GBP/USD Price Analysis: Retreats from the daily highs, steadily around 1.2080

- GBP/USD trims some of last Friday’s losses but remains trapped between the 20 and 50-DMA.

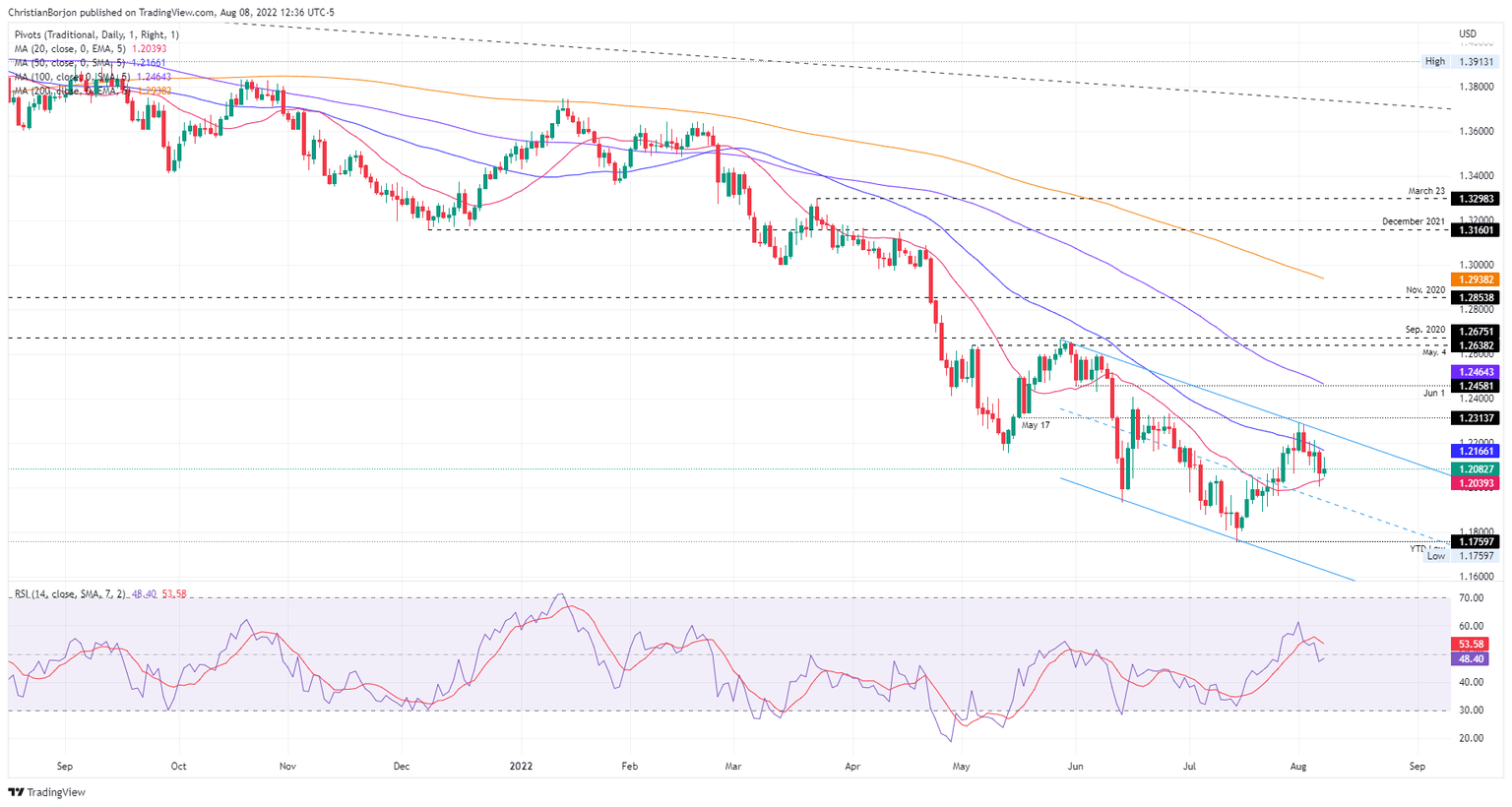

- The daily chart depicts the pair trending between a descending channel as sellers eye the 20-day EMA.

