as an extension in the debt ceiling would impact the long-term outlook of the US economy.

On the Pound Sterling front, Bank of England (BoE) policymakers are preparing for a 12th consecutive interest rate hike to tame double-digit United Kingdom inflation.

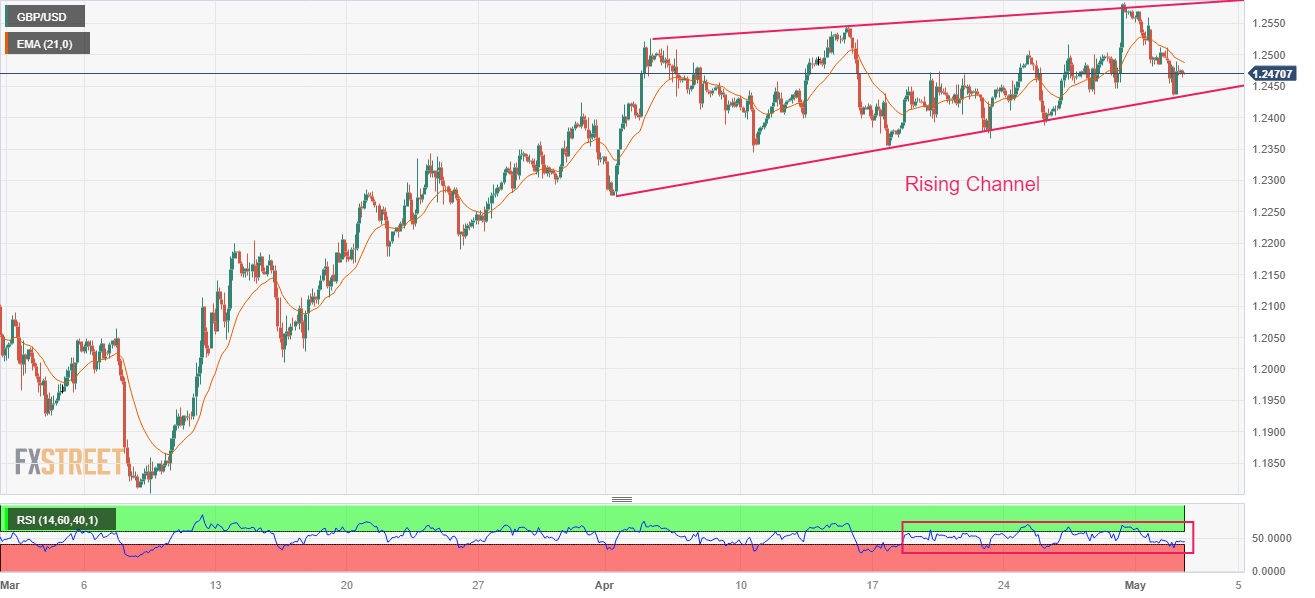

GBP/USD is auctioning in a Rising Channel chart pattern on a two-hour scale. The current variation of the Rising Channel lacks strength and is signaling a loss in the upside momentum. The upper portion of the aforementioned chart pattern is plotted from April 04 high at 1.2525 while the lower portion is placed from April 03 low at 1.2275.

The Cable is below the 20-period Exponential Moving Average (EMA) at 1.2488, indicating that US Dollar bulls have an upper hand.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, signaling an action only after the Fed’s monetary policy.

A decisive move above April 14 high at 1.2546 will drive the asset towards a fresh 10-month high at 1.2597, which is 08 June 2022 high. A breach of the latter will expose the asset to May 27 high at 1.2667.

On the flip side, a slippage below April 10 low at 1.2345 will expose the asset to March 30 low at 1.2294 followed by March 27 low at 1.2219.

GBP/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.