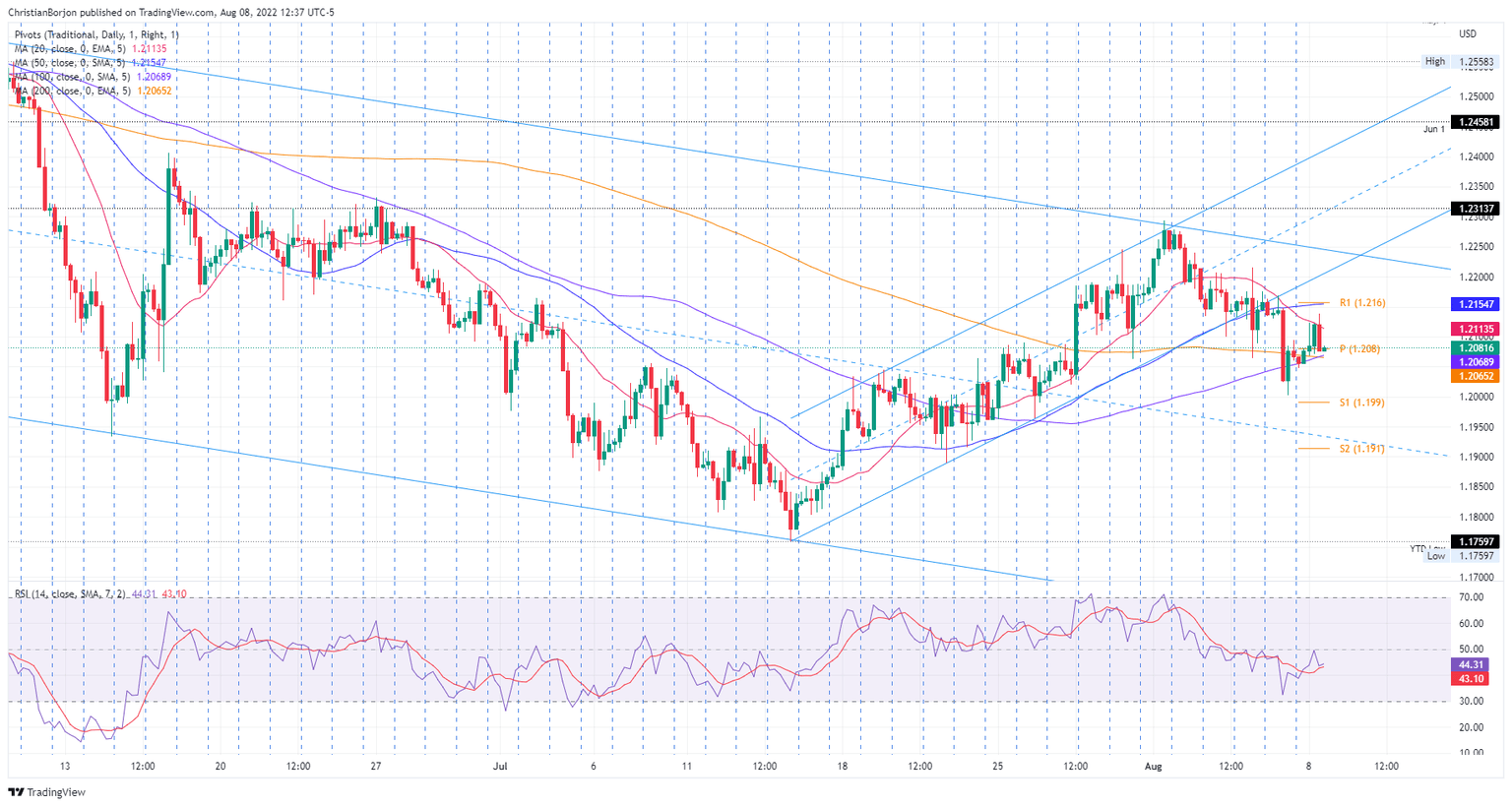

- The GBP/USD 4-hour scale depicts the pair as neutral-downward biased and might test the 1.2000 figure, short term.

The GBP/USD records minimal gains after hitting a daily high at 1.2137, shy of the 50-day EMA at 1.2166, which has proven to be solid resistance in the last four days. However, the British pound retreated under 1.2100 but remained above the opening price, recording gains of 0.12%. At the time of writing, the GBP/USD is trading at 1.2081.

GBP/USD Price Analysis: Technical outlook

The GBP/USD daily chart illustrates the major as neutral-to-downward biased. Further confirmation of the previously mentioned is that sellers are gathering momentum, as shown by the Relative Strength Index (RSI), aiming lower, residing below the 50-midline. Also, the major trades within a descending channel and the spot price is 50 pips shy of the 20-day EMA at 1.2039. Once cleared, it would exacerbate a fall towards the bottom of the channel, near the YTD low at 1.1759.

Meanwhile, the GBP/USD 4-hour chart shows that an ascending channel was broken to the downside last Friday, adding further selling pressure on the pair. Worth noting that GBP/USD buyers lifted the pair from the confluence of the 100 and 200-EMAs, near the 1.2040s lows of the day. However, sellers piling around the 20-EMA at 1.2113 weighed on the pair, which slid below the 1.2100 mark.

Hence, the GBP/USD 4-hour chart is still neutral-to-downward biased. Therefore, the GBP/USD first support would be the confluence of the 100 and 200-EMA around 1.2065-68. The break below will send the pair tumbling towards the S1 pivot at 1.1990, followed by the S2 at 1.1910.

GBP/USD Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